The prolonged lockdown period has had a serious impact on the fitness industry. As gym-goers had to resort to home workouts all over the world, technology has started to play a key role in fitness regimes. In light of this, Mintel analysts from the US and the UK explore how technology will shape the fitness world post-pandemic.

Andrea Wroble, Senior Research Analyst for Health and Wellness in the US:

Andrea Wroble, Senior Research Analyst for Health and Wellness in the US:

The person-to-person connection necessary to everyday life is compromised in the attempts to control the COVID-19 outbreak. Instead, people are leaning heavily on technology to provide new connections and access to a myriad of brand products and services. With adults spending more time at home, digitally savvy fitness brands are taking this opportunity to strengthen their relationships with current users and entice new users to stay active and healthy. Traditional revenue streams from gyms and fitness facility have become nearly obsolete due to non-essential business closures. As shelter-in-place restrictions continue, fitness facilities are challenged to stay relevant with their members.

Prior to the outbreak, over half of exercisers in the US were already working out within their home, and the frequency of at-home exercise was even more substantial among adults interested in digital workouts. This crisis has been an opportunity for digital platforms/services to find their voice in a previously crowded space. Digital fitness platforms, such as Peloton, that already had at-home exercise content on hand, found their stride with many offering extended free trials to gain new members. To compete with established online platforms, some niche exercise franchises, such as CorePower Yoga and Studio Three, turned to social media platforms to provide free, streamable classes for users to join at home. Larger gyms, such as Equinox, maintained engagement by sending daily check-ins to members via their app with exercise tips, self-care advice and health-forward rituals to continue during home isolation. Prior to the COVID-19 outbreak, adults who exercised at boutique fitness facilities were more likely to seek out a sense of community through fitness fellowship than those who work out in a traditional gym setting. Fostering a sense of community and belonging when in-person contact has been discouraged is even more critical to keep users engaged during and after COVID-19.

When considering post-COVID-19 life, adults are not rushing back to activities or commitments that put them in crowded locations or close proximity with others. When asked about their comfort level returning to certain activities, over half of consumers said they were not comfortable going back to the gym compared to only two in ten who said they were comfortable doing so. Going about routines as adults once did means coming in contact with germs through daily touchpoints. Prioritizing personal health may compromise the trust adults once had in others to maintain safe and clean environments. Consumers now have new perspectives on what necessities and social settings are worth risking health safety – crowded environments that were once part of their routine may be replaced with at-home or scaled-down versions.

The health and fitness industry will be forced to adapt to consumers new expectation of health safety. At-home workout platforms will maintain the interest of adults who are planning to limit their time spent in crowded locations. High volume, low-priced fitness facilities will likely struggle following the COVID-19 outbreak due to their significant number of locations and lower income clientele who may be prioritizing spending elsewhere. As consumers grow accustomed to exercising from home, they may see less need to hold on to gym memberships – this shift could welcome a surge of digital platforms launched by fitness facilities, a larger focus on at-home equipment and revised membership expectations, such as time slot reservations to limit overcrowding at gyms, updated cleaning mandates and mask requirements.

Amidst changing times, there are pockets of opportunity for fitness facilities to provide value for consumers. Adults may be adopting new routines to maintain physical activity and escape from their own homes. For many, COVID-19 has changed the purpose of the home to include all responsibilities/commitments, including work, school/daycare for kids and exercise. Feeling confined to one space pushes adults to seek safe outlets outside of the home, making walking a welcomed activity for both mental and physical benefits. The shift in consumer priorities challenges fitness brands to rethink how and where they connect with members – facilitating socially distant outdoor activities, for example, builds a sense of community while offering a mental and physical release. Beyond that, fitness brands could support walking initiatives by providing playlists, meditations, or podcasts to listen to along the way.

Prior to COVID-19, many people were already motivated to exercise in order to relieve stress. Post-pandemic, positioning exercise as a tool to better mental and/or emotional health will resonate more than focusing on physical gains. Mintel’s 2030 Consumer Trend Driver Wellbeing predicted that technology would enable fitness in smaller spaces. The COVID-19 outbreak is having a profound impact on the economy and consumer behavior. As a result, the connection between wellbeing and technology has been accelerated. Fitness brands have the opportunity to become more seamless and integrated within consumers’ day-to-day lives, such as pairing with health tracking apps to emphasize the benefits of exercise commitment both inside and outside the home.

