Car sharing hits a roadblock as membership drops for the first time in five years

The US car sharing market experienced unprecedented growth in recent years, increasing membership by 139 percent in the five years 2010-14. However, the market made a wrong turn, as new research from Mintel reveals that car sharing membership suffered a first ever decline in 2015. Indeed, membership dropped 11 percent last year with factors such as the emergence of alternative mobility options like ride sharing contributing to slowed growth.

29% of consumers age 18-24 use ride sharing services vs 7% who use car sharing services

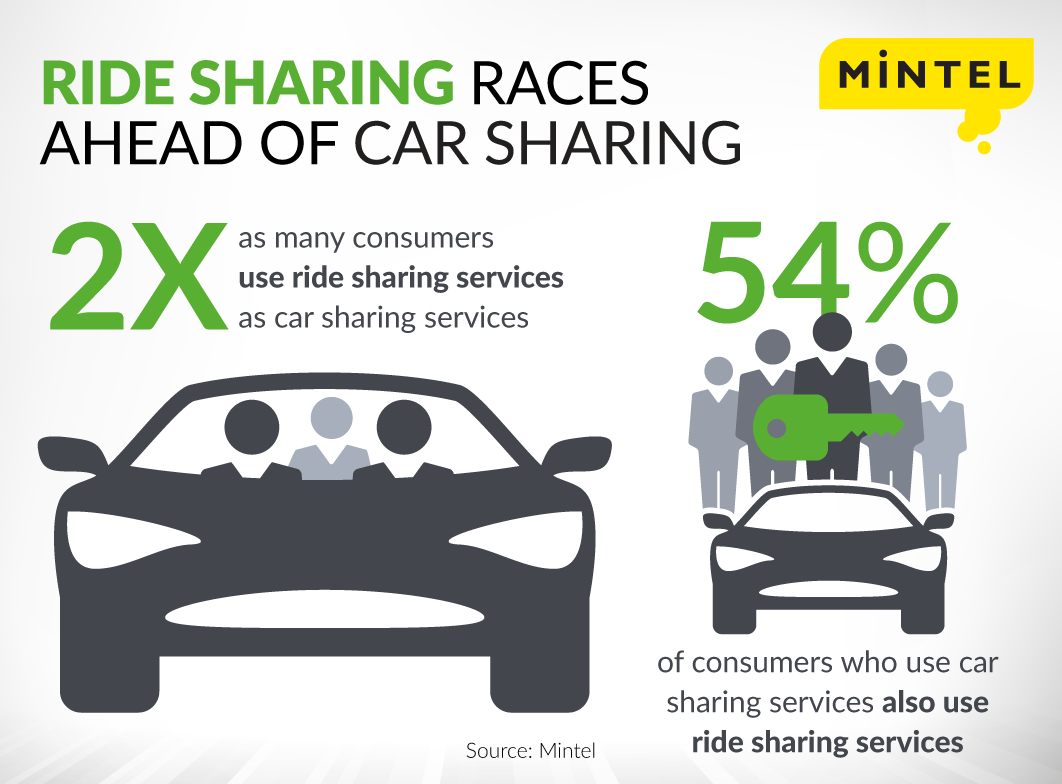

Mintel research reveals that on-the-go consumers prefer ride sharing, which provides users with a ride on demand, as compared to car sharing, in which users rent vehicles for short time intervals, typically by the hour. In fact, twice as many consumers have used a ride sharing service (18 percent) compared to a car sharing service (9 percent) in the past year*. What’s more, 29 percent of consumers age 18-24 use ride sharing services compared to just 7 percent who use car sharing services, the largest discrepancy of any age group.

Among the factors for decline in car sharing popularity, 59 percent of consumers prefer to drive their own car, while two in five (37 percent) say they have never needed to use the service. Another 13 percent of consumers perceive car sharing services as being too inconvenient to use.

Mintel research also indicates that consumers who use car sharing services are seeking out additional convenience through other mobility options: 85 percent also use alternative methods of transportation (eg taxis, car rentals, public transportation), including more than half (54 percent) who use ride sharing services.

“One of the main features that has drawn consumers to car sharing services over the years is that they offer a convenient mobility option at a reasonable price. However, the emergence of alternative options, lower gas prices and increased vehicle sales have been detrimental to the car sharing market,” said Buddy Lo, Automotive Analyst at Mintel. “We see a direct correlation in the decline in car sharing and the rise in ride sharing, and not by coincidence, as consumers are opting for better experience. In order to compete, car sharing providers need to increase the convenience of pickup and dropoff locations, as ride sharing not only offers consumers a reasonably priced alternative, but also on-demand service.”

Conventional wisdom points to car sharing as a service that best serves people without a vehicle, but Mintel research reveals that is not the case. In fact, nearly all (98 percent) car sharing service users report that they own at least one car in their household, while 70 percent have at least two cars.

That said, as vehicle sales are on the upswing thanks to consumers’ increasing confidence in paying the large expense of a vehicle, consumers are most interested in using car sharing services as a way to try out new vehicles before they buy a new car (88 percent). Overall, car sharing users see the service as cost-efficient (88 percent) and environmentally friendly (87 percent). Cost-efficiency is of the utmost importance for the 30 percent of consumers who say they use a car sharing service when their typical method of transportation is not suitable, as well as for those consumers who use car sharing services because their vehicle is not reliable (25 percent).

Car sharing services enjoy a loyal customer base as 85 percent of users agree that they almost always use the same provider. Added incentives could drive loyalty even higher, as two in five (38 percent) consumers agree they like to get rewards for using their preferred car sharing provider.

“While car share users see the utility in owning a personal car, they view car sharing as a cost-effective way to have access to, and test, other vehicles before the time comes to purchase an additional vehicle. In addition to communicating money savings and the positive environmental impact that can result from car sharing, providers would benefit from creating robust rewards programs to boost retention and attract consumers who are loyal to competitors,” continued Lo.

While some car sharing start-ups have discontinued service in recent years, a bright spot for the struggling industry has been the entrance of big players like auto manufacturers. A variety of manufacturers have thrown their hats into the car sharing ring, meeting the demands of consumers, which range from practicality to luxury. This is good news for the 93 percent of consumers who agree that car sharing is an opportunity to drive a car tailored to their needs.

In fact, while the majority of consumers look for compact (51 percent) or crossover (50 percent) vehicles when using a car sharing service, one third (32 percent) prefer to use sport, convertible or luxury vehicles. And another 42 percent of consumers target hybrid/alternative power vehicles. Overall, consumers who use car sharing services use them frequently, as seven in 10 use them daily (36 percent) or multiple times per week (34 percent).

“Losses in car sharing membership may be offset by auto manufacturers’ entrance to the market, creating a potential win-win situation. Many auto manufacturers are worried that they will be relegated to contractors for vehicle fleets in the near future, but by investing in car sharing services, they can diversify the offerings available to consumers that are considering a growing number of options for transportation,” concluded Lo.

*12 months leading to April 2016

Press copies of the Car Sharing US 2016 report and interviews with Buddy Lo, Automotive Analyst, are available on request from the press office.

For the latest in consumer and industry news, top trends and market perspectives, stay tuned to Mintel News featuring commentary from Mintel’s team of global category analysts.

-

Mintel StoreGet smart fast with our exclusive market research reports, delivering the latest data, innovation, trends and strategic recommendations....View reports

-

Mintel LeapMintel Leap is a revolutionary new AI-powered platform that will transform your research process....Book a demo