The third wave coffee movement has fueled renewed interest in the coffee category, creating innovation opportunities as it continues to evolve into an artisanal or craft beverage, rather than a commodity. Cold brew coffees are part of this trend, created with more labor intensive methods and touted as having more flavor, less acidity, and smoother mouthfeel.

While cold brews have seen a number of launches at foodservice and within the ready-to-drink (RTD) segment, the concept is generating new attention in ground coffee formats. The idea of at home cold brewing has potential to catch on with consumers: more than one in five iGeneration and Millennial coffee drinkers are interested in roasts specially made for making cold brew coffee at home.

Starbucks recently announced the launch of its Cold Brew Coffee Pitcher Packs that allow consumers to make Starbucks cold brew coffee at home. While coffee specific to at home cold brew preparation is not new (PT’s Coffee Roasting Co and Atomic Café are just two examples of roasters who sell grounds and beans exclusively for cold brew preparation at home, and Grady’s offers consumers Cold Brew Bean Bags, pre-packaged and portioned grounds), Starbucks’ highly visible launch will likely bring greater awareness to the concept.

Retail cold brew sales grow, but future outlook is uncertain

There is no doubt that cold brew is a strong trend driving innovation in the coffee category. However, the vast majority of consumers still do not drink it, and of those who don’t only a third are interested in trial, per Mintel’s Coffee US 2015 report. RTD coffees are still the preferred cold coffee drink at retail, and only a quarter of cold brew coffee consumers say they prefer cold brew coffee over other RTD coffees. Infrequent consumption is also a challenge, as consumers mainly drink cold brew on a monthly or perhaps weekly basis. In fact, consumption of retail cold brew stayed the same 2015-2016, indicating the consumer base is not growing anywhere near as fast as sales.

Although consumption of cold brew at retail remains unchanged compared to a year ago, the sub-segment continues to grow at an impressive rate. This is in part a reflection its size: cold brew at retail makes up less than one percent of the RTD coffee segment, which in turn is only 17% of the total coffee category. Sales gains within the sub-segment seem particularly impressive given the fast growth it experiences as it trends, but mainly it is due to a humble market sales start at less than $2 million as of 2010.

The US cold brew sub-segment grew 580% from 2011-16

However, the cold brew sub-segment grew 580% from 2011-16, with cold brew sales in 2016 proving to be cold brews’ strongest year yet at retail (per Mintel’s Coffee US 2016 report to be released in September). Since consumption is still infrequent, sales are likely driven by increased awareness and interest in trial, which encourages one-time purchases.

Manufacturers are challenged with exciting consumers beyond their desire to just try a new preparation method. Already new brewing methods that tout superior flavor production are inching their way to the forefront, such as pour overs and flash-brewing or ice-brewing. A future for cold brew beyond the current trend will depend on consumers’ greater awareness and consideration that it is more than a one-time experience, but a drink they can incorporate into their daily or even weekly routine.

Foodservice awareness greater than retail

Specialty coffee drinks tend to have greater popularity at foodservice outlets, where there is the equipment and know-how to create specialty drinks like cold brew quickly, properly, and at the peak of freshness. Many foodservice artisan and craft coffee houses were quick to launch their versions of cold brew, as were leading national coffee companies like Peet’s Coffee and Tea and Starbucks. Foodservice companies continue to launch cold brew offerings, the latest being Dunkin Donuts who recently announced the launch of their cold brew coffee at select locations.

Cold brew awareness at foodservice is high: Mintel’s Coffee Houses and Tea Shops US 2015 finds that four in five consumers know what cold brew coffee is, but only a third have had it before, while one in five haven’t but are interested in trying it. There is a greater percentage of consumers that drink cold brew at foodservice than there are at retail, perhaps positioning foodservice locations as more successful outlets for cold brew and other specialty coffee products after the initial novelty fades away.

