Germans fall in love with strong cheese as mild fades from the menu

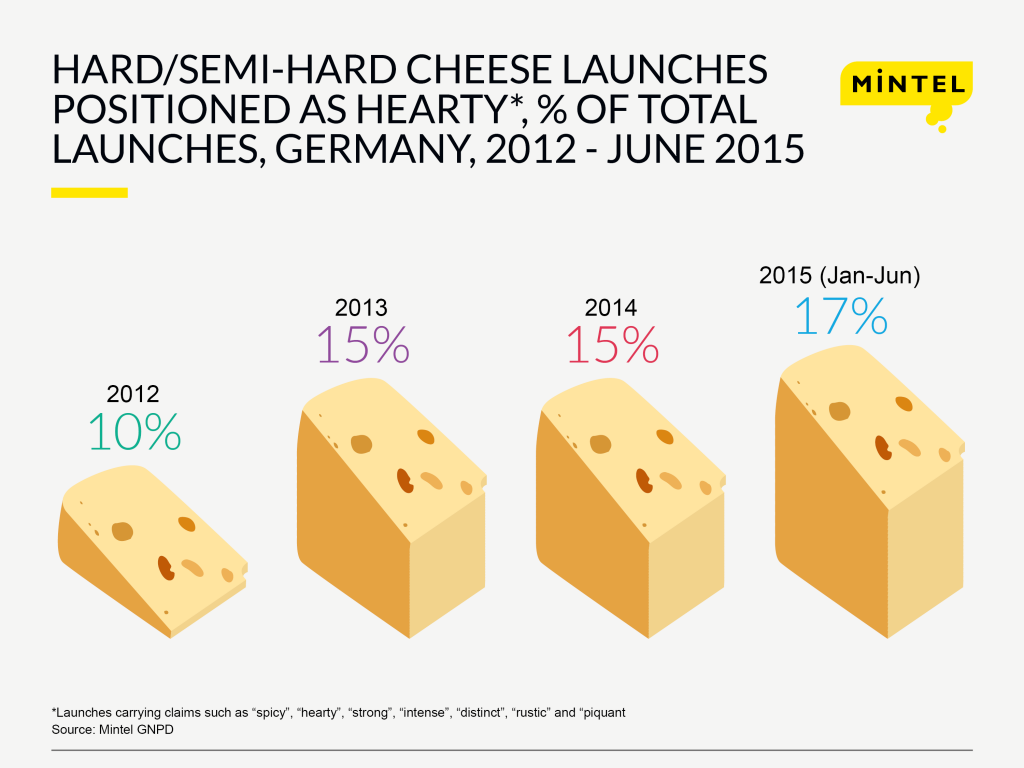

While Germany remains a mature and highly competitive market for cheese, new research from Mintel reveals it is a growing market for stronger variants of the category. Indeed, Mintel Global New Products Database (GNPD) shows that the number of launches carrying claims such as “spicy”, “hearty”, “strong”, “intense”, “distinct”, “rustic” and “piquant” have grown from just 10% of total introductions in 2012 to 15% in 2014 in the German hard and semi-hard cheese sector*. Mintel research indicates this trend is set to continue, with nearly one in five (17%) hard and semi-hard cheeses launched in Germany during the first six months of 2015 featuring one or more of these claims.

Across Europe, Mintel research shows that Germans’ love of hearty cheese is particularly strong. In 2014, only Austria (25%) witnessed more launches of these descriptors, with Germany ahead of Sweden (13%) and the UK (12%). In Europe as a whole, “strong”/”spicy” descriptors have featured at a relatively stable rate of around one in 14 (7%) non-flavoured hard cheese launches between 2012 and 2014.

Just as hearty cheese is growing in popularity, the number of “mild” cheese launches in Germany has declined, falling from 24% of new hard cheese launches in 2012 to 16% in 2014, with a similar development evident in wider Europe.

