45% of US beauty consumers prefer mobile devices over sales associates for in-store assistance

Beauty retailing in the US is evolving as consumers increasingly turn to technology during their shopping experiences, and new research from Mintel reveals that 45 percent of beauty consumers prefer to search for product information in-store on their mobile device rather than ask for assistance from a sales associate. What’s more, two in five (39 percent) consumers are interested in using, or have used, a store-provided tablet to research beauty products available.

This demand for digital comes as 16 percent of consumers decide to shop where sales associates will leave them alone until sought out for help. Many consumers are quickly becoming dependent on digital assistance in nearly all aspects of the beauty retailing experience, with more than one third (36 percent) agreeing that they would be interested in using in-store tablets or their own mobile device to pay for beauty products. Mintel research also reveals that smartphones are the preferred device used to purchase cosmetics (22 percent), the only category surveyed in which consumers were most likely to shop via smartphone*.

58% of beauty consumers are interested in mobile apps that provide product offers to redeem in-store

Consumers are turning to technology as a cost-saving measure as well, with three in five (58 percent) interested in mobile apps that provide beauty product offers to redeem in-store. Coupon redemption is popular among beauty retail shoppers as nearly half (47 percent) have redeemed coupons using their smartphone or tablet when purchasing products in-store or online. Further, 54 percent of beauty retail shoppers are interested in apps that allow them to compare prices.

“Smartphones and tablets are playing an increasingly pivotal role in the beauty retail experience. Brands should assume that their audience has a connected device at their fingertips at all times and should look to leverage behavioral research in order to better understand when and how consumers are using these devices,” said Diana Smith, Senior Research Analyst, Retail & Apparel at Mintel. “The beauty category is ripe for an explosion of technology-driven innovation – it’s a fun category where personalization, individualism and experimentation meet and flourish. A great example of this is connected stores which allow consumers to shop how they choose while giving them unique ways to try out products on their own before buying, regardless of a salesperson’s availability.”

The beauty market’s heaviest buyers, those who made 11 or more purchases in the 12 months ending October 2015, are the most likely to engage on social media with seven in 10 (69 percent) saying they like to share their product experience on retailers’ social media channels, double that of consumers overall (35 percent). What’s more, 71 percent say social media posts encourage them to buy particular products.

