-

Articles + –

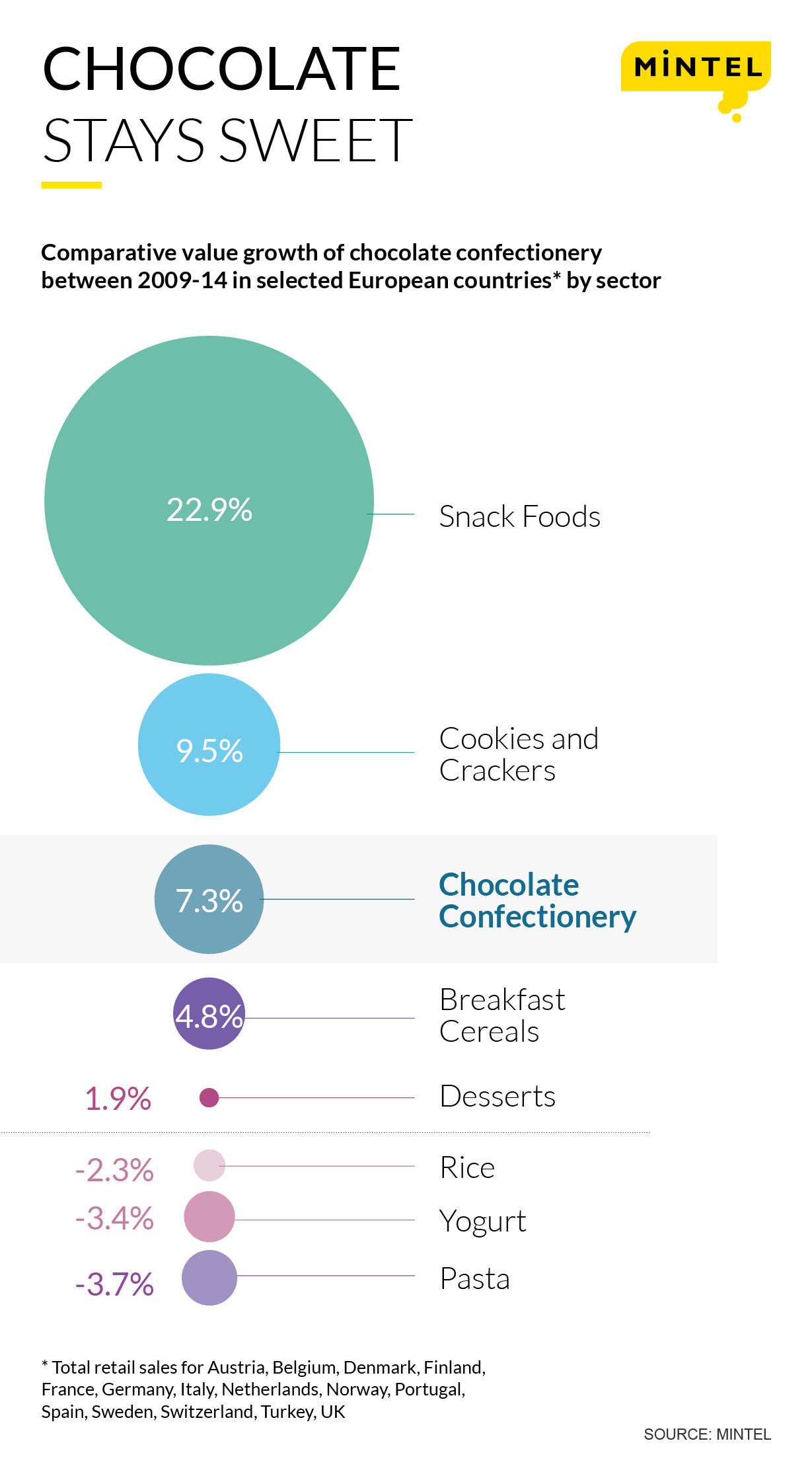

The European chocolate market has proved quite resilient given the economic turmoil on the continent. Value sales increased by some 7% between 2009 and 2014, placing chocolate confectionery among the best performing variety of competing, and other food, markets, as seen in the chart below.