Julia Buech, Food and Drink Analyst at Mintel, said:

“Hearty flavours are on the rise with a move towards stronger cheese and brands promoting the inherent, pronounced flavour profiles of longer matured products. This development is set to gain further steam, as interest in high-quality and specialty cheese continues to grow. Whether cheese is positioned as traditional, healthy or exclusive, brands are increasingly looking to trigger consumers’ senses with more intense taste experiences. The cheese sector has seen a heat wave, with the addition of chili and other spices and herbs aimed in particular at attracting younger consumers. Beyond that, brands are now increasingly seen to cater to more grown up, discerning palates.”

Whilst strong flavours are proving popular among cheese brands, it seems the German market for cheese is in need of new stimuli. Germany’s retail cheese market has grown by an average of 4.1% in value since 2010; yet, volume wise, growth has been comparatively subdued at an average of 1.2% over the same time period.

Today, hard/extra hard types are the most popular cheese products in Germany, commanding a 42% value share, ahead of soft (33%), semi hard (13%) and spreadable/processed varieties (12%). Semi hard cheese was the top growing segment in 2014 in both value (+9%) and volume (+3%).

Moreover, Mintel research finds that while Germany’s grocery shelves boast a wide selection of cheese types, when it comes to filling their baskets, this great variety on offer presents a challenge for two thirds (63%) of Germans. The sentiment is considerably more pronounced than among neighbouring consumers. Indeed, just a quarter (26%) of French shoppers are overwhelmed by the choice on offer, followed by Spanish (30%), Polish (33%) and Italians (46%).

While the large variety of cheese can be daunting, as many as three quarters (76%) of German cheese shoppers say the type of cheese is an important factor when deciding which cheese to buy. Meanwhile, as many as two in five (39%) German consumers say that convenient packaging is an important purchasing factor, which is followed by price and promotions (31%) and trusted brands (31%). Yet, flavour, too, looks to be an important attribute; one third (34%) of German consumers would be interested in trying cheese with unusual flavours.

“Germany’s mature cheese market is enjoying steady development, driven by value growth, but competition is high, with demand driven more by cheese types as opposed to cheese brands. The preference for specific cheeses is inextricably linked with taste aspirations, providing a platform for brands to add value by underlining their products’ aromatic profile.” Julia adds.

Alcohol-flavoured cheese on the rise

As part of the general trend towards stronger flavours, so called “wine cheese” has been receiving renewed attention in Europe. Overall, Austria dominates launch activity in Europe, accounting for over one third (35%) of “wine cheese” introductions between 2014 and October 2015, followed by Germany (29%) and France (17%).

“Many ‘wine cheeses’ are washed-rind types which are periodically cured in white or red wine to develop pungent, distinctive flavours. The combination of cheese with wine is widely considered a natural, classic culinary match. Translating that ‘perfect match’ into product innovation, the market has seen a growing focus on wine-infused varieties, targeting adventurous, yet grown-up palates with their overtly adult positioning.” Julia says.

While wine-infused cheese is a classic, brands are also increasingly moving beyond the grape and towards other alcoholic flavours. Apart from wine, according to Mintel GNPD, the top used alcohol flavours in new cheese launches in Europe between 2014 and October 2015 were beer (32%), calvados (11%), cider (8%), brandy/Armagnac (6%) and whiskey (6%).

The most notable upswing has come from beer, with a share in alcohol-flavoured cheese launches that has jumped to 40% between January and October 2015, up from 22% over the same period in 2012, bringing beer on par with wine in launch activity.

“The increased launch activity in the beer-flavoured cheese sector reflects a wider, growing acceptance of beer’s capacity to pair with all kinds of foods, which is expressed, for example, by the emergence of beer sommeliers in recent years.” concludes Julia.

*Hard cheese refers to cheeses such as Parmesan, Manchego and Pecorino Romano; semi-hard cheese includes cheeses such as Edam, Cheddar and Gouda.

Press review copies of the research, more information on the sample sizes of the surveys and interviews with Food and Drinks Analyst Julia Buech are available on request from the press office.

Julia Büch is a Food and Drink Analyst, specialising in delivering insights on issues affecting the German market, providing analysis across a range of categories.

-

Mintel StoreGet smart fast with our exclusive market research reports, delivering the latest data, innovation, trends and strategic recommendations....View reports

-

Mintel LeapMintel Leap is a revolutionary new AI-powered platform that will transform your research process....Book a demo