That shrinking product on the shelf isn’t your imagination. It’s a money-making tactic. Products get smaller, but the prices stay the same. Or worse, products get smaller and prices get larger.

While “shrinkflation” isn’t a new tactic, the attention it’s getting is. As brands shrink their products to offset increasing costs, shoppers are noticing. And they’re making the worst offenders public on social media, giving others a heads up so they can get the best value while shopping.

Meanwhile, some brands are taking action in marketing, publicizing product changes to get ahead of the criticism. Others are staying quiet, hoping their smaller and lighter product sizes are going unnoticed, thanks to prices that remain steady.

Either approach is, when you get down to it, a little sneaky. Brands that make product changes known tend to do so under the guise of improvement. Brands that do the opposite, keeping product changes under wraps, simply change the name of sizes—the size formerly known as “family” becomes “giant,” while “family” gets smaller. Or they might change nothing at all. Both approaches take advantage of brand-loyal shoppers, who might be likely to look past the price and reach for the product they already know and love.

But shoppers are getting savvier, and brands will have to adjust their strategies to successfully appeal to a more informed audience.

New packaging, new product, same price

Historically, it’s common for brands to shrink the size of their products rather than increase prices during economic downturns. This way, brands are still able to save money while their customers are less likely to notice that their dollar isn’t going as far. However, consumers have gotten wise to these tactics, especially as inflation forces price increases. Why, consumers might wonder, do their favorite products still cost the same (or close to it)?

They might look to the packaging for clues. The weight and number of units (if it is a multipack, for example) are always there on the front of the pack. But as companies shrink their package size, often those numbers may be the only way to tell if a product has downsized. And who remembers what the size was before? One classic example from the Great Recession was the size of what we always called “half gallon” containers of ice cream. They quietly downsized, and while consumers did notice, it did not explode on social media then the way it has now.

They might also look at the marketing. Rethinking packaging to make it look more modern—or simply to make it look novel, and therefore more exciting—is standard. Pair that with cost pressures, and companies have an easy way to try to sell less for the same price. Sometimes, companies will call attention to their new look, hoping to divert attention away from the new form factor’s effect on what’s inside.

Pedigree, for example, began running a new campaign for Dentastix in 2022:

Unfortunately for shoppers not paying close attention, “new design” doesn’t just mean new packaging design; it also means new product design. While the old Dentastix, in the old packaging, 7 treats weighed 1.94 pounds grams; in the new packaging, 7 treats weigh 1.87 grams. It would likely take a detail-oriented shopper to zoom in on the comparison product shot on Chewy.com to notice the difference, rather than just seeing the new packaging for what it seems to be: new packaging.

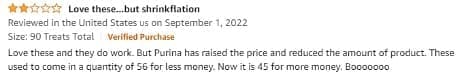

At least on Amazon, shoppers did notice and complain in reviews:

Another strategy for shrinking the size while maintaining positive consumer sentiment is to focus on how the new size or form factor benefits consumers. One of the best examples from the Great Recession on this point is what Coca-Cola did with its soda cans. Now called Mini Coke (or Diet Coke or others), the cans are only 7.5 fl. Oz., smaller than 12-oz. cans and much larger bottles. The price per 100ml of product for the Mini Coke cans is 32 cents; for a 12-pack of 12-oz. cans, it’s 18 cents, according to an analysis of Mintel Global New Products Database data. The smaller-size-with-a-bigger-price product has been a resounding success for Coca-Cola, as it gives consumers exactly the amount they need, with no waste.

Another example came from Dawn, which released a new dish soap that opens from the bottom to prevent mess and additional cleanup. The item is technically 4.7 ounces smaller than a typical bottle of dish soap—and, in fact—costs more but because the packaging changes were improvements, shoppers might not be as likely to mind, instead focusing on the perceived benefits.

A new form factor, rather than just redesigned packaging, allows a company to more effectively use marketing to shift consumers’ attention and steer sentiment.

Even though the product size is clearly displayed on the bottles, the upside-down dish soap—previously foreign in the world of popular dish soap—gets all the attention.

Consumers call out shrinkflation when they see it

TikTok, where shopping advice abounds, is abuzz with shrinkflation. The hashtag #shrinkflation had 19 million views on the platform (as of Dec. 6, 2022), with videos of consumers explaining the concept and calling out specific brands on their shrinkflation tactics. This critical lens shows no signs of slowing down. Mintel’s 2023 Consumer Trend Intentional Spending explains that consumers will be spending more thoughtfully in 2023, which means doing more research prior to purchasing items – including looking at product size and value per oz. before buying.

In 2022, there were over 36,000 public posts across social media platforms featuring “shrinkflation” or “#shrinkflation”—a 19% increase in social media mentions from 2021. That timing isn’t coincidental: often posts about shrinkflation increase following news articles and shows about the topic from outlets like The Associated Press and The Daily Show.

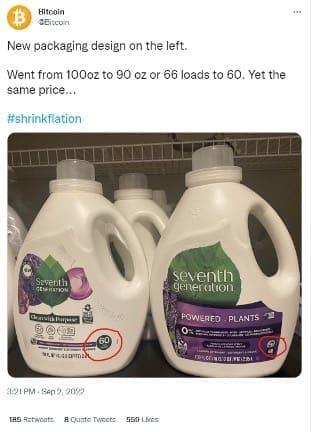

When consumers do spot suspected shrinkflation from a brand, they aren’t hesitant to call it out to both their followers and the brand itself. Often this outreach takes place on Twitter, which is known for being one of the most direct ways to get the attention of a brand’s customer service team. Consumers will often attach photos of the product and brand logo to prove the change and sometimes even tag the brand themselves.

What we think

Knowing that brands have a smaller chance of flying under the radar when shrinking down product size, should brands stay quiet? In some cases, particularly those where a shrunken product is combined with an increased price, probably not. Mintel’s 35-market global data shows that 63% of US adults agree that brand name is not important to them when shopping most categories, indicating that if consumers recognize shrinkflation and a higher price tag, they may switch to a competitor. In these cases, brands should justify the price increase or size change by making clear in marketing that the new version is definitively better.

But in other cases, for companies in sectors with more brand loyalty, there may be no need to mention this kind of change at all. If they do, as Pedigree did, it may warrant unwelcome attention. Cereal is another great example: cereal is a category where shrinkflation runs rampant, but Mintel’s Private Label Food and Drink – US, 2022 shows that the majority of US grocery shoppers prefer the name brand for cereal, and Mintel’s Hot and Cold Cereal – US, 2022 shows that nearly half of cereal shoppers stick to their go-to brand when shopping for cereal.

As we have seen, companies who can successfully make this shift in size with less backlash from consumers do so when they offer additional benefits, creating a new consumption experience for consumers.

All in all, it’s all about how elastic demand is. For companies whose products can easily be swapped when prices or sizes change, marketing is an opportunity to show off clever packaging design and improved ingredients. And for those whose products (and brand names) are stickier, there may be no need to come up with any new marketing strategy at all.