Robinhood Markets made a significant strategic play in late March that positioned the company beyond the parameters of a typical fintech startup: It acquired daily e-newsletter company Market Snacks. Now branded as Robinhood Snacks, this move enables Robinhood to command more control of the research and purchase funnel, two elements that go hand-in-hand with stock market trading. It also benefits its brand reputation—serving up digestable US financial news positions Robinhood as a trustworthy, expert source beyond its stock-trading product.

It’s a strategy we’ve seen before, reflecting through Bloomberg’s business model: Build a reputable hub of US market information and consumers will buy your products. With the recent introduction of the premium Gold research subscription, Robinhood is on its way to becoming a content hub and continues to blur the lines between research and product.

E-newsletters can be the solution for FSIs

Investing in an e-newsletter supports two crucial elements for consumers: trust and confidence. According to Mintel research on consumer attitudes toward fintech, less than half of consumers trust financial service institutions (FSIs). And, if you factor in that nearly half of consumers say they would invest more if they understood investing better, developing educational resources is a no-brainer.

Email is proving to be an especially valuable tool for FSIs. Not only does it allow the institution to include links to information and application functionality, it also allows them to create a more personal connection with their customers. It especially resonates with Millennials—The Skimm and Morning Brew are both popular e-newsletters meant to help young people feel more prepared.

Robinhood, a startup geared toward Millennials, clearly sees the value. Robinhood recognizes that nascent investors need easy-to-digest resources on market news, as well as that it needs to establish (or re-establish) trust and credibility as a challenger brand to its audiences (especially after its failed Checking and Savings launch). When executed correctly, trust and credibility result in long-term loyalty from Robinhood’s customers.

Snacks gave Robinhood a boost beyond sponsored content

The idea of brands participating in a newsletter isn’t new. It’s a common practice for an FSI to distribute product news to consumers or invest in sponsored content in a newsletter. However, these practices are not as effective, as consumers have awareness to when they are being sold to. According to Mintel research on digital advertising, nearly half of consumers aim to ignore sponsored content in their news sources.

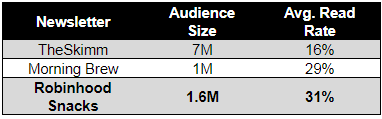

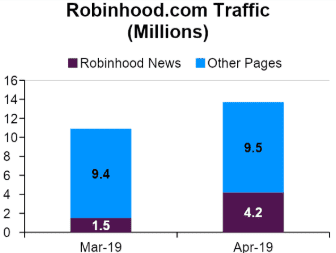

Robinhood found a workaround by going beyond sponsored content to serving its own content. The newsletter is purely news-focused and does not push any products on the reader. By not providing ads, Robinhood keeps it’s content informative and cements the trustworthiness and expertise of the brand. The proof is in the data: Robinhood Snacks engagement rate beats that of TheSkimm and MorningBrew, with competitive volumes. According to clickstream data from SEMRush, Robinhood saw a 26% month-over-month increase in overall traffic to its site, which is a result of increase interest in its news – the news page increased 179%. It’s clear Robinhood is gaining traction as a news provider as well as a trading platform.

Success will hinge on translating leads to reads

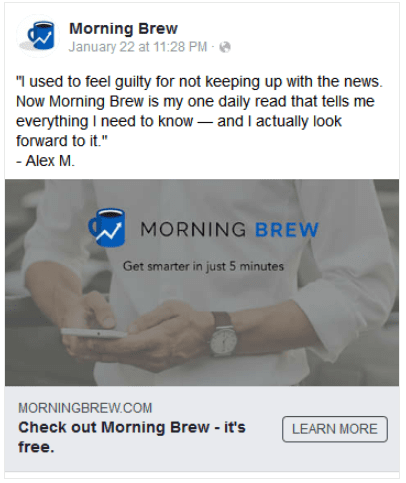

Robinhood’s biggest challenge will be attracting email signups beyond its current customer base. To remedy this, Robinhood needs to leverage a testimonial-based paid social campaign, similar to its fellow e-newsletters TheSkimm and Morning Brew. Interest and affinity-based targeting would support finding Robinhood’s desired audience, and leading with customer reviews legitimizes the content as a trusted source. This would result in Robinhood attracting more signups that would support a greater revenue stream from its content hub in the long term.

What we think

Robinhood’s first acquisition could not have come at a better time. With 2019 ushering in an onslaught of US market news, interest in staying abreast of IPOs and trade war updates is on the rise. Robinhood is off to a great start in terms of serving important topics to those most interested, developing a good foundation for the brand to inspire trust and confidence in its customers. Robinhood will continue to evolve into the likes of Bloomberg and distribute and sell more in-depth information and advanced insights that will eventually attract more consumers to its trading platform and services.