It’s taken almost a year, but the UK has finally started its journey towards leaving the EU by triggering Article 50.

From a consumer perspective, the triggering of Article 50 won’t change much. The economy has held up better than many expected. GDP is growing, unemployment is at record lows and, crucially for a nation that is obsessed with property prices, the property market has held firm.

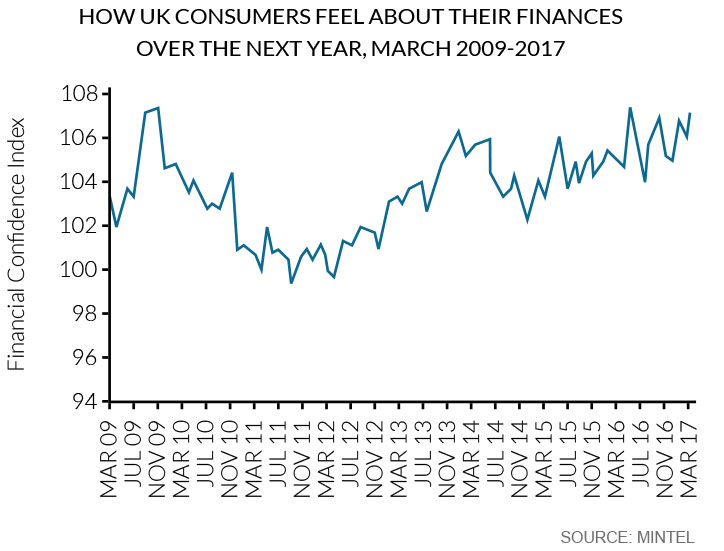

This is reflected in Mintel’s consumer confidence research. When it comes to how people think their finances will change over the next year or so, there was a clear dip immediately after the result of the vote was announced. However, after that initial moment of shock, confidence returned to its rising trend. In mid-March 2017, sentiment was close to its highest point since Mintel started to track this measure, back at the start of 2009.

Inflation is the key concern for consumers

Part of the reason why confidence has held strong is that people tend to separate the big macro-economic issues from their own financial situation. It’s not GDP or trade disputes that people worry about: it’s their own bank balance that matters most.

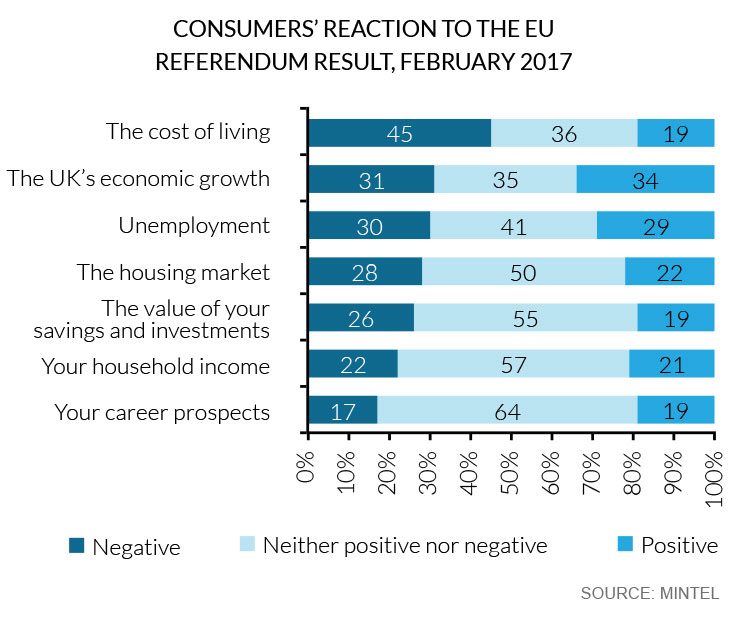

When asked about the impact of Brexit, most people think that it won’t have any real impact on either their career prospects or their household income, for example.

What people are worried about, though, is the prospect of rising prices. 45% of UK consumers think that the EU vote will have a negative effect on the cost of living.

The income squeeze is on

Consumers’ fears are justified. In February 2017, consumer price inflation (CPI) rose by 2.3%. After almost two and a half years where average wages were finally outpacing inflation, we’re back in a situation where people’s incomes are barely keeping pace with price rises. And with the cost of UK manufacturers’ raw materials increasing by 19.1% in the 12 months to February 2017, there are surely more price rises to come.

When real wages fall, shoppers start to re-think their spending decisions. The long post-recession income squeeze contributed to the rise of discount supermarket chains like Aldi and Lidl, for example, and there was an overwhelming focus on obtaining the best possible value for money.

“Value for money” doesn’t always mean cheap, however. There were categories where the premium sector boomed because people thought that trading up offered a better return on their investment. Premium skincare and fragrances had a good recession, for example. And disruption always opens up opportunities for brands that are switched on enough to capitalise on changing consumer preferences.

Even if it does open up opportunities, though, the return of the income squeeze is inevitably going to feed through into consumer spending. There’s a huge amount of uncertainty associated with the Article 50 negotiations, and there’ll be no end of arguments between the Remain and the Leave camps over whether it’ll be good for the UK’s long-term prospects.

But the short- to medium-term impact of the vote on consumers’ financial situation is much clearer. They will need to brush up on their recession-era savvy shopping habits if they’re going to bridge that gap between wage increases and price rises. For retailers and shoppers alike, life on the high street is going to get even more challenging over the next few years.

Toby Clark is the Director of Research EMEA at Mintel , where he has worked for over 10 years. Toby leads a large team of researchers who produce over 500 consumer reports annually on UK and European market sectors. Prior to this, Toby was Head of UK Financial Services research at Mintel.