Whilst cheese is a supermarket staple in the West, brands are now looking to the East as a testing ground for product launches. South Korea is a prime example of this, with as many new cheese products having launched here in the first six months of 2016 as in the whole of 2015 highlighting how cheese innovation is picking up and evolving.

Innovation is pushed by imports, particularly of natural cheese, accounting for 93% of imports in 2013. Despite the increase in import of natural cheese, processed and fresh cheeses still accounted for 40% of new launches in 2015, as local manufacturers – mainly – kept innovating in the segments. In fact, the most active companies in the processed and fresh cheese segments were Seoul Dairy and Dongwon.

In the natural cheese segments (which include hard and soft cheeses), both local manufacturers and international players are contributing to broadening the offer. Cheddar, mozzarella, parmesan or feta are now available, brought to the market by South Korean companies such as Dongwon and Pulmuone and global manufacturers in the like of Arla and FrieslandCampina.

Shift towards more flavoured cheese

The recent arrival in South Korea of Arla, Bel and Savencia contributes to an increase of flavoured cheese innovation. In the first six months of 2016, 42% of new cheese was flavoured, compared to 17% in 2014 and 2015. The range of flavours is very wide, covering fruit and vegetable, nuts, spices and herbs, often combined together. Flavours are both savoury and sweet. The format of these flavoured cheeses often implies a specific usage. Over a third of flavoured cheese launched between January and June 2016 were spreadable and therefore designed to be eaten on a piece of bread or cracker. Arla, for example, has launched a range of flavoured cream cheese made with natural ingredients and high quality fresh milk. The serving suggestion showed on-pack features the product spread on bread. Cubes are the favourite format for snacking. For example, Arla Apetina feta-style cubes in chile oil is described as a snack pack, while private label Peacok smoked cube cheese comes with a fork.

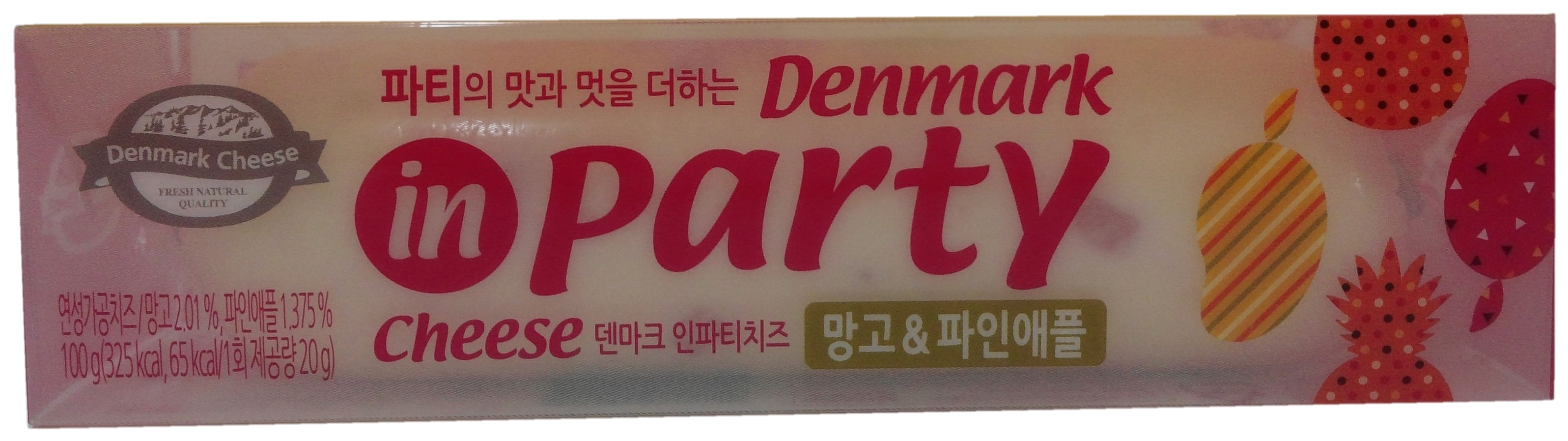

Whole flavoured cheeses are designed for entertaining. Dongwon has a dedicated range for this occasion called Denmark in Party Cheese. The cheese, flavoured with mango and pineapple, for example, has been “specially designed to consume during a party”. Meanwhile Australian company The Fresh Cheese Company has launched some rather unique flavour combinations such as mango and melon; pear, hazelnut and vanilla; or cookies n’ cream.

Slices of flavoured cheese are designed to be used in cooking, in particular to be melted on dishes such as rice, very much as it is used in Japan. South Korean consumers are used to food containing cheese in foodservice.

Steady growth but restricted by very high retail price

The South Korean retail cheese market is still very small but is one of the fastest growing markets in the world, with most of the growth coming from the soft cheese segment which accounts for a third of the market volume.

Despite this, consumption per capita remains low. Beyond the fact that cheese is not a staple in the Korean diet, consumption is also limited by very high retail prices, partly due to import taxes. However, as South Korean consumers are increasingly exposed to cheese in both retail and foodservice in diverse and innovative formats and flavours, it could pique interest in the category.

Caroline provides robust consumer insights and realistic recommendations to dairy companies and tracks global innovation and consumer trends to assist clients in their growth strategies. Prior to Mintel, Caroline managed brand strategy in the UK and France for a FTSE 250 dairy company. As part of this she led annual brand planning; developed and executed marketing plans, including advertising campaigns and media planning; and, drove innovation and renovation projects, from market research to in-store implementation.