Not just due to inflation

Some of this, of course, is due to price rises in the last five years, particularly for cocoa and sugar. However, most other food markets have also encountered price hikes for their ingredients over the period 2009-14 and have not fared nearly so well. Furthermore, despite the increased cost, volume sales still recorded a 2% growth; not bad for a product which has come under attack on health grounds.

Fitting the snacking bill

The reasons for the success are numerous but, by looking at the most successful markets in Chart 1, being part of the snack sector has been particularly beneficial.

This has not been a passive response to changing eating habits: some might even go so far as to say that confectionery manufacturers pioneered the snacking habit. Without doubt the sector has fostered this aspect of food consumption. Countlines fulfil a one-off sating of hunger between meals, while “bite size” wrapped and unwrapped individual chocolates have a function for snackers who prefer to pick. Mintel’s Global New Product Database analysis reveals that some 40% of new introductions in the past 12 months in these countries fell within these categories.

Formats for every occasion…

But the beauty of the chocolate confectionery segment is that there are so many available varieties of product which can cater for all sorts of occasions and a wide range of tastes. Furthermore, many are multi-functional: for example individually wrapped chocolates are not only for periodic snacking but also for sharing, such as while watching entertainment. Then there are gifts; either in formal, decorative packaging and/or for specific, and seemingly more numerous, seasons. Countlines have long provided a sweet addition to lunch boxes. Not many other food markets can cater for all these consumption permutations.

… and a product for every pocket

There is also a wide range in terms of price/value positioning. It can be a relatively cheap and cheerful way of filling a hunger gap, but the likes of single origin products cater for those who take their subject seriously. Another reason for weathering the recession relatively well: an affordable treat in times of austerity.

Providing excuses for consumption

Moreover, suppliers have proved remarkably adept at managing consumer reaction to potential market shocks. Unlike some other areas, such as ready meals, where there is a certain amount of flexibility in the mix of ingredients used, when sugar and cocoa prices head skyward, there is less room to manoeuvre. Yet by careful manipulation of sizes under the guise of portion control; clever marketing of fun in less than humorous times; and by providing a way for customers to trade down or consume less of more value added products without abandoning the product altogether, it has survived well intact. The industry has also held out well against the “bad for health” publicity. Compared with one of its major constituents, sugar (see Not so sweet: Sugar market review), chocolate is still highly regarded among most Europeans. It has even received a clean bill of health by some in the science community: a message chocoholics are only too pleased to accept.

Gibt mir mehr Schokolade!

Certainly it has not deterred the nations of the world where German is predominantly spoken. The Swiss have long held the number one position in terms of per head consumption and, of course, are a major producer. And in terms of retail sales, they are followed by their northern and eastern neighbors, who also have high consumption levels: just over and under 8kg per capita respectively for Germany and Austria. The former is helped by particularly low price positioning. While there is no evidence of a Teutonic gene linked to a craving for chocolate (it was, in fact, brought from the New World by an Italian in Spain), it is interesting to note that another major world producer, Belgium, has a German-speaking region too and the country comes in at a global number seven.

Chocolate provides a case study for adaptability in a tough food market environment.

Peter Ayton, Global Market Sizing Quality Manager at Mintel, is responsible for ensuring that market data is comparable, compatible and pertinent across the organisation’s range of products. His several roles over 30 years at Mintel have included editing, analysing, publishing and conference speaking across the whole range of titles from food to finance and personal care to pharmaceuticals.

-

Mintel StoreGet smart fast with our exclusive market research reports, delivering the latest data, innovation, trends and strategic recommendations....View reports

-

Mintel LeapMintel Leap is a revolutionary new AI-powered platform that will transform your research process....Book a demo