Lauren Ryan, Leisure Analyst for the UK:

Lauren Ryan, Leisure Analyst for the UK:

Broadly, fitness trends seen in the UK market tend to mirror those from the US.

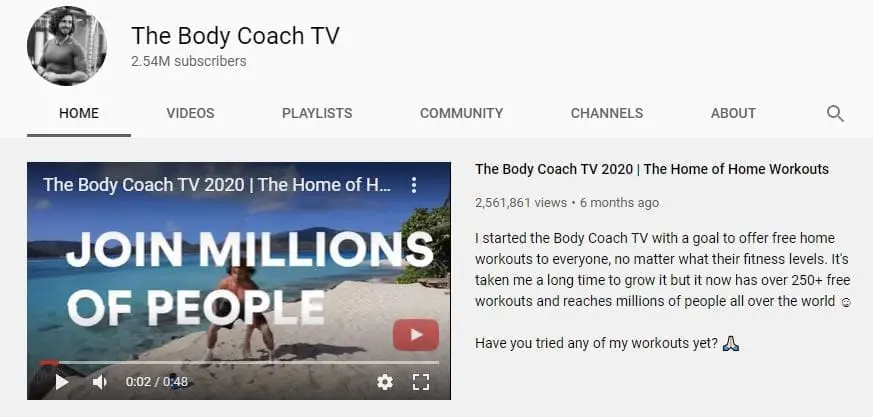

Just prior to lockdown, nearly half of Brits already exercised outdoors or at home, which was twice as many as those who exercise at a gym or other fitness venues. However, the COVID-19 lockdown drove large increases in consumers trying new digital fitness services. Free workouts streamed through social media were the most popular, such as Joe Wicks’ now famous daily P.E with Joe series on YouTube.

Fitness trainer Joe Wicks has been offering free workouts on his popular YouTube channel

Source: YouTube, The Body Coach TV

Competition between venues and digital fitness services increased rapidly over the last few years. However, the large majority of key venue operators were not quite convinced in the value of investing in a digital service prior to COVID-19, with most offering a minimal online service. This of course changed practically overnight when gym operators went digital to engage members with online content.

As health and fitness clubs across the UK reopen, concerns have risen regarding whether consumers will cancel memberships in favour of the virtual options used during lockdown. There is some data to suggest this, as pre-lockdown gym members are more likely to state they will use digital fitness services in the future, particularly fitness activity tracking apps such as Strava. However, intention to use such digital services differs little between gym members that intend to return, versus those that don’t. This indicates that only a small number of people have ditched their gym membership for online options. It also highlights the idea that ‘intermediate’ level exercisers are the core consumers of fitness services, regardless of channel or location. They are more likely to opt for paid-for options such as gym memberships or paid apps, while ‘beginner’ exercisers are more likely to opt for free options such as social media while gaining confidence and knowledge.

The greatest opportunities for gyms will require a radical change of thought and product proposition – a shift from a venue-based brand, to a ‘wellbeing’ brand that can meet consumers’ fitness needs anytime and anywhere. Indeed, pre-lockdown gym members are more than twice as likely to want ‘hybrid’ memberships that offer both online workouts and in-person access to venues.

The critical role of the gym as a ‘third place’ is more important than ever in the era of working from home. The features that were most missed during lockdown were those that at-home digital options will struggle to replicate, such as gym equipment, in-person classes and even as a reason to get out of the house.

The hyper focus on self-care and personal health as a result of COVID-19 will persist in the long term. As the virus threat decreases and consumers begin trusting that operators can keep them safe, we expect the UK health and fitness club market to make a full recovery.

Andrea Wroble, Senior Research Analyst for Health and Wellness in the US:

Andrea Wroble, Senior Research Analyst for Health and Wellness in the US: Lauren Ryan, Leisure Analyst for the UK:

Lauren Ryan, Leisure Analyst for the UK: