One quarter of German Millennials would pay more for pre-cut vegetables

As German Millennials gravitate towards more fresh foods, pre-cut and ready-to-eat fresh vegetables are on the rise, while consumer interest in canned vegetables is waning.

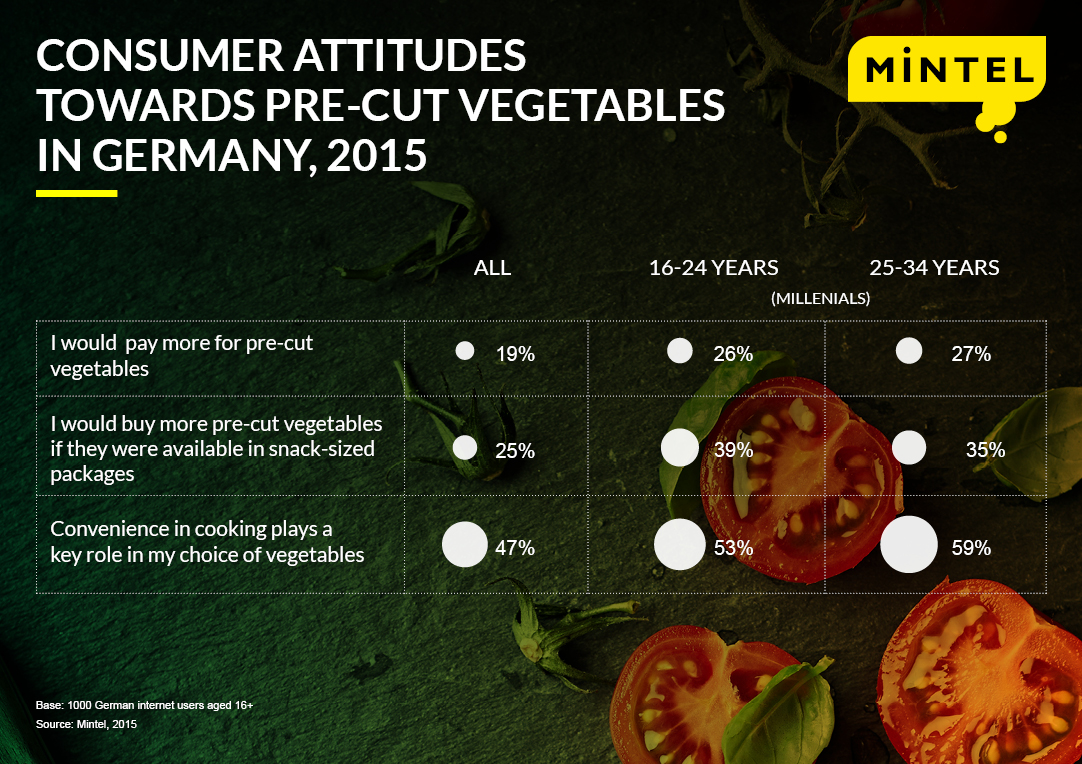

New research from Mintel finds that more than one quarter of German Millennials would be willing to to pay more for pre-cut vegetables such as sliced carrots, chopped onions or stir-fry. In fact, 26% of consumers aged 16-24 and 27% of those aged 25-34 say that they would pay extra for such products, compared to just one in five (19%) German consumers overall who say they would be happy to do so.

However, when compared to neighbouring Western European markets, the usage of convenient pre-cut and ready-to-eat fresh vegetables is still rather low in Germany. While only one in 10 (10%) German consumers claim to regularly buy fresh ready-to-cook vegetables, 17% of Italian, 17% of Spanish, 16% of Polish and 12% of French consumers claim to regularly purchase these products.

Mintel research indicates that this is due to the fact that German consumers are less likely to eat vegetables incorporated in soup or other dishes, opting for raw vegetables instead. While 35% of Spanish, 29% of French and 24% of Italian consumers say they prefer to eat vegetables incorporated in soup or other dishes instead of on their own, less than one in five (19%) of German consumers agree.

