Another month, another budget

It used to be that the UK had one budget a year. Over time, the importance of the Autumn Statement has grown, meaning that we had effectively moved to having two set-piece fiscal events a year. The chaos of the last few months, though, means that we’re now onto our second major shift in government tax and expenditure policy in as many months.

Today’s statement confirms the 180-degree shift in policy since Kwasi Kwarteng’s fiscal intervention in September. From Kwarteng’s sweeping and, at the time of the mini-budget, unfunded tax cuts, British consumers are now going to have to deal with both tax rises and cuts to government spending.

The Government’s belief is that this fiscal tightening is important in both the battle against inflation, and to ensure the long-term health of the UK’s balance sheet. And after the catastrophic reaction on the financial markets to the mini-budget, this return to a more conventional approach to managing the economy is also intended to restore some of the Government’s credibility on the markets.

Why the Autumn Statement matters to consumer behaviour…

At Mintel we’re experts in what consumers want and why: we’re not economic forecasters, or political pundits. But the choices that Jeremy Hunt has made will affect almost every household to some degree and will, in turn, have an impact on people’s spending.

The tax increases will hit the middle class’s spending power, bringing in more people to the 45% tax rate, while the freeze on thresholds for both income and inheritance tax will also primarily hit middle and higher earners.

Longer-term, a healthy economy underpins consumer spending. If, as Jeremy Hunt claims, tax rises and spending cuts are essential to ensuring the UK’s future prosperity, then the long-term pay-off will be worth the short-term pain.

…and why the economy is only of indirect importance

But ever since the financial crisis, it’s been clear to anyone who tracks consumer behaviour and spending that economic growth has very little direct bearing on consumers’ sentiment. What really matters to consumers are the benefits that economic growth is believed to bring: the likes of low unemployment, and rising wages.

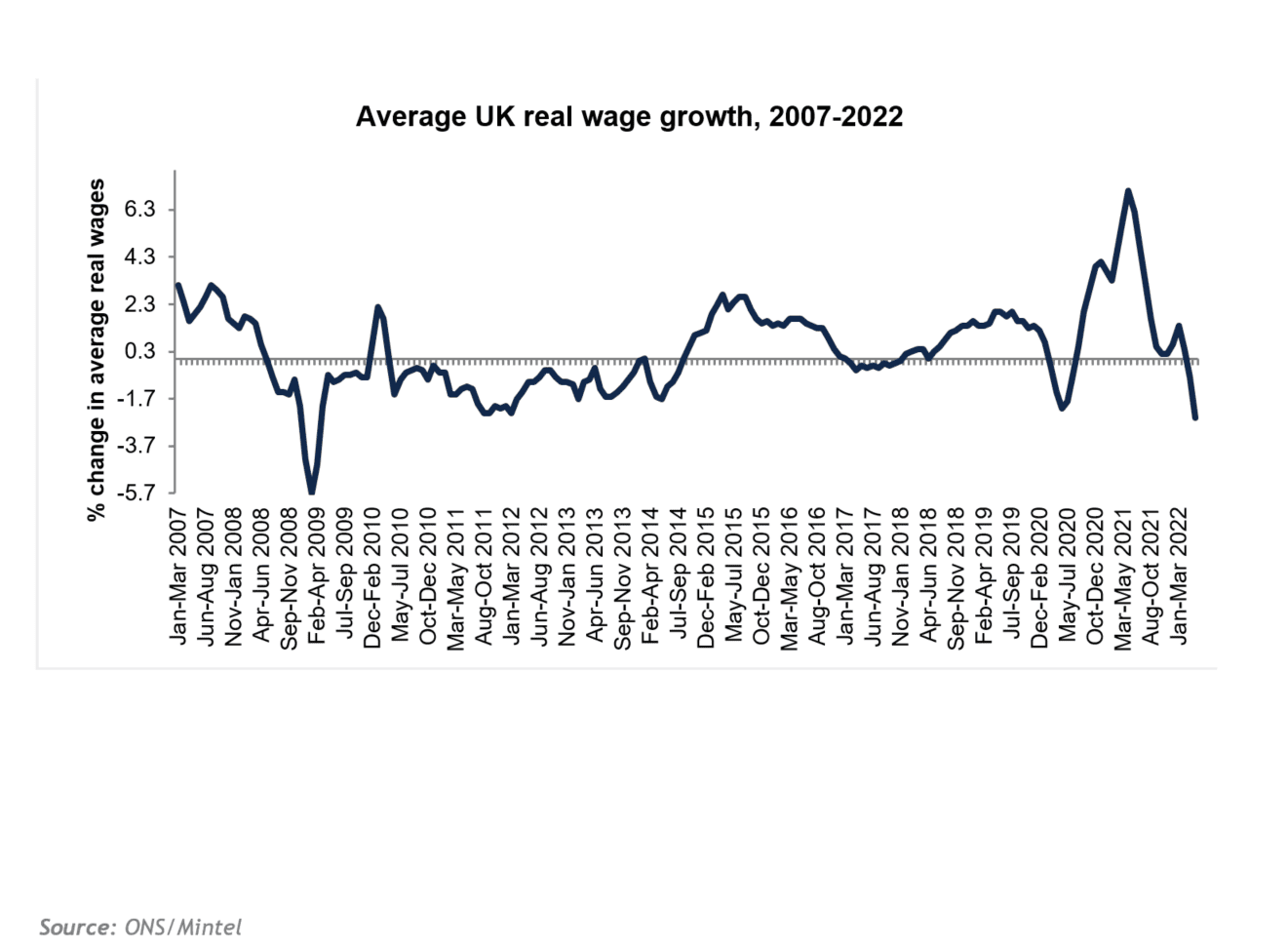

The problem is that the financial crisis showed us that rising GDP doesn’t necessarily mean that people actually feel any better-off. The British economy had returned to growth by 2009, but real wages were still falling for years after the recession was technically over.