The cold brew evolution

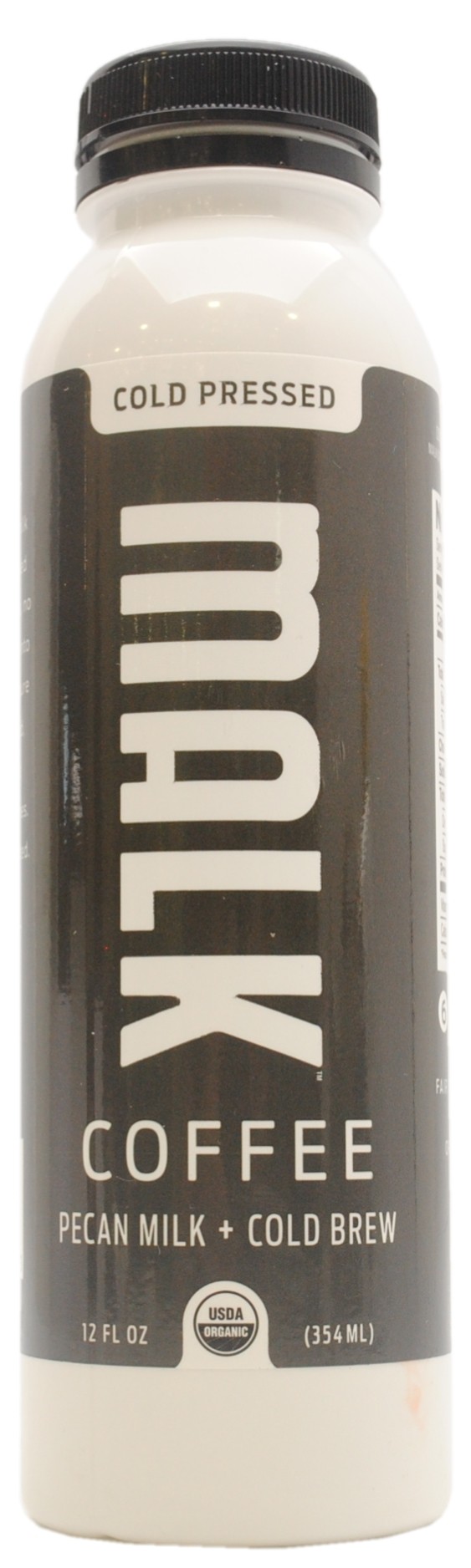

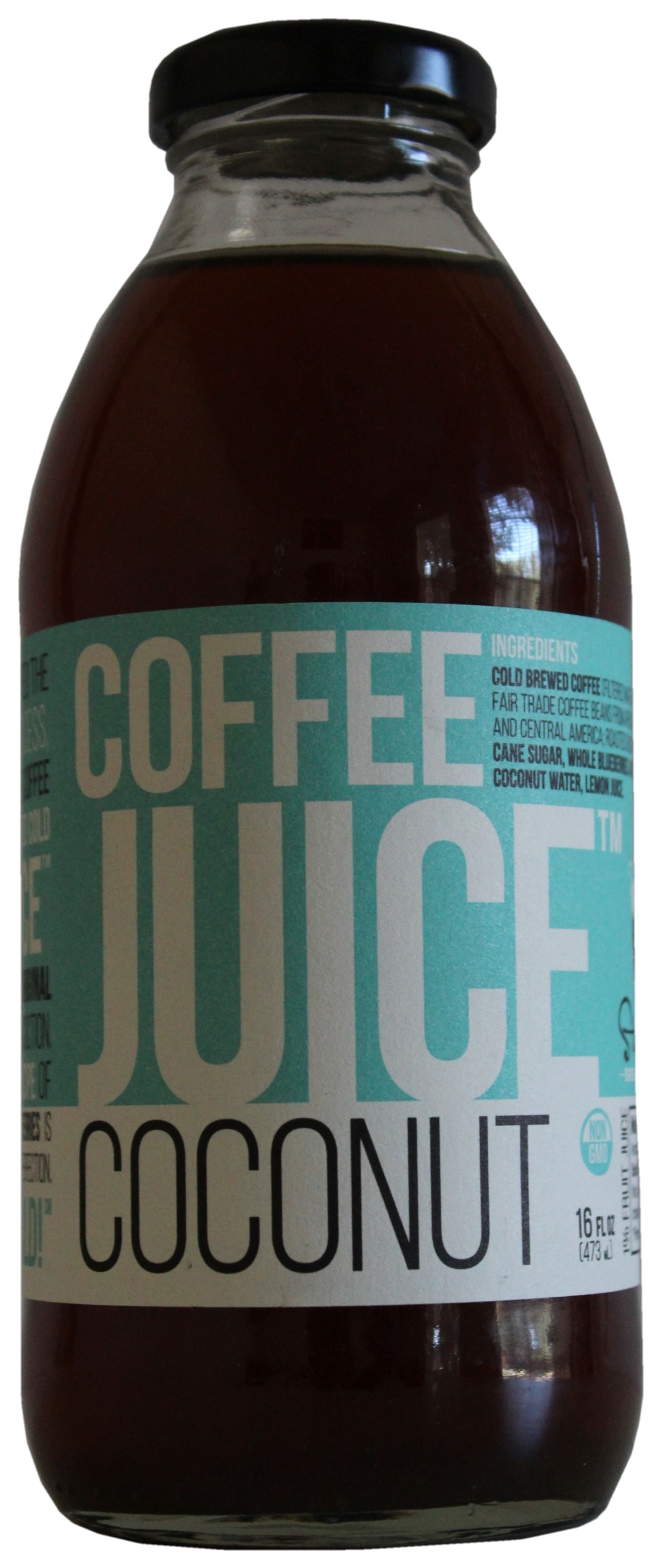

As a RTD offering in the third wave coffee movement, cold brew gained positive consumer attention with its more labor intensive preparation methods that promised a superior experience compared to the classic RTD coffee beverage. Innovation continues to expand the cold brew portfolio at retail, which is seeing new flavors, dairy and non-dairy milk additions, and even functionalities and cross over products.

While there are the original pioneers of the cold brew industry – like Stumptown, Grady’s, and Chameleon Cold Brew, among others – a number of new launches have hit the market in the past year, continuing the sub-categories fragmentation but also introducing consumers to innovations that have yet to be seen in the coffee category.

More nitro coffees – cold brew coffees infused with nitrogen – have entered the retail space as manufacturers find ways to package the premium RTD coffee with and without widgets. Nitro coffees provide a smoother, foamy texture and create a mouthfeel similar to some craft beers. Many coffee shops – from small, third wave roasters to national coffee companies like Starbucks – have launched their version of nitro coffee on tap. The concept bridges the qualities and craftsmanship of craft beers with coffee, both popular categories with the same core consumer groups. Nitro coffees benefits from retail appeal: more than one in 10 coffee consumers would purchase bottled/canned nitro coffee, which increases to approximately one in five Millennials.

What it means

The state of the cold brew industry is a small, but trending with force. Right now it is experiencing impressive growth, thanks to consumers’ enjoyment of new styles of coffee preparation and interest in trial. However, cold brew consumption and RTD coffee in general are not consumed frequently, challenging future growth and perhaps foreshadowing early onset for a plateau in sales. Greater awareness is needed, but most importantly consumers need to be in the mind set to drink cold coffees just as frequently as they do hot coffees. Habit may be to blame, as well as an extremely fragmented market. Consumers likely enjoy one-time or spontaneous trial of cold brew by different roasters and manufacturers, both at retail and at foodservice, but it is unlikely they are staying loyal to a particular brand and drinking it on a regular basis. While the innovation opportunities are plentiful, so are the challenges to maintain and support future growth.

Elizabeth Sisel is a Beverage Analyst at Mintel where she is responsible for writing monthly analysis reports providing strategic insight and consultancy across several categories, including alcohol, non-alcohol and beverage packaging.