In India, 90% of consumers primarily use bar soap for their bathing routine, demonstrating their deep-rooted affinity for this format according to Mintel research. Conversely, only 9% of Indians report using body wash, shower gel, or shower cream as their main bathing product.

Their hesitance to use the body wash format is driven by factors such as perceived high costs of body wash, associations with harmful chemicals and concerns about water wastage. In this article, we explore how brands can overcome these barriers and make body wash more appealing, particularly to metro consumers who are often early adopters of beauty trends.

Make body wash more economical

The significant price tag of body washes, often perceived as a luxury product, deters many consumers, with 63% considering it too expensive. This sentiment rises to 69% among metro consumers who usually have larger budgets for beauty products.

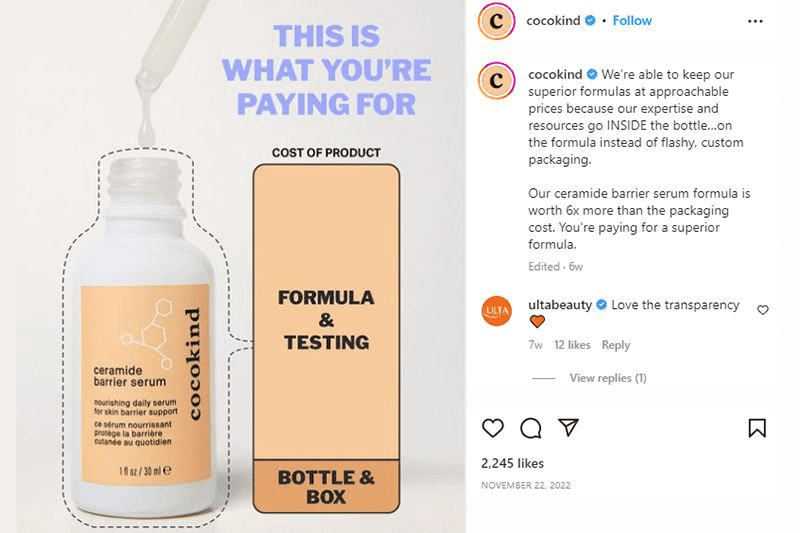

To overcome this, brands could deploy pricing strategies that incentivize trial and repeat consumption. Offering value packs, combo deals, and subscription services are potential tactics. Transparency and communication about pricing strategies can also enhance the brand’s image of being economical.

For instance, Cocokind emphasises its use of minimalistic packaging to reduce costs. Meanwhile, Outlaw offers a Body Wash Subscription Box, delivering a chosen body wash to the customer every month.

Emphasise ‘cleaner’ formulations

The perception of body washes being laden with harmful chemicals is another barrier to usage. Indian consumers prefer natural beauty products, associating chemicals with being harmful to the skin. Mintel research on Clean Beauty shows that ‘free from harmful chemicals’ is ranked as the most important factor by 12% of Indian consumers when choosing beauty products, closely following ‘made with natural ingredients’ (15%).

Brands like Plum Goodness counter this concern by offering shower gels with gentle, non-drying cleansing formulas that are said to be cruelty-free and devoid of harmful substances like sulphates, parabens, phthalates, silicones, and animal-derived ingredients.

Address water consumption concerns

India, being one of the most water-stressed nations, frequently faces water shortages. Given the prevalent practice of bucket bathing, the perceived high water requirement of body wash pushes consumers towards bar soap.

Although more sustainable options (eg biodegradable packaging or innovative formulations) can be more expensive to produce particularly for smaller beauty brands, positioning eco-friendly options at affordable prices can be a game-changer. Brands could explore innovative, waterless formats like powders, sheets, and tablets to improve the value perception of body wash.

Godrej, for instance, introduced India’s first ready-to-mix body wash, affordably priced for the mass market. The product, available in small sachets of concentrated formula, can be mixed with water and poured into reused containers, creating 200ml of body wash. This approach not only addresses sustainability but also breaks down the price barrier, making it easier for consumers to switch from bar soap to body wash.

What we think

The higher price of body wash compared to bar soap in India is a significant barrier to adoption. Brands can make body wash more economical through value packs and smaller packaging, coupled with cleaner formulations that do not significantly increase costs. Lastly, to enhance the perceived value of body wash, brands have the opportunity to delve into inventive alternatives such as powder, sheet, and tablet formulations that eliminate the need for water.