-

Articles + –

Bank of America enhances customer experience with digital upgrades

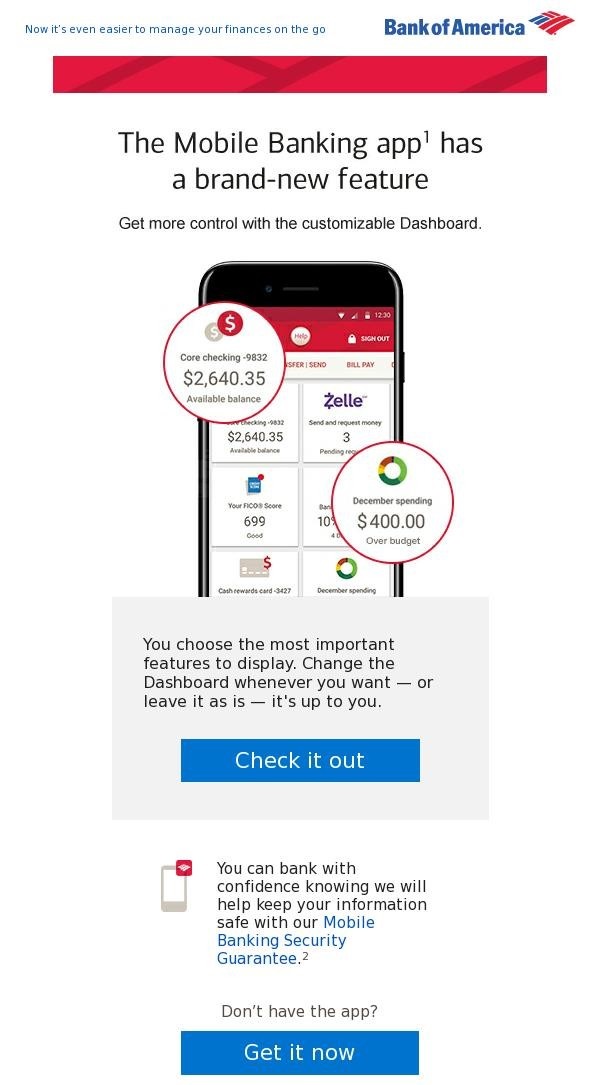

Earlier this month, Bank of America announced a suite of new tools and features for its mobile app and website. The promise behind these updates is more personalization and customization. Some of the new features include a customizable mobile dashboard, a goal-setting tool, and improved ATM and online bill pay experiences.

Mobile app enhancements and upgrades not only make the user experience better, but they can also be an opportunity to generate renewed excitement and increase customer engagement. In an industry such as banking where mobile apps are often used for transactions or singular tasks, it can be hard to get customers to spend any more than the absolute minimum amount of time necessary on the app. Bank of America’s addition of a customizable dashboard will let users create their own welcome screen that is easier to navigate, making every visit more efficient. And with the new goal-setting tool, customers will be encouraged to personalize their savings goals with names, target amounts, and even photos. This will encourage more frequent and longer visits to the app.

Although Bank of America announced these updates in early September through a press release, the bank did not email customers to notify them about the updates until September 15 with the subject line, “New: Customize how you bank on the go.” Instead of introducing all of the announced updates all at once, this initial email focused on the customizable dashboard and highlighted the ability to choose the most important features to display.

Email is certainly the preferred channel for communicating these types of updates, and Mintel Comperemedia has observed a variety of different strategies around this. Some brands utilize a “coming soon” strategy, such as what E*Trade did in March when it emailed customers with the subject line, “Coming Soon! A Brand New Mobile Experience for Your Stock Plan Account.” This particular email campaign generated an impressive read rate of 36%, which is above the industry average of 31%. Other banks invite customers to view the latest updates for themselves once they are live. Sallie Mae recently launched a suite of new features to their app and emailed customers with the inviting subject line, “Check out these new mobile app features.”

The key to success with any communication strategy for mobile updates is the value proposition. Security continues to be the primary concern that is keeping consumers from downloading a mobile banking app. In order to overcome that concern, the messaging for any new mobile app feature or service must be positive enough to outweigh this apprehension, or else it must solve a big enough pain point in the overall financial experience.

The concept of personalization in online or mobile banking is not new. In 2015, BB&T launched U by BB&T, a build-your-own money management platform geared towards Millennials who wanted to customize their own online experience. Barclays also recently launched a new mobile design and invited Barclaycard customers to share their summer travels by posting photos and sharing experiences in real-time through the newly enhanced mobile website.

Lily Harder is the Vice President of Research for Mintel Comperemedia. Lily specializes in the financial services industry, researching and presenting on the latest industry trends, competitive intelligence insights and newsworthy developments.

Lily Harder is Vice President of Research, Mintel Comperemedia. She specializes in financial services, researching industry trends and competitive intelligence insights.

-

Mintel StoreGet smart fast with our exclusive market research reports, delivering the latest data, innovation, trends and strategic recommendations....View reports

-

Mintel LeapMintel Leap is a revolutionary new AI-powered platform that will transform your research process....Book a demo