Mintel’s consumer confidence data reflected this, and it wasn’t until the 2012 “Jubilympics” year that people started to feel a bit more upbeat about their financial situation. Even then, there was massive polarisation, with most of the improvements in confidence being driven by higher income households.

A return to the austerity years?

There’s a quote attributed to Mark Twain, which is that “History doesn’t repeat itself, but it often rhymes”. With 11% inflation, the conflict in Ukraine and the after-shock of the pandemic means that the situation now is very different to 2009, but there are clear similarities, especially when it comes to household finances.

The combination of falling real wages, cuts in government spending and tax increases will all have an impact on households’ spending power, particularly among lower earners. For lower earners, the increase to the National Living Wage, the new energy support payments and the promise to increase benefits in line with inflation will at least alleviate some of the downsides of the coming recession.

There are few upsides in the statement for middle and higher earners, though. And this is compounded by the broader economic challenges that the UK faces. One major difference this time around is that after the financial crisis, interest rates were slashed. This time, rates have increased significantly. The impact that this will have on mortgage rates means that the pain of an economic slowdown will be felt further up the income scale, compared to the post-crisis austerity years where it was low-income households who bore the brunt of the economic slowdown.

The fact that so many people are on fixed mortgage rates means that the interest rate rises will take months (or years, in some cases) to fully feed through into consumers’ disposable income, but we’re already starting to see an impact at the upper end of the income scale: 36% of people with a household income of at least £75,000 say that they’ve noticed an increase in interest rates, compared to 26% of the population as a whole.

Looking to the positives

But there are other, more positive differences. Unemployment is expected to rise, but the labour market is still extremely tight – bad for anyone recruiting, but good news for job-hunters. The other really big difference is that the pre-financial crisis boom mentality meant that many people went into the recession with high levels of debt and low savings.

This time round, there are still millions of people who are sitting on the savings that they were able to build up over the lockdown years. The Bank of England estimated that over the lockdown, people had saved almost £200 billion more than they would have done in more normal times. Our analysis of their savings data suggests that most of those savings are still there.

For households that are struggling, these savings should provide some protection against the economic headwinds. For more comfortable households, it means that there are still funds available for big-ticket or discretionary spending – as highlighted by our prediction that the UK’s holiday market will have grown by almost 150% over the course of 2022, proving that people desperate to go back to pre-pandemic holiday patterns are prepared to overlook the economic challenges that the country is facing.

A radically different budget – but a similar message when it comes to consumer spending

Although this latest set of fiscal measures is almost the polar opposite of Kwasi Kwarteng’s mini-budget, it seems unlikely to radically reshape consumer spending habits.

The tax rises will take some money out of people’s pockets, but for most people they’ll be relatively minor compared to the impact that inflation and energy costs are having on their discretionary income.

Similarly, the spending cuts will hit some households, but they were already the people who were finding conditions particularly tough.

And as such, Mintel’s view on consumer spending hasn’t been radically reshaped, either.

People are still going to be heavily focused on value, at both upper and lower price points. This still gives opportunities for brands to convince people to trade up as well as down. Our consumer research is showing that people are already switching to private label or to lower-cost retailers, but in multiple categories there were premium products that outperformed the market during the post-financial crisis years.

Premium fragrances and sparkling wine are both entirely discretionary products, but both of them benefited from the lipstick effect in the 2009-12 income squeeze. (And, of course, the lipstick effect works for lipsticks too – and we’re already seeing signs of increased sales of lip colour this time around.)

The post-pandemic bounce back in experiential spending will be held back by the economic situation, but not entirely killed off: there’s still plenty of pent-up demand for live music, for holidays, and for festivals. (As usual, Glastonbury sold out in minutes, despite a sizable increase in ticket prices and the already challenging economic climate).

Good news for brands: consumers are still managing financially

And, most importantly for brands, it’s still the case that most people are still able to make ends meet.

Consumer confidence has slipped, but not collapsed, and across all the countries in which Mintel runs our financial tracker study, the majority of consumers still say that they’re doing OK financially. The slowdown and these new fiscal measures will shift the balance, and some people will have to cut back, but our British Lifestyles – UK – 2022 Report forecasts that consumer spending in 2023 should still be close to £1.5 trillion. There will always be opportunities for brands who are close enough to their consumers to identify the next big market trend.

Cutting back on innovation risks losing market share

From the last financial crisis, a new wave of disruptive innovation emerged, from foodservice to groceries to beauty and personal care. Inevitably, the tough financial environment will mean that some major brands switch to defensive mode, cutting back on advertising and innovation. That might seem like the safety-first option – but they lay themselves open to the risk that the next wave of start-ups will take a chunk out of their business, just as those start-ups stole a sizable slice of the FMCG giants’ market share in the post-financial crisis years.

How to find more Mintel research

All Mintel clients have access to our monthly consumer confidence and spending intentions survey. The corresponding British Lifestyles – UK – 2022 Report will contain in-depth analysis of the impact of the crisis on consumer spending, including sector-by-sector forecasts and analysis of how consumers have reacted in previous recessions. Register for our upcoming webinar, Mintel’s 2023 Food & Drink Trends, and download the FREE 2023 Global Consumer Trends now for insight on changing consumer behaviour, market expertise, and strategic recommendations to drive better business decisions faster—now and in the future.