As part of the “new year, new me” resolutions, many consumers will plan to cut down on sugar and refined carbs and include more protein in their diets. With an abundance of healthy proteins and omega-3 fatty acids, canned fish is sure to be on the shopping lists of many health-conscious Germans and is especially appealing to price-sensitive shoppers looking for a low-cost alternative to fresh fish.

However, the customer base for canned fish and seafood is highly skewed towards an older demographic in Germany. Indeed, the cupboard staple seems to have a somewhat old fashioned image among younger audiences who find canned fish less appealing. According to a Mintel survey from 2014, nearly half (47%) of Germans aged 55+ claimed to have bought canned fish or seafood in the previous three months. But among those aged 16-24, this number drops to one third (33%).

One possible reason for the lower interest in canned fish among young Germans might be the distinctive lack of flavour innovation. A closer look at new shelf stable fish products introduced in Germany in the past 12 months reveals that one-quarter (24%) of all new launches were unflavoured or plain. Moreover, the leading positions among flavoured varieties were represented by old-school sauce flavours, such as tomato or chilli pepper.

But these traditional flavours are unlikely to appeal to younger audiences, as they are increasingly looking for exciting taste sensations. Indeed, recent research from Mintel shows that two in five German 16-24 year olds consider themselves to be very adventurous in their cooking habits. This willingness to experiment suggests that canned fish manufacturers should be looking at new, exciting flavours rather than introducing yet another tomato sauce range.

Brands rejuvenating their image

As canned fish faces growing competition from chilled and frozen offerings, and as private label activity grows, the lacklustre image of the branded side of the category has become more obvious in the past years. This has prompted the leading German canned fish brands to step up product innovation in a bid to rejuvenate their market image and reach out to younger consumers.

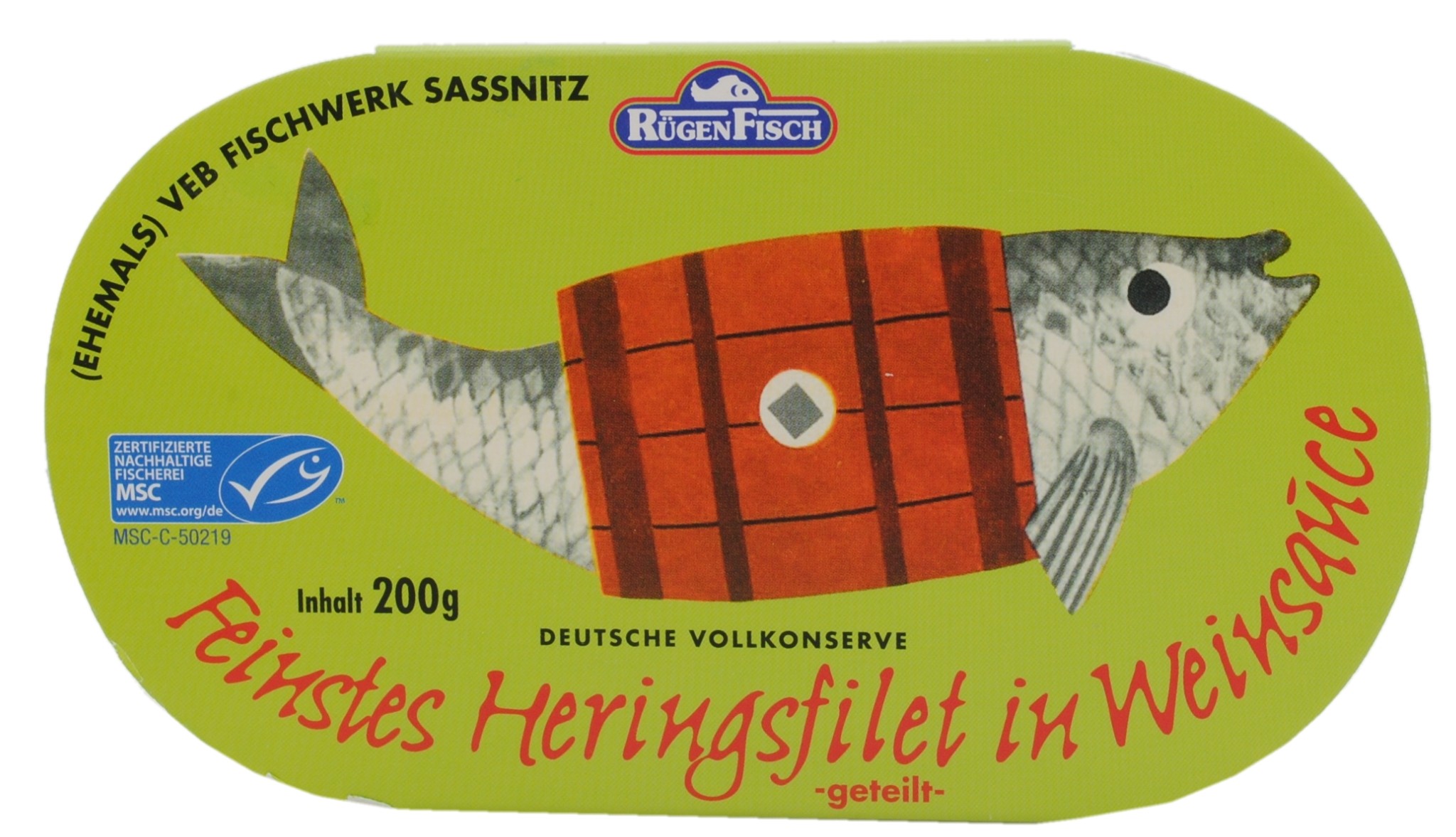

Some brands have introduced innovative packaging in a bid to polish up their image. Rügen Fisch recently launched a new line of herring fillets with highly recognisable packaging visuals that stand out on supermarket shelves. It uses bold colours and whimsical fish illustrations to achieve a more colourful, artisanal and modern appearance, compared to the majority of canned fish products available, in an effort to appeal to a younger audience.

Tapping into the trend of ethnic foods, Rügen Fisch’s main rival Appel Feinkost GmbH has launched two new variants of its fried herring range using trendier flavours. These include a Mediterranean infusion sauce with onions, tomatoes and red wine, as well as a spicy Asian-style sauce with peppers, bamboo strips and Mue Err mushrooms.

While canned fish and seafood remain popular in Germany, shelf-stable fish producers need to step up innovation to keep up with evolving consumer needs and to re-engage with younger audiences. Flavoured variants could improve diversity in the German canned fish market, while creative packaging design can help attract a wider, and in particular younger, demographic without alienating the existing consumer base.

Katya is Senior Food and Drink Analyst at Mintel with a dedicated field of focus on Germany. Katya draws on her comprehensive knowledge of the market to identify and explore the major trends across various FMCG categories, providing the insights needed to successfully navigate the German market. She brings over seven years of expertise in market research and the grocery industry, hands-on experience from her previous role in the strategic development of private label at METRO Group.