Consumers are motivated to buy meat alternatives by health, ethics and the rising cost of meat. However, attributes such as taste and clean label have increasingly become significant drivers for new meatless product launches. As meat alternatives attract younger consumers, time-saving and ease-of-use products can sustain the surging popularity of the category.

Demand for meat alternatives is on the rise

In line with Mintel’s 2017 Global Food & Drink Trend, ‘Power to the Plants,’ consumers claim to be reducing meat consumption and moving towards more plant-based diets. Among those purchasing meat alternatives, Millennials are leading the charge:

- Nearly eight in 10 US Millennials eat meat alternatives, compared to more than half of non-Millennials.

- Almost one-third of US Millennials are trying to eat a more plant-based diet, compared to more than one-quarter of non-Millennials.

- A third of US consumers plan to buy more vegetarian/plant-based food products in the next year, rising to nearly two in five of Millennials.

Health concerns motivate consumption

Nearly half of US consumers cite health concerns as the reason for consuming plant-based proteins. Uptake of meat alternatives, as well as meat reduction, is driven by health concerns such as heart health and weight management. Nearly six in 10 US consumers are interested in eating less meat, rising to two-thirds of older Millennials (ages 31-40). However, the most significant motivation for eating plant-based protein is taste, which is a essential to repeat purchase.

Top attributes for buying plant-based proteins

Overall, US consumers’ top priority for meat alternatives is taste. If the products do not convey tastiness on the package, they will not inspire trial. More importantly, if they do not taste good, consumers will not re-purchase them.

Clean-label attributes, such as no artificial ingredients, non-GMO and protein are considered “must-haves” for US Millennials, as consumers are becoming increasingly conscientious of what they eat.

Product formats matter to consumers

Time is an increasingly precious resource, especially for Millennials who are in their prime working and child-rearing years. Millennials are redefining “scratch” cooking from meals made with unprepared ingredients to component-style assembly of prepared and partially prepared foods.

The majority of Millennials who consider themselves to be “cooking enthusiasts” prepare a meal at home that requires little to no actual cooking at least once a week.

Millennials are also more likely to prepare international cuisines when cooking at home, with four in 10 US Millennials cooking dishes from different cultures at least once a week, compared to one-quarter of all consumers who cook.

The evolution of cooking and Millennials’ affinity for international fare creates opportunities for alternative protein components that can be easily incorporated into ethnic fare at home.

Top-scoring meat substitute launches that can seamlessly stand-in for meat

Mintel’s Purchase Intelligence measures instant reaction, purchase intent and consumer attribute perceptions for new product launches in the US. Here, we share the meat substitute launches that score the highest in purchase intent.

Sauce-inclusive for easy prep

Gardein Mandarin Orange Crispy Chick’n

47% purchase intent

Ancient grain-enhanced tenders

Gardein Seven Grain Crispy Tenders

47% purchase intent

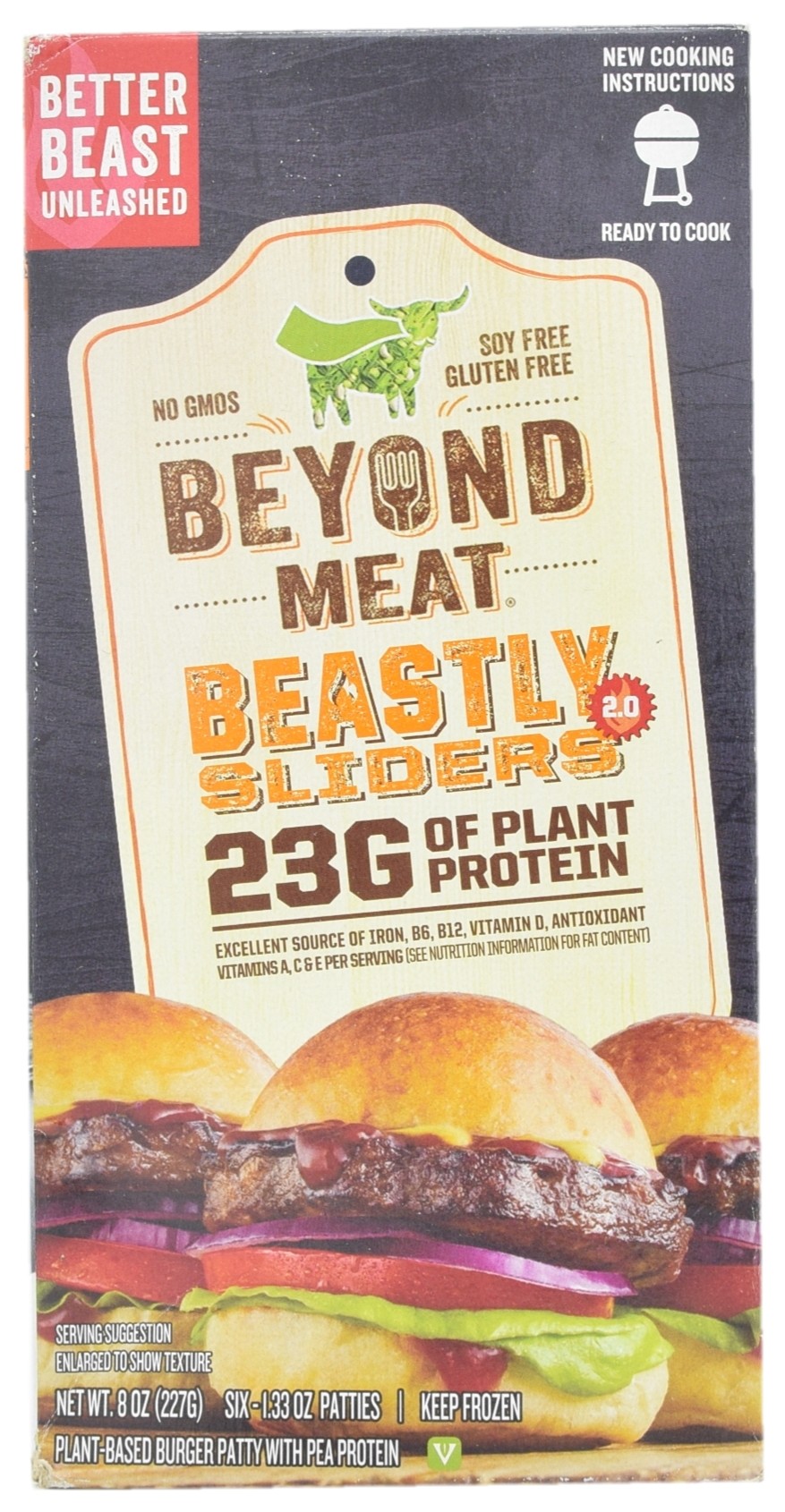

Burger joint favorite without the meat

Beyond Meat Beastly Sliders 2.0

45% purchase intent

What’s next for meat alternatives?

Submitting lab-grown meats to USDA oversight would require lab-grown meat companies to comply with existing regulations on meat, which could hamper research and development.

Cultured meat alternatives may provide distinct competition to meat producers as they leverage healthy attributes in a product which may be better for the planet than traditional animal farming, which accounts for close to 18% of greenhouse emissions, uses 47,000 square miles of land annually, and exhausts 70% of the world’s water, according to the UN’s FAO.