US sales of dairy milk turn sour as non-dairy milk sales grow 9% in 2015

Driven by negative health perceptions, reduced retail prices and exports and a growing number of non-dairy alternatives, the US dairy milk market has declined in recent years, as new research from Mintel reveals that sales of dairy milk decreased 7 percent in 2015 ($17.8 billion) and are projected to drop another 11 percent through 2020. Seen as a better-for-you (BFY) alternative to dairy milk, non-dairy milk offerings continue to see strong growth, with gains of 9 percent in 2015 to reach $1.9 billion.

The continued popularity of non-dairy milk is troubling for the dairy milk category with Mintel research revealing that half (49 percent) of Americans consume non-dairy milk, including 68 percent of parents and 54 percent of children under age 18. What’s more, seven in 10 (69 percent) consumers agree that non-dairy milk is healthy for kids compared to 62 percent who agree that dairy milk is healthy for kids.

Among non-dairy milk consumers, nearly half (46 percent) drink it at least once a day, including 57 percent of parents. When looking at reasons for consumption, non-dairy milk is more likely than dairy milk to be consumed for heart health (29 percent non-dairy milk vs 20 percent dairy milk) and weight loss (23 percent non-dairy milk vs 8 percent dairy milk).

69% of consumers use dairy milk as an addition to other food while just 57% drink it by itself

While an overwhelming majority of Americans consume dairy milk (91 percent), it is most commonly used as an addition to other food (69 percent), such as cereal, or as an ingredient (61 percent). Just 57 percent of consumers drink dairy milk by itself.

“In addition to half of Americans consuming non-dairy milk, our research reveals that nearly all non-dairy milk drinkers also drink dairy milk, revealing that consumers are turning to non-dairy out of preference as opposed to necessity,” said Elizabeth Sisel, Beverage Analyst at Mintel. “Consumers are also less likely to drink dairy milk by itself, instead adding it to food or as an ingredient, undoubtedly contributing to the category’s steady decline in consumption. This signals a need for brands to communicate the benefits of consuming dairy milk as a beverage, especially among parents, who are more willing than consumers overall to drink non-dairy milk and buy non-dairy milk for their children as a better-for-you alternative.”

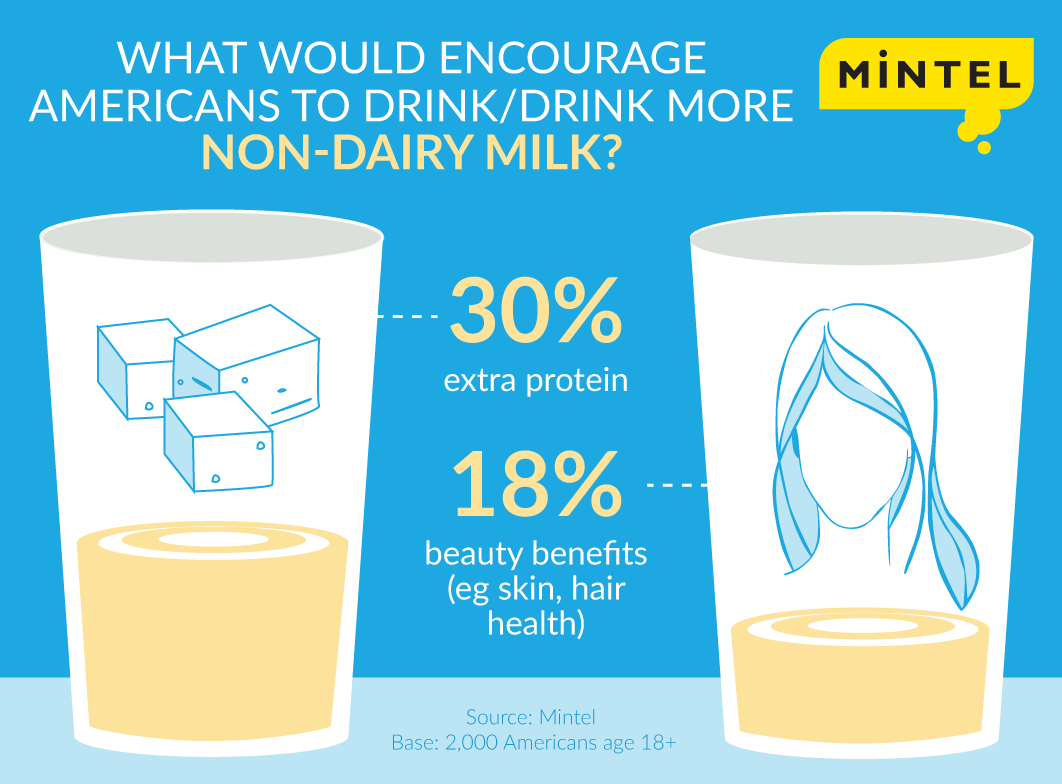

Mintel research indicates that product and ingredient innovation could lead to further adoption of non-dairy milk. In fact, 30 percent of Americans would be encouraged to drink/drink more non-dairy milk if it had more protein. One in five (18 percent) Americans would also be drawn to drink/drink more non-dairy milk with the addition of beauty benefits (eg skin, hair health), including 19 percent of men age 18-34.

“Our research shows that the difference in when and how much consumers are drinking milk demonstrates that dairy milk is still the go-to option, but it also exposes an opportunity for greater non-dairy milk market penetration. Consumers are connecting their diets with the way they look and feel. This creates opportunities for non-dairy milks to promote health in a number of areas for both men and women, from wellness and nutrition to beauty benefits such as hair and nail health,” continued Sisel.

There are still areas of opportunity in the market for dairy milk. Two thirds of consumers agree that dairy milk (67 percent) is naturally nutritious compared to 60 percent for non-dairy milk. In addition, consumers are more likely to agree that dairy milk is free of additives (81 percent vs 62 percent non-dairy milk). What’s more, 86 percent of consumers view dairy milk as fresh compared to 63 percent who agree non-dairy milk is fresh.

Positive attitudes toward dairy milk’s freshness and nutrition is promising for the category as the top attributes consumers look for when purchasing dairy milk are natural (43 percent) and vitamin/mineral content (34 percent), while one in five (21 percent) look for organic options, driven by 28 percent of parents.

Furthermore, 82 percent of consumers believe dairy milk offers a wide variety of flavors in comparison to non-dairy milk (61 percent). In fact, the flavored dairy milk segment posted 5 percent gains from 2014-15.

“While consumer trends are not favoring dairy milk, brands have an opportunity to re-engage consumers by developing innovative offerings that focus on improving already favorable aspects such as taste profile and nutritional value. It’s also important for brands to highlight that dairy milk is not just beneficial for bone health, but may also provide other benefits for consumers’ overall well-being as compared to non-dairy milk,” concluded Sisel.

Press copies of the Dairy Milk US 2016 and Non-dairy Milk US 2016 reports and interviews with Elizabeth Sisel, Beverage Analyst, are available on request from the press office.

For the latest in consumer and industry news, top trends and market perspectives, stay tuned to Mintel News featuring commentary from Mintel’s team of global category analysts.

-

Mintel StoreGet smart fast with our exclusive market research reports, delivering the latest data, innovation, trends and strategic recommendations....View reports

-

Mintel LeapMintel Leap is a revolutionary new AI-powered platform that will transform your research process....Book a demo