When the calendar turns over every year, consumers find comfort in numbers: pounds to lose, drinks to not drink, and in 2024 – dollars to save. Mintel research shows six in ten US adults noted improving their finances as one of their top three goals for the next year, only one percentage point lower than the number of adults hoping to improve their physical health. A stronger focus on finances makes sense, as the percentage of consumers who are financially worse off than a year ago has increased to nearly a third of US adults. Even though consumers are resolving to live financially healthier lives, financial services institutions have missed the opportunity to get in on the resolutions conversation.

Despite the shift in consumer priorities, health and wellness CPG companies are some of the best New Year’s resolution marketers. While health and financial resolutions may have different objectives, the principles and strategies for success often overlap, highlighting the interconnectedness of personal well-being.

Financial services brands have the opportunity to learn and update their future seasonal strategy by incorporating key components of successful CPG resolution marketing. Consequently, brands can maximize the use of new and pre-existing tools intended for improving financial well-being.

1. Break goals into steps

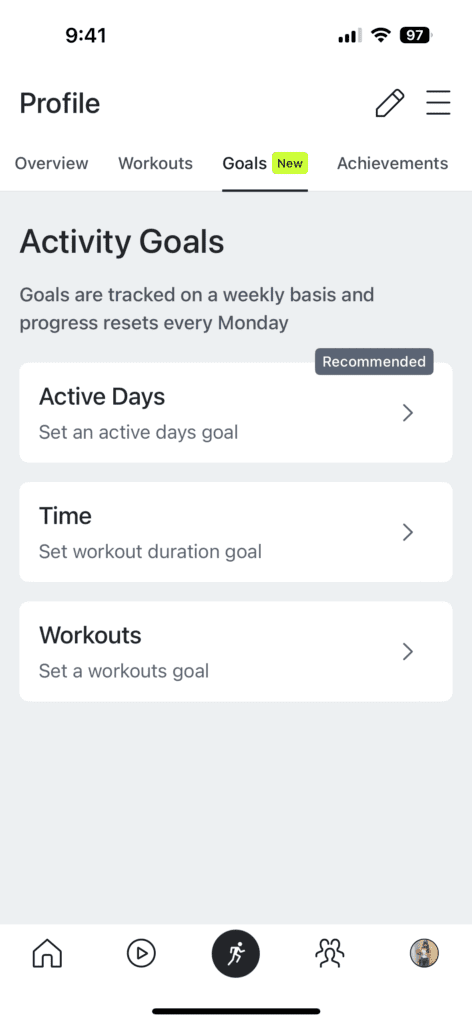

Consumers often lose motivation when they don’t see progress as quickly as they’d like. Mintel’s research indicates that slow progress is the top obstacle to maintaining a healthy lifestyle, which also applies to financial well-being. To combat this, breaking down goals into smaller, manageable steps can help keep consumers on track. For example, Peloton’s Goals feature lets members set weekly targets by active days, workout duration, or number of workouts, making larger goals appear more attainable.

To enhance financial goal-setting, incorporate regular reminders and the flexibility to modify goals based on current achievements. This approach ensures that goals remain realistic and adaptable. For instance, Walmart+ capitalized on “Quitter’s Day” by reminding customers that it’s not too late to recommit to their objective.

2. Offer the right tools

To help consumers achieve their New Year’s resolutions, CPG brands or retailers often promote items like water bottles, athleisure, or supplements. That’s exactly what Target did with its Wellness Jumpstart initiative, where the retailer featured one product each day in January that would aid in health and wellness goals. Similarly, financial services should guide customers towards the appropriate tools, like cards or accounts, to support their financial objectives, much like a gym membership is crucial for marathon training.

3. Incentivize progress

Financial services brands are no strangers to incentivization, whether it’s incentivizing members to save or to spend. To strike a balance between the two, brands can incentivize members to make progress on their personal financial goals relating to both. This could mean saving towards short-term purchases or reallocating their budget across different categories.

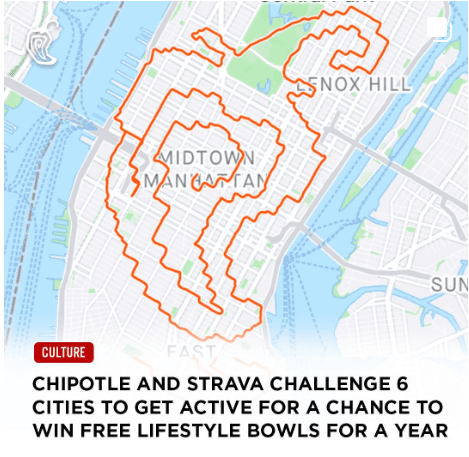

Duolingo is reportedly approaching this strategy from a long-term perspective, rewarding users who hit annual streaks within its app. Chipotle honed in on the short-term, hosting its Chipotle Segment Challenge Series with fitness-tracking app Strava in January that rewarded winners with a free weekly Chipotle bowl for an entire year.

Consider how existing incentives can apply to goal setting and how your existing partnerships, such as streaming services or airline lounges, can play a role here.

4. Build a community

Consumers don’t always respond well to brands telling them what to do – especially when it comes to their finances. The response to this tweet from Chase in 2019 comes to mind. But that’s not to say that financial institutions shouldn’t have a role in consumers’ financial goals; rather, it underscores how important it can be to let members do the talking once in a while.

An example is NBC’s Today Show’s Start Today platform, which offers a community-driven approach to health and wellness goals, featuring group activities and shared content that feels more like peer support than corporate messaging.

What we think

Financial services brands are well-equipped to embrace these opportunities by leveraging their existing reward structures and thought leadership on financial well-being. The key lies in effectively curating these resources and delivering them when they’re most impactful. Content hubs can help members in setting, pacing, and tracking their financial goals while fostering a community of like-minded individuals. And with this work done, your members will view you as a necessary partner to achieving larger goals in the future.

If you’re interested in learning more about financial services or CPG resolution marketing from Mintel Consultancy, please reach out today and someone will be in touch.