Brands have an opportunity to offer post-makeup application convenience by offering long-lasting products that do not harm the skin.

Makeup is a category full of opportunities with the potential to increase penetration and drive more usage. Indeed, nearly half of Indian women said they have not used makeup in the past six months. Those who use makeup 2-3 a week are classified as Moderate Makeup Users. Meanwhile, those who use makeup daily are classified as Frequent Makeup Users.

Here, we share three recommendations for brands to expand usage and dig deeper into behaviours to maximize engagement with Moderate and Frequent Makeup Users.

1. Moderate Makeup Users: Strengthen skincare benefits

Key concerns for Moderate Makeup Users are harming their skin and aggravating existing issues. Brands can overcome this by incorporating skincare into their products. Skin issues this user group faces include dark circles, dry patches, and acne. Most are in search of makeup with added skin benefits.

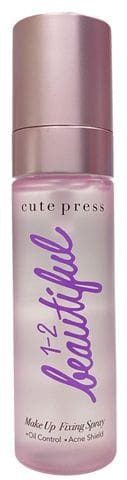

For brands, this is where the skinification trend comes in. In Thailand, beauty brand Cute Press has launched a makeup-fixing spray that claims to reduce the risk of acne with Acne Shield, which combines zinc PCA and Centella Asiatica extract (cica) and uses hyaluronic acid to provide double hydration. Meanwhile, La Roche-Posay’s Toleriane range claims to be specifically designed to “address sensitive skin issues by using minimalistic formulas comprised of thoughtfully selected ingredients.”

Brands could lean into this opportunity by incorporating skincare ingredients into makeup removers to offer added skin protection. In the Philippines, Happy Skin Cica Makeup Removing Cleansing Gel claims to temper redness, itching, dryness, and other inflammation with salicylic acid to penetrate pores and lift away pimple-causing oil, dirt, and dead skin and hyaluronic acid to hydrate.

Hyaluronic acid is increasingly being used in India’s facial skincare category for hydration benefits but it’s still a niche in colour cosmetics and something brands can further explore. Indian products like House of Makeup Luminous Skin Tint utilizes hyaluronic acid as one of the key ingredients.

2. Moderate Makeup Users: Tap into convenience

Moderate Makeup Users are in search of longer-lasting makeup that adheres better to the skin and reduces the need for reapplication. Thus, brands can innovate with easy-to-use makeup that doesn’t need a lot of touch-ups.

Moderate Makeup Users are also more inclined toward makeup formats that are multifunctional, such as three-in-one makeup products like colour sticks that can be used for the eyes, cheeks, and lips. However, the multi-use category in India is stagnating, making it a good opportunity for makeup brands to innovate.

An example of a brand innovating in this category is Makeup by Mario with its Softsculpt Transforming Skin Perfector, a multipurpose powder with a gradient consisting of translucent powder, highlighter, and bronzer. Another example is Gatsby’s Easy Eye Brow, a three-in-one multipurpose brow makeup product with a hard, slim-edged pencil, a sponge tip, and an angled brush.

Colour cosmetics brands can also create products that don’t need brushes or sponges for application. The famous Glossier Cloud Paint is a lightweight gel-cream texture that can be seamlessly blended with the fingertips.

3. Frequent Makeup Users: Boost fun to drive engagement and loyalty

Finally, Frequent Makeup Users like to experiment and learn from social media. They derive happiness from trying out different makeup styles. However, many feel there is nothing new in colour cosmetics and seek excitement and innovation.

Brands can capture the attention of Frequent Makeup Users with new and exciting makeup options, such as unique formulations, co-creating to showcase creative and diverse looks, and showing the suitability of their products for events like festivals and weddings.

Indian fashion brand Masaba Masaba, which recently got into beauty, launched its limited edition Band Bajaa Dark Pink blush beauty collection, describing it as a combination of wedding aesthetics, fun, “nakhre” (moodiness or tantrums) and “naach-gaana” (dance and music).

Brands can also collaborate to offer interesting and exciting collections. Clinique and Kate Spade teamed up to launch a playful collaboration that combines vibrant Kate Spade New York patterns with Clinique’s Pop Plush™ Creamy Lip Gloss collection.

Technology can also play an important role in enhancing the excitement and engagement with makeup. For example, in the Philippines, eCommerce platform Lazada partnered with beauty tech firm Perfect Corp for Bobbi Brown, Estée Lauder and M·A·C flagship stores in LazMall. Here, customers can virtually try on makeup products and receive professional makeup assistance through live chat. Additionally, Charlotte Tilbury lets its customers invite friends to join a virtual shopping experience in the metaverse.

Tapping into non-makeup-related issues is another avenue cosmetics brands can explore to drive engagement and meet consumer needs. Some Frequent Makeup Users experiment with makeup to alleviate stress and express a willingness to pay more for makeup products that offer long-lasting fragrances. Brands could incorporate scented makeup that helps to relieve stress or uplift the user’s mood.

What we think

Strengthening skincare benefits and positioning makeup as safe, multifunctional, long-lasting, and fuss-free are critical ways brands can drive increased product usage among Moderate Makeup Users.

On the other hand, Frequent Makeup Users seek excitement in makeup. Brands can leverage this by using technology to create new experiences such as scented makeup and virtual try-ons.

Mintel’s Beauty and Personal Care market research combines the latest market intelligence, industry insights and expert recommendations to help you anticipate what’s next. For more insights on India’s colour cosmetics trends and consumer preferences, please visit Mintel Store.