It’s not an easy time for anyone to be navigating the world right now – what with economic, social and environmental headlines constantly reminding us of the instability of things. It’s even more difficult for Gen Zs; individuals who have experienced setbacks and missed out on milestones thanks to the pandemic but still need to face the realities of gaining a solid footing in life and establishing a path towards financial independence. A commonality seen across both Canada and the US is that Gen Zs, (the generation roughly defined as being born between 1997-2012) are more likely to report experiencing stress and anxiety than older generations.

While 18-26-year-olds across the border share in this similarity, Canadian Gen Zs are more likely to report that they feel a sense of control over their mental health than their American counterparts. What is driving this difference? Naturally, it has to be acknowledged that the social on-goings such as policy changes in the US undoubtedly are a contributing factor. Outside of the social environment, however, Mintel’s research finds that spending responsibility may also be a contributing reason. Specifically, Canadian Gen Zs are more likely to report holding primary responsibility for spending on their own leisure activities and hobbies than American Gen Zs. Being responsible for one’s own purchases in categories that the cohort leans on to spend their free time and express themselves is likely giving them a greater sense of control over their own lives and a greater sense of independence.

So what areas are Canadian Gen Zs focused on? When awarded a hypothetical $500 spending spree, clothing and eating out were the top areas they would spend in. What’s important to note here is that because Canadian Gen Zs are more likely to be making these purchases themselves, brands and companies in these sectors hold the potential to connect with Canadian 18-26-year-olds more deeply than with American ones. The key to doing so is to help them focus on themselves and to provide options that fit into where they’re at right now.

Diving into the Gen Z mindset – the Me Mentality

Mintel’s Global 2023 Trend Me Mentality discusses how for the last two years, consumers have had to put their own needs on the back burner in favor of a community mindset. Remember, this mindset came at a cost for Gen Zs – they missed out on major milestones like proms, lost jobs due to being more highly represented in the service sector, and even missed out on internships as kick-starters to careers while companies cut back on operations. All at a stage in life where they are trying to establish themselves and set themselves up for future success. There is a real sense that Gen Zs feel that life isn’t going as planned. Now more than ever, they are keen to make up for lost time and eager to re-focus on themselves. Brands that acknowledge their hardships, make them feel like they’re doing ok right now, and empower them with tools and resources to take concrete steps to move forward and achieve future successes will be the ones that win.

3 strategies for marketing to Canadian Gen Z consumers

Ultimately, Gen Zs need to gain back a sense of control and stability in the immediate term, and they need to be set up with tools that will empower them on the right track to achieve success in the future. Here are three strategies to consider.

1. Celebrate small wins to reassure them they’re doing ok

While completing everyday mundane tasks may seem like no big deal, bringing attention to the completion of such tasks would help to highlight to the segment that there are achievements being made on a daily basis. In a sense, these small accomplishments are small signs of success – something that could hold significance when the future feels uncertain and things feel out of control right now. Brands that can be there to help celebrate these small successes will help provide a sense of reassurance that they’re doing ok and help them to feel good about where they are at right now.

2. Literally, put some control in their hands through personalization/customization

Being keen users of social media, Gen Zs are more visible to others than ever. They’re not just passively on social media but actively promoting themselves and their interests, as seen with 42% of Gen Zs creating content in their free time (eg TikTok videos, or recording a podcast). This means that outward expression of individuality and uniqueness is a constant point of consideration for Gen Zs. Indeed, Mintel data confirms this as the segment is more likely than older generations to rely on their physical appearance to showcase who they are and express their individuality.

It is important to note that personalization can go well beyond clothing and food. For example, dermatologist-recommended skincare brand, Cetaphil, launched a comprehensive skin analyzer to help consumers to make more informed decisions about their skincare routine. The user takes a selfie and then the Cetaphil AI Skin Analysis utilizes AI technology to compare the selfie to a database of 70,000 diverse skin images. The tool then creates a personalized report for the user providing information about their skin type, skin concerns and proneness to various skin conditions. This level of personalized understanding allows users to make choices more confidently that will allow them to best enhance their outward appearance.

3. Economic uncertainty now necessitates tools to help them gain control of finances starting right now

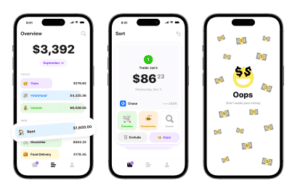

As they look towards the future, economic uncertainty and inflationary conditions may make attaining future financial plans like homeownership feel more daunting and out of reach. The reality is that Gen Zs and Millennials are taking longer to attain these financial milestones. While investment apps are aplenty, empowering them with tools to learn how to establish solid financial footing now is key. This means starting with the basics – things like budget management, building credit, and understanding the implications and consequences of using features that make it easier to buy things now like BNPL (Buy Now Pay Later) offerings. Practical tools like the user-friendly budgeting app Oops, a financial app that went viral on TikTok for allowing people to mark when they make an impulse purchase and holistically get a sense of how much they spend on impulse, will be key to helping young consumers budget and keep track of their finances.

What we think

While the suggested strategies are broad, the main thing to consider is that Gen Zs are unique and have experienced unprecedented conditions at a very informative time in their lives, rendering playbooks of older generations less relevant. As the cohort looks to build themselves up towards a successful adulthood, it must be acknowledged that challenges will be unique to each and the end goals will also vary accordingly. This means that more customization and personalization are needed to help them be the stars of their own show, and with so much uncertainty, work must be done to help provide the tools that meet them where they’re at.

For additional consumer data and research on Canadian Gen Z consumers, contact us today.