Pre-owned baby durables marketplace grows as 24% of US parents shop at secondhand stores

Birth rates are on the upswing for the first time following the Great Recession as Americans become more confident in the economy and feel financially prepared to start a family. However, value-conscious parents have maintained their penny-pinching ways and are driving interest in the pre-owned durables market. New research from Mintel reveals that less than half (48 percent) of US parents buy the majority of their baby durables new, while one quarter (24 percent) of parents with children age 4 and under shop at secondhand stores.

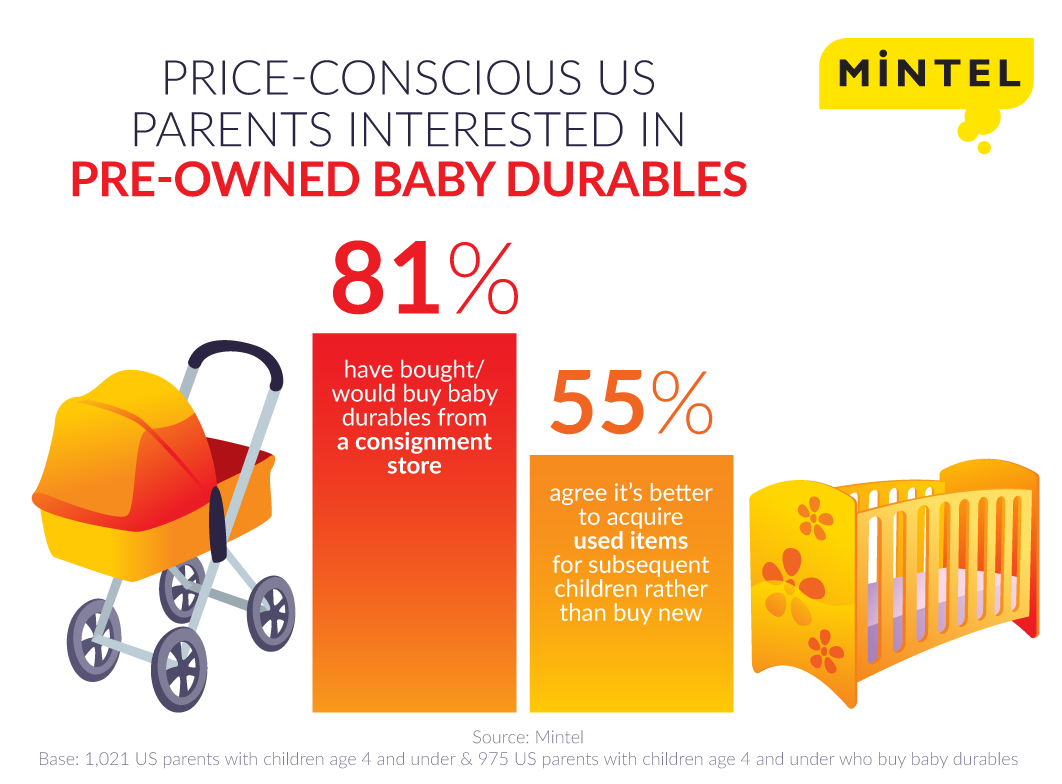

Mintel research indicates that an array of pre-owned retail channels appeal to parents: four in five parents have bought/would buy baby durables through a mom-to-mom sale (83 percent) or consignment store (81 percent). Interest in pre-owned options also transcends income levels, with 51 percent of parents with a household income of at least $150,000 buying baby durables from a consignment shop (vs 42 percent of parents overall). What’s more, one in five parents buy the majority of their baby durables secondhand (11 percent) or borrow/receive hand-me-downs (11 percent).

76% of parents agree that price is the driving factor when buying baby durables

For three quarters (76 percent) of US parents, price is the driving factor when buying baby durables, with half (55 percent) agreeing that it’s better to acquire used items for subsequent children rather than buy new items. With that in mind, parents increased purchasing through all alternative and pre-owned retail channels that Mintel surveyed from 2013-16*, including a 10 percent increase at consignment stores and 21 percent increase of mom-to-mom sales.

“Growth and acceptance of the sharing economy is finding a home in the baby durables market as more and more parents are turning to pre-owned options in an effort to save while also being less wasteful,” said Diana Smith, Senior Research Analyst, Retail and Apparel at Mintel. “Birth rates are turning positive again as an after-effect of the recent recession, and consumer confidence is increasing, which should be positive signs for retailers. But as household structures grow more diverse, with a recent rise in unmarried parents and single-income households, it’s necessary for traditional retailers to appeal to the unique financial needs of parents or risk losing their business.”

Growing interest in the pre-owned marketplace has not supplanted mass merchandisers from being the go-to source for baby durables, with three in four (74 percent) parents shopping at these retailers. Further, baby superstores have become a more popular destination in the last year: three in five (61 percent) parents currently shop at baby superstores, up from 54 percent in 2015. These retailers also pace online shopping, with 43 percent of parents buying baby durables online from mass merchandisers and one third (33 percent) from online baby superstores. Overall, 71 percent of parents shop for baby durables online.

While online shopping is ubiquitous in many retail categories, parents still prefer to buy baby durables in-store. Indeed, four in five parents primarily research products online, then buy them in-store (77 percent), while 82 percent are interested in ordering online but picking up in-store.

Innovations in the pre-owned market could bring added success to traditional retailers, especially mass merchandisers, as shopping at these retailers decreased 13 percent since 2014. Further, 81 percent of consumers agree that stores should offer trade-in programs for baby durable items that are no longer needed.

While the secondhand market continues to trend upward, the majority of all baby durables are still acquired new (76 percent) with 28 percent of consumers receiving them as gifts. This has resulted in 3 percent growth from 2014-15 for the retail baby durables market, reaching $9.3 billion, driven primarily by sales of baby furniture ($5.4 billion in 2015). What’s more, sales have increased annually every year since 2011 and are expected to grow through 2020 to $9.8 billion.

“Parents rely heavily on online resources when purchasing baby durables, however, we find that most opt to shop in-store in order to ensure product safety and quality before buying. While this is a positive sign for traditional retailers, they stand to lose share to other channels unless they find ways to offer parents opportunities to trade in old items or facilitate marketplaces that allow parents to connect with each other. Retailers should look to engage with consumers via their mobile devices through deals and promotions, especially once they are already in-store, to give added purchasing incentives,” concluded Smith.

*Channels surveyed include Amazon.com, a garage sale/estate sale, a consignment store, a mom-to-mom sale, Craigslist, eBay and Diapers.com

Press copies of the Baby Durables US 2016 report and interviews with Diana Smith, Senior Research Analyst, Retail and Apparel, are available on request from the press office.

For the latest in consumer and industry news, top trends and market perspectives, stay tuned to Mintel News featuring commentary from Mintel’s team of global category analysts.

-

Discover your next big breakthroughGet smart fast with our exclusive market research reports, delivering the latest data, innovation, trends and strategic recommendations....View Reports

-

2026 Global PredictionsOur Predictions go beyond traditional trend analysis. Download to get the predictive intelligence and strategic framework to shape the future of your industry in 2026 and beyond. ...Download now

-

Are you after more tailored solutions to help drive Consumer Demand, Market Expansion or Innovation Strategy?Ask for a customised strategic solution from Mintel Consulting today....Find out more