A liquid ceiling

Food and drink markets are subject to limitations that many others are not. Given time and/or money many consumers could take more holidays, buy more clothes and get more gadgets for the home. However, there is only so much individuals can ingest. True, obesity rates are rising but, even so, there is only so much volume growth this can add to food and drink markets.

This is perhaps most keenly felt in the drinks market, where the “down the gullet” theory comes into play. This states that there is a finite amount that can be drunk; any increase in one type, will be balanced by decreases elsewhere. As Mintel Market Sizes retail markets concentrate on packaged products only there is still potential in some developing countries as consumers swap eating loose products for those packaged. In mature markets volume growth from people switching from tap water to packaged drinks has now virtually been “tapped”; further growth must come from product substitution.

Drinks competition reaches new peak

Suppliers have reacted by developing all sorts of new products and variants to gain ground on their rivals. Indeed, sometimes it just means repositioning: Lucozade used to have a limited target audience of convalescents, mainly children; now it is part of the burgeoning energy drinks market. Indeed, drinks manufacturers have latched onto the health and well-being market with a plethora of new products.

Juice at the battle front

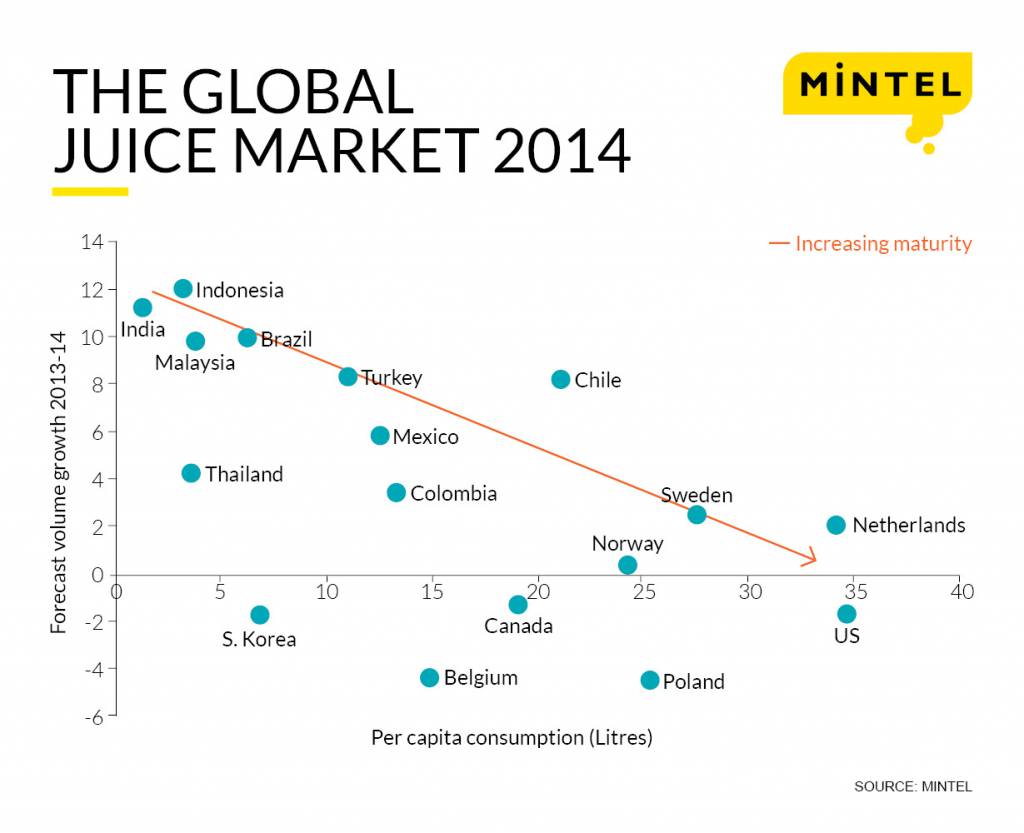

In such a competitive environment juices have not been the main beneficiaries. Growth over recent years in the retail market has only been 2%; barely ahead of population growth. This translates into globally near-static per capita consumption. However, as always, there are strong regional differences which are evident in the chart.

Source: Mintel Market Sizes

Market evolution

Looking at growth plotted against per capita consumption illustrates where potential could lie. The underdeveloped markets, where consumption is low and growth is high, are found on the top left. India, Indonesia, Brazil and Malaysia fall into this group. As markets mature they travel down and to the right, arriving at the negative growth area below the axis. The US may have the highest per capita, but this is now declining.

Of course, it is a little too simplistic to assume that countries will gradually migrate south eastwards in the chart; there are all sorts of factors at play. In India, Brazil and Mexico the freshly squeezed products, either at bars or done at home, remains popular and restricts packaged sales. This is also a factor in the more mature markets although the major restriction of growth has been consumer concerns over sugar and calorie content. In this aspect, the sector has been hoist by its own petard: juices were marketed in the past as a health drink; now a more discerning consumer chooses from a plethora of other drinks which have better credentials on this front.

The way forward

It is clear that the juice suppliers can no longer rely solely on the health credentials of their products. The competition is now too fierce for that. The category has a large range of products ranging from 100% squeezed juice to juice drinks where juice content is generally below 25%. The former competes with juice bars; its main competitive advantage is convenience. However, it could perhaps be enhanced by smaller mix and match packs, whereby the consumer could select several to concoct at home while, with clever packaging, it may not need to ask the retailer to devote yet more oversubscribed chiller space.

Juice drinks may benefit from a repositioning. In the past they were often regarded as a poor man’s alternative to the “proper” pure juice, but now they offer a health drink with lower sugar content than juice, frequently with enhanced functions. It can take on the competitors such as enhanced, flavoured waters more easily. This might not be confined to wealthier countries. In Malaysia the government is keen to curb inhabitants’ high consumption of sugar – it is noticeable that juice drinks form not only the largest, but also the fastest growing, segment; yet annual per capita consumption of these is still only two litres.

But there are dangers. The juice market, more than most other non-alcoholic drinks, is susceptible to swings in prices as crop yields fluctuate with climate. In 2012 the sharp price increase led to drop in consumption in Turkey. The market bounced back in 2013 but, with the increasing competition, this might not happen the next time.