In this new Mintel blog series, Mintel Trends analysts take a look back at a trend observation and discuss how their predictions fared as well as its impact on consumer behavior.

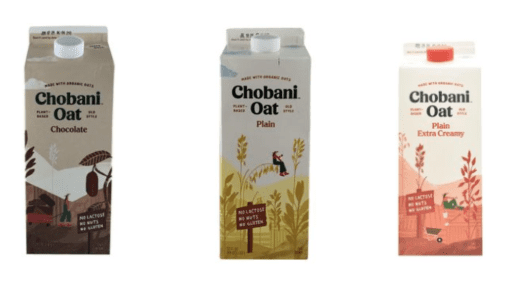

In December 2019, the US Mintel Trends Team wrote about Chobani developing a line of non-dairy oat milk-based products that launched in November 2019. Here, we check on this launch to see how the innovation has played out.

What Mintel analysts predicted

The name recognition of Chobani in the yogurt space would provide a sense of trust toward taste and quality. Chobani was balancing the innovation of new markets without ignoring the dairy staples it has built its market around, in many ways reflecting the type of balance consumers seek in their own diets. From a broader non-dairy perspective, Mintel predicted that with its superior sustainability profile compared to the likes of almond and coconut milk, oat milk was poised to be a winner in the market.

A current reflection

When the pandemic hit and lockdown restrictions were put in place, consumers gravitated toward staples. Oat milk-based products found a successful niche of being a staple, but also a treat. With this demand, Chobani really found a sweet spot for its launch. By April 2020, Chobani was already second in oat drink sales according to Nielsen sales data, putting it ahead of notable plant-based brands Oatly and Silk.

Mintel’s Purchase Intelligence Tool revealed that across Chobani’s oat-based drink releases—which include Plain Oat, Extra Creamy Plain Oat, Chocolate Oat and Vanilla Oat—the Extra Creamy Plain Oat Milk Drink had a higher purchase intent than the Plain Oat Drink and the Chocolate Oat Drink had the highest purchase intent overall across the varieties. This clearly demonstrates that consumers are looking for treats and even as they engage in healthier lifestyles they still want a sense of indulgence.

The Mintel Trend, ‘Bannedwagon’ highlights how consumers are embracing once niche ways of living and eating. The success of oat milk at a time when consumers are focusing on fundamentals demonstrates that plant-based milk has fully hit the mainstream market, and oat milk is proving to have a staying power. Beyond Chobani, the pandemic hasn’t impeded innovation in the food and drink space. Since the start of the lockdown in March, Mintel has written more than a dozen trend observations under the Bannedwagon Trend, including Lupii snack bars made from the Lupini bean and the launch of MorningStar Farms‘ meat alternative Incogmeato burgers.

Broader focus: What this means moving forward

Mintel’s Wellbeing Trend Driver emphasizes that consumers are taking a more holistic approach toward wellness; Chobani has become an industry leader in marketing health through a holistic lens. For example, Chobani recently expanded further into functional health territory with a new line of fermented, plant-based drinks made with organic fruit juice, botanicals, and immunity-supporting probiotics, but it explicitly avoided highlighting specific functional claims outside of associated benefits from the ingredients. COVID-19 is rapidly accelerating consumer interest in health benefits, and that leaves a lingering question for food and drink brands of how far brands should expand into new health and plant-based spaces. According to Mintel US research on functional drinks, nearly three in 10 US consumers trust drinks with functional claims will deliver the promised results and one in five need to immediately feel the promised effect to believe the product is working. While there are dedicated consumers strictly focused on specific benefits, a majority of consumers are likely looking through a broader lens as they invest in a new product, including taste and price, but also brand trust. Chobani balances entering niche categories without losing its everyday appeal, as evidenced by it launching oat milk with clear texture and flavor profiles versus health claims. This signals that trust doesn’t always come from promising benefits, but rather just staying true to mission.