Indian consumers seek healthier instant noodles, pasta, and soups with more Desi flavours

Indian consumers are looking for healthier options for instant noodles, pasta, and soups: with over 61% market penetration for these three instant foods, there is indeed much room for improvement and innovation according to Mintel’s latest research.

Tulsi Joshi, Principal Food & Drink Analyst, Mintel Reports India, said, “Consumers’ imagination of healthier instant food options is devoid of maida and oil. Although the substitution of maida is a growing trend rather than mainstream, this presents an opportunity for instant noodle and pasta brands.”

Maida is a super-refined wheat flour also used to make pastries, breads, and biscuits. Mintel research shows that there is increased interest in maida substitutes like whole wheat (57%), oats (47%) rice and soya (45% respectively). Furthermore, over a third (38%) of consumers said they are willing to pay more for instant noodles/pasta/soup with “no maida” as a healthy feature.

The “no oil” attribute in instant foods is also an untapped opportunity. Mintel research suggests that brands can adopt oil-free cooking methods for their product offerings.

In the report, Joshi said consumers are “poised to invest more in wellness, elevating the value of health-centric propositions. This trend is projected to fuel the demand for healthier alternatives within indulgence- and convenience-focused categories, including instant noodles, pasta and soup.”

Furthermore, Joshi said the pasta and soup market is propelled by time-constraint lifestyles and urbanisation, driving consumers increasing preference for convenient, competitively priced products. Mintel research shows that the primary consumers of instant noodles, pasta, and soups are predominantly the younger demographic such as Gen Z (74%). Additionally, the category enjoys higher penetration among Sec A consumers (68%) and women (67% compared to 54% of men).

The most consumed product among Indian consumers is instant noodles (52%), followed by instant pasta (30%) and soup (16%).

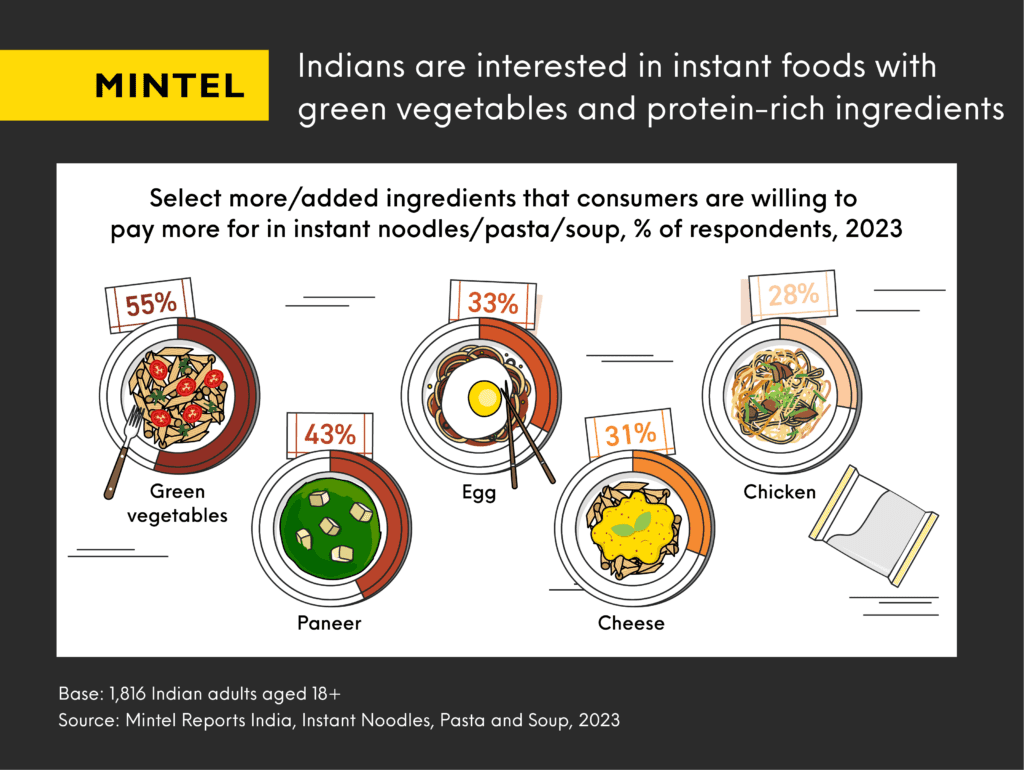

Indian consumers said they are willing to pay more for instant noodles/pasta/soup that includes green vegetables and protein-rich ingredients such as eggs, paneer, cheese, and chicken.

Consumers are also seeking Desi (Indianised) versions of Asian flavours. They prefer these versions over authentic Asian flavours and are willing to pay more for them (34% vs 18%, respectively). For instance, they like Regional Indian, Desi Chinese, Desi Thai, and Desi Korean. For brands, it is crucial to Indianise international flavours to suit Indian palates.

According to Joshi, brands can take inspiration from local street food vendors, foodservice restaurants, home chefs and chefluencers (chef influencers) to “Desify” instant foods. They can also target the niche segment of experimentalists with authentic Chinese flavours in instant noodles and maximise reach with desi versions of Thai and Korean classics. For Desi Korean flavours, brands can ride the current Hallyu trend to attract more consumers. Indian Gen Zs are embracing Korean culture, particularly Korean noodles, indicating that Hallyu culture can go mainstream in India in the near future.

“The Hallyu culture is anticipated to strengthen its foothold in India, particularly among Alphas Gen Z, Gen Z and Younger Millennials. Brands offering Korean noodles and flavours will actively vie for market share in response to this trend,” she added.

As the market in India is at the cusp of a shift toward a new era of healthier instant food, brands are poised to integrate health-conscious offerings with affordability and taste.

Additional research on haircare trends and interviews with the analyst are available upon request from the Mintel Press Office. For those interested in purchasing the full report, please visit the Mintel Store.

-

Mintel StoreGet smart fast with our exclusive market research reports, delivering the latest data, innovation, trends and strategic recommendations....View reports

-

Mintel LeapMintel Leap is a revolutionary new AI-powered platform that will transform your research process....Book a demo