Katya Witham, Senior Food & Drink Analyst at Mintel, said:

“Evolving eating habits, the growth in single-person households and ever-increasingly busy lifestyles are driving demand for pre-packaged fresh produce in Germany. However, uptake of fresh pre-cut vegetables in Germany is relatively low in comparison to its European neighbours. This can be partially attributed to consumer concerns with regards to the safety, quality and freshness of pre-cut fresh produce, but also to differences in vegetable consumption patterns across the various regions.”

While it’s true that 40% of Germans say they are concerned about the safety of fruit and vegetables, Mintel research reveals that there is an opportunity to sway consumer opinion — especially among younger consumers. In fact, almost three in five (59%) Germans aged 25-34 claim that convenience in cooking plays a key role in their choice of vegetables, compared to less than half (47%) of Germans overall.

German Millennials are also the cohort who are most likely to show the least interest in cooking from scratch. Over one quarter (27%) of Germans aged 16-24 admit to rarely cooking properly from scratch during the week, compared to an average of 19% of consumers overall.

What’s more, almost two in five (39%) Germans aged 16-24 say they would buy more prepared vegetables and fruits if they were available in snack-sized packages, while only one quarter (25%) of Germans across all age groups agree.

“While German consumers are not yet entirely convinced of the added value of pre-cut vegetables, the convenience aspect presents ample opportunities for Germany’s fresh produce companies. Time-saving innovations that are aligned with growing consumer demand for convenience are likely to drive sales in the coming years as more consumers face time constraints.” Katya adds.

Consumer interest in canned vegetables is shrinking in Germany

Due to the shift towards fresh produce and increased competition from chilled convenience vegetable formats, consumer interest in canned vegetables is shrinking in Germany. Mintel research reveals that only two in five (41%) German consumers bought shelf-stable vegetables on a weekly basis in 2015, down from 52% in 2014 — a significant decline of over 10 percentage points in the participation rate.

What’s more, canned beans in particular experienced declining consumer interest, albeit not as steep as the rest of the canned vegetables segment, with 23% of German consumers purchasing canned beans in 2015 compared to 26% in 2014.

Mintel research indicates that the waning interest in canned varieties is due to the fact that such products do not seem to appeal to Millennials. Compared to consumers overall, the proportion of those who bought tinned vegetables and beans were significantly lower among younger age groups: only 32% of 16-24 year olds purchased canned vegetables, while just 18% bought tinned beans.

Yet, organic canned vegetables appear to trigger the interest of younger consumers, with 13% of those aged 25-34 regularly purchasing organic canned varieties compared to 8% of consumers overall. In fact, when it comes to attitudes towards fruit and vegetable consumption, Germany’s Millennials find organic attributes among the most motivating. Over two in five (42%) Germans aged 16-24 believe that organic fruit and vegetables are more nutritious than conventionally grown fruit and vegetables, compared to just 27% of Germans overall.

According to Mintel’s Global New Products Database (GNPD), the strong interest in organic fruit and vegetable offerings has not gone unnoticed among shelf-stable vegetable producers, as the share of new shelf-stable vegetable launches with organic claims has soared in Germany from 25% in 2014 to 39% in 2015.

“The waning consumer interest in tinned vegetables among Millennials highlights the fact that current canned offerings in Germany fail to excite younger audiences. It is time for canned vegetables brands to modernise and to increase consumer uptake of canned formats by developing added value products that cater to evolving consumer demands through positive attributes, such as organic certification, premium ingredients or stand-out packaging design.” Katya concludes.

Press review copies of the research and interviews with Senior Food & Drink Analyst Katya Witham are available on request from the press office.

Katya Witham is Senior Food & Drink Analyst, identifying and exploring the major trends across various FMCG categories, giving invaluable insights into global markets.

-

Mintel StoreGet smart fast with our exclusive market research reports, delivering the latest data, innovation, trends and strategic recommendations....View reports

-

Mintel LeapMintel Leap is a revolutionary new AI-powered platform that will transform your research process....Book a demo