The influence of wellness on traditional health products

More than ever before, adults are prioritizing aspects of their health that support the full spectrum of mental, physical and emotional wellbeing. The rise of holistic wellness stems from consumers’ shifting health needs. According to Mintel research on health management trends, since the start of 2020, nearly half of adults are placing greater emphasis on managing stress, improving quality of rest/sleep, taking time for themselves and strengthening their immune system. The COVID-19 pandemic acted as a catalyst for certain health ambitions: following a year of high stress, illness anxiety and lack of motivation, adults are more conscious of maintaining healthy behaviors. Still, adults have been making the connection between internal and external health factors. For example, two in five adults say stress regularly disrupts sleep, more than half of consumers say stress is their reason for regular or occasional pain and nearly three in ten adults experience digestive health problems when they are stressed.

The crossover of functional health and mental/emotional needs calls for a more dynamic approach to health care and health-focused products. As such, key players across categories have embraced the influence of wellness by incorporating holistic ingredients, adopting self-care-focused marketing strategies and developing formulas to treat several health needs at one time.

Oral care brands blend with wellness by supporting daily routines

Mintel Trend Drivers track seven fundamental themes that influence consumer choice and change. These seven drivers (Wellbeing, Surroundings, Technology, Rights, Identity, Value and Experiences) and underlying Pillars can help explain the key behavioral changes likely to impact consumers in the years ahead.

As highlighted by the Mintel Trend Driver, ‘Value,’ consumers are looking for ways to make their lives easier. Therefore, consumers are mindful of their purchases and stress the importance of simplicity. COVID-19 has spurred a shift in how consumers evaluate the meaning of essential: supporting health priorities by de-cluttering daily routines can provide value to adults. In terms of oral care, ‘Value’ plays out through a new age of electric toothbrushes that are focused on convenience, affordability and optimizing consumer routines. According to Mintel data on oral health habits in the past 12 months, more than one in four adults upgraded their toothbrush in the last year and usage of electric toothbrushes has increased since 2019.

Hum by Colgate is proving value by syncing with consumers’ lifestyles. The smart toothbrush connects directly with the Apple Health app so users can have all their health information, including brushing habits, stored in one convenient location. Additionally, Hum offers a reward system to motivate daily brushing habits. In March 2021, the brand launched a partnership with Headspace where users can exchange brushing points for a 60-day free trial of the popular meditation app, showcasing Colgate’s support of consumers’ mental and physical wellbeing.

Retailers differentiate from traditional healthcare by focusing on wellness

Consumers often turn to retail health locations and drug stores to fulfill their health management needs, meaning retailers have the ability to guide consumer health choices or bundle products on-shelf to support both physical and emotional wellbeing. According to Mintel research on consumer trust in healthcare facilities, more than one in four adults say their trust in retail health clinics has improved since 2019, which aligns with the growing trend of retail health locations becoming more consumer-centric.

To differentiate from traditional healthcare facilities, retailers are focusing on healthy living, preventive-care habits and top-of-mind health topics such as building immune system strength. Repositioning OTC remedies as solutions for broader health goals showcases the influence of wellness and self-care within healthcare services.

CVS, in particular, has turned to social media to promote the retailer’s health-centric and wellness-focused products. The pharmacy is tying in-store remedies to health benefits consumers are looking to prioritize, such as avoiding common illness and supporting optimal sleep. By taking on the role of a wellness advocate, the retailer is positioning itself as a partner in managing concurrent health needs.

OTC pain relievers expand marketing tactics and ingredient profiles to meet changing consumer needs

Pain is universal and nearly all consumers use some sort of OTC pain reliever to manage discomfort. Because pain experience is consistent and unwavering, the market is supported by mainstream, hero products that consumers are familiar with and trust to work. However, certain key players are looking for ways to stand out on the shelf by tapping into consumer lifestyle trends or incorporating wellness-focused ingredients.

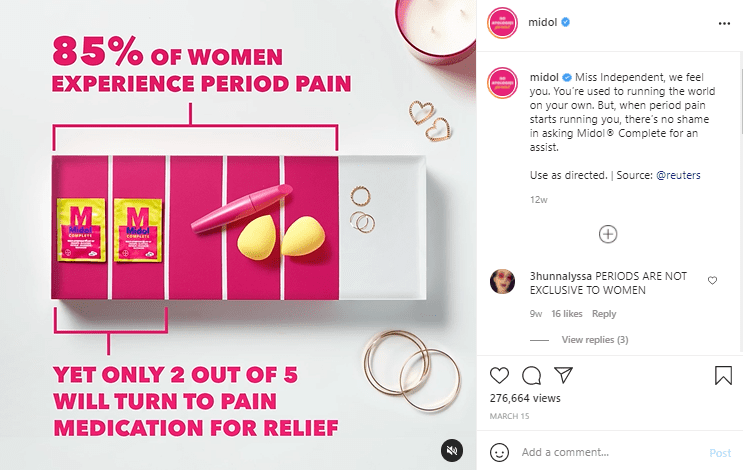

Midol recently overhauled its brand strategy to focus on young women and symptoms related to menstruation – the added element of personalization and empathy toward women managing monthly periods allows the brand to offer emotional support in addition to physical relief. According to an upcoming Mintel research on OTC pain management, nearly two in five women aged 18-34 would try a new pain reliever if it was tailored to specific stages of women’s health, supporting Midol’s approach as a partner in female wellness.

For consumers who report pain regularly caused by stress, more than two in five use external OTC pain-relieving medicated rubs or ointments – 11% higher than the total population. Aspercreme’s product launch addresses stress-induced pain through aromatherapy, offering wellness benefits in tandem with recovery.

What we think

In years to come, the blurring of traditional health products and services with wellness will become universal. Managing wellness and self-care was previously a benefit afforded by time and affluence. Now, consumers are beginning to expect elements of wellness through their everyday products and services, challenging key players to adapt formulas, benefits and marketing strategies.

Andrea Wroble is a Health & Wellness Analyst at Mintel. Andrea focuses on writing reports and providing consumer-driven insights for health and wellness categories.

-

Discover your next big breakthroughGet smart fast with our exclusive market research reports, delivering the latest data, innovation, trends and strategic recommendations....View Reports

-

2026 Global PredictionsOur Predictions go beyond traditional trend analysis. Download to get the predictive intelligence and strategic framework to shape the future of your industry in 2026 and beyond. ...Download now

-

Are you after more tailored solutions to help drive Consumer Demand, Market Expansion or Innovation Strategy?Ask for a customised strategic solution from Mintel Consulting today....Find out more