The trick to non-dairy chocolate treats

Whether hitting the town dressed in a costume or staying in watching scary movies, no Halloween is complete without candy and chocolate. However, some Americans may be filling their candy bowls with a different kind of chocolate this year: non-dairy milk chocolate. No matter the occasion, chocolate confectionery overall has a significant place in the US consumer’s shopping cart: 81% of consumers buy chocolate confectionery, according to Mintel’s US report on chocolate confectionery.

While the various virtues of dark chocolate continue to receive considerable media attention, only 42% of chocolate users opt for the cocoa-rich products, suggesting that milk chocolate has managed to remain attractive, even if it cannot make similar claims. But while milk chocolate is popular, no major manufacturer has launched a chocolate bar made with a dairy milk alternative such as coconut, almond or soy milk. Launch activity in the sub-segment is limited to small and, for the most part, artisanal players whose focus leans toward the needs of vegan and paleo dieters who avoid dairy products.

Dairy milk has recently come up against competition from other milks, such as those derived from a range of plant sources from almond to soy. In fact, more than half of dairy milk drinkers also drink non-dairy milk, and while the majority of non-dairy milk drinkers choose alternatives because they like the variety of flavors, more than a quarter drink non-dairy milk for health reasons, according to Mintel’s US non-dairy milk report.

Less than 1% of chocolate confectionery launches in the US between June 2015-May 2017 were dairy milk-free.

Given the high acceptance of, and interest in, non-dairy milk, it is notable that there are very few non-dairy milk chocolate confectionery products being introduced in the US market. According to Mintel Global New Products Database (GNPD), less than 1% of chocolate confectionery launches in the US between June 2015 and May 2017 were positioned as dairy milk-free. In other chocolate markets, including Europe, such launches are also infrequent.

Non-dairy milk chocolate innovations

Launches of non-dairy milk chocolate may be limited, but they provide a canvas for imaginative flavor combinations. This in part may tie to the demographics of those who seek out non-dairy chocolate alternatives for reasons other than those tied to allergies or intolerances. Consumers who follow lifestyle diets such as vegetarian, vegan, and paleo tend to be younger and thus may be more adventurous in their acceptance of innovative flavor combinations.

It would not be surprising to see more non-dairy chocolate confectionery products come to market as innovation continues to grow in non-dairy milk. Mintel’s 2017 Global Food and Drink Trend ‘Power to the Plants’ demonstrates the interest in non-animal products across food and drink categories. The trend has seen greater acceptance of plant-based foods in the US, but it still has room to grow in the chocolate confectionery category.

Aloha Original Dark Superfood Chocolate Bar

Aloha Original Dark Superfood Chocolate Bar is handmade an contains unrefined coconut sugar and 60% cacao with fruit and veggies. The organic chocolate is free from artificial ingredients, sweeteners, GMO, dairy and gluten, and is made with Fair Trade ingredients.

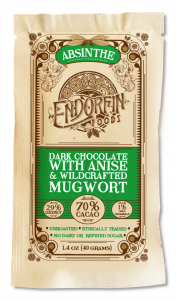

Endorfin Foods Absinthe Dark Chocolate Bar 90% Cacao

Endorfin Foods Absinthe Dark Chocolate Bar 90% Cacao is made from ethically traded unroasted cacao, coconut mylk and coconut sugar. It is dairy free, soy free, gluten free, agave free, GMO free and does not contain refined sugar.

Vita Organic Foods Goji Organic Chocolate Bar

Vita Organic Foods Goji Organic Chocolate Bar is free from soy, dairy and gluten, is suitable for vegans and is low glycemic.

What we think

As more consumers look for dairy alternatives in the milk category, it is likely that their interest will extend to other categories in which dairy can be substituted for plant-based milks. Chocolate confectionery is a prime example of the potential for dairy-free milk products. To date, only a handful of non-dairy milk chocolate confectionery products are available in the US, where the major manufacturers, such as Hershey, are well known for their dairy-based offerings. With a growing population of young and adventuresome Millennials adopting more vegetable-based diets, the time may be ripe for more small manufacturers to enter the non-dairy milk chocolate market. They can distinguish themselves through their choices of the “milk” – hemp, quinoa and cashew, for example – and by experimenting with unusual flavor and ingredient combinations.

Marcia Mogelonsky, Director of Insight, Food and Drink, has been with Mintel since 2000. Her expertise is centered on a number of areas in confectionery and snacks. Before joining Mintel, Marcia headed her own consulting company which focused on consumer behavior and product innovation in a wide range of industries.

Marcia Mogelonsky, Ph. D. is the Director of Insight, Food & Drink, at Mintel. Her expertise focuses on consumer behavior across a range of categories.

-

Discover your next big breakthroughGet smart fast with our exclusive market research reports, delivering the latest data, innovation, trends and strategic recommendations....View Reports

-

2026 Global PredictionsOur Predictions go beyond traditional trend analysis. Download to get the predictive intelligence and strategic framework to shape the future of your industry in 2026 and beyond. ...Download now

-

Are you after more tailored solutions to help drive Consumer Demand, Market Expansion or Innovation Strategy?Ask for a customised strategic solution from Mintel Consulting today....Find out more