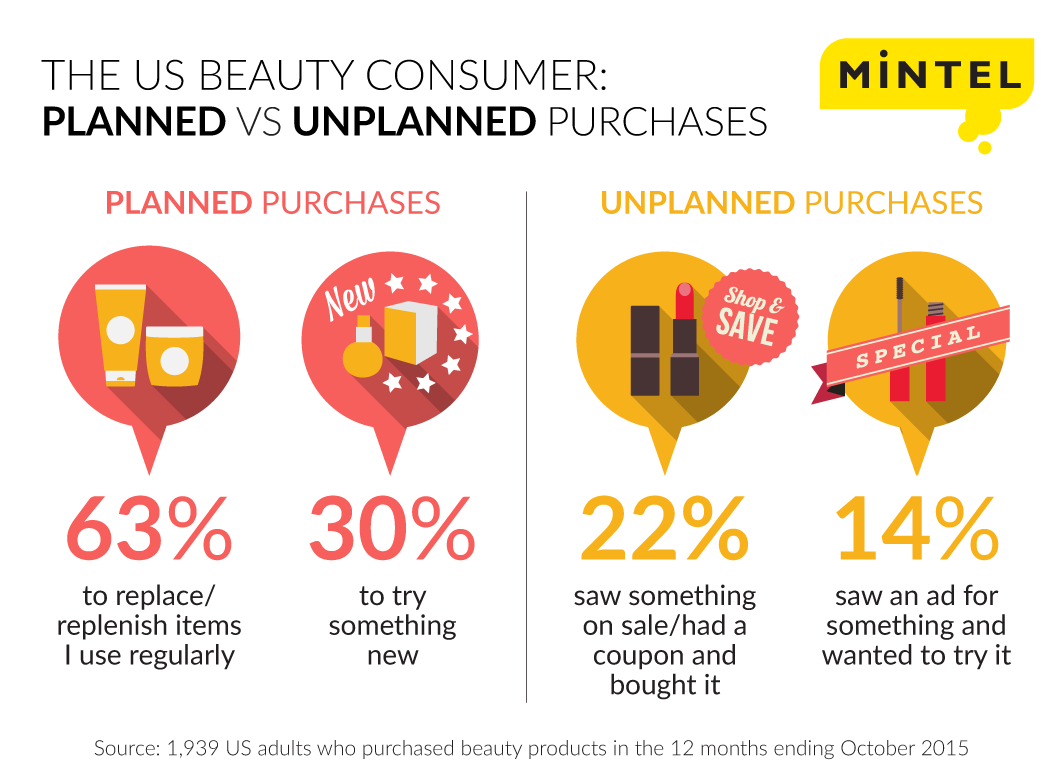

Mintel research reveals that the majority of beauty retail purchases are, in fact, planned with three in five (63 percent) consumers buying items to replace/replenish products they regularly use. Planned experimentation with new beauty products is not uncommon as 30 percent of consumers venture out with the intent of trying something new. However, spontaneity is also popular among beauty retail shoppers: half (52 percent) are influenced to make a purchase that is most likely unplanned, with one in five (22 percent) influenced by a sale or the opportunity to use a coupon. Another 14 percent of beauty retail shoppers report unplanned purchases resulting from advertisements.

When deciding how and where to spend their money on beauty products, Americans have adopted a “high/low” buying strategy. Mintel research reveals that there is an increased likelihood of consumers purchasing less risky products (eg shampoo, body wash) at mass retailers, while higher risk items (eg fragrances, makeup) are increasingly likely to be bought at department stores and specialty retailers.

“The beauty category’s heaviest purchasers not only turn to the internet and, more specifically social media, for inspiration, but they also are influential to others given their increased interest and knowledge of beauty items and brands. Brands should look to capitalize on these influential consumer advocates by giving them a voice and providing rewards for their endorsements. Taking into consideration the fact that many consumers plan their beauty purchases – whether to replace regularly used items or experiment with new ones – positive feedback from heavy users on social platforms could encourage potential buyers to move forward with a purchase,” continued Smith.

Overall, the category is seeing steady growth in the US, reaching total sales of $46.2 billion in 2015, representing 4.1 percent growth from 2013. This is projected to continue, with Mintel estimating gains of 12 percent from 2015-2020. Color cosmetics remains the leading segment of the beauty category, representing 21.8 percent of the market. From 2013-2015, every segment in the category saw sales gains except for nail color and care, which saw its market share drop 3 percent while Mintel research shows that sales of lip cosmetics increased 3.6 percent, due largely to the recent popularity of bold, bright lip colors and product options.

“The nail color and care segment has experienced adverse effects because of consumer trends in recent years. Namely, the hot beauty trend has shifted from nails to lips, resulting in a steady increase in sales of facial and lip care products. Despite women becoming less engaged in at-home nail care, not all hope is lost for the segment, as this dip in sales is reflective of the cyclical nature of beauty products and trends and is not expected to be enduring,” concluded Smith.

*Other categories surveyed include: Clothing/accessories; Electronics, Toys, games, or school supplies; Personal Care; Furniture/home decor; OTC health items; Hardware/tools; Household products; and Nonperishable items.

Press copies of the Beauty Retailing US 2016 report and interviews with Diana Smith, Senior Research Analyst, Retail & Apparel, are available on request from the press office.

For the latest in consumer and industry news, top trends and market perspectives, stay tuned to Mintel News featuring commentary from Mintel’s team of global category analysts.

-

Discover your next big breakthroughGet smart fast with our exclusive market research reports, delivering the latest data, innovation, trends and strategic recommendations....View Reports

-

2026 Global PredictionsOur Predictions go beyond traditional trend analysis. Download to get the predictive intelligence and strategic framework to shape the future of your industry in 2026 and beyond. ...Download now

-

Are you after more tailored solutions to help drive Consumer Demand, Market Expansion or Innovation Strategy?Ask for a customised strategic solution from Mintel Consulting today....Find out more