The first lockdown led to a genuinely unprecedented shift in consumer behaviour. Partly through choice, and partly because many options were simply no longer available, people sharply reduced spending across most categories. The scale of disruption caused by the second lockdown won’t be anywhere near that seen in March 2020 – but only because many of the initial spending changes have been maintained despite the gradual lifting of restrictions over the summer.

In this two-part series, we explore six opportunities brands could tap into in the second lockdown.

Many shoppers have maintained the habits they developed in spring

Some of the shifts in consumer behaviour that we picked up during the first lockdown have faded, particularly those that play to the enduring protective mindset that has developed across 2020.

Back in March, we suggested that the shift online, for example, would lead to a permanent change in consumer behaviour – just as it did in the aftermath of the Asian SARS outbreak. This prediction has proved to be entirely right: In late October, more than two in five Brits said they were shopping more online than before the COVID-19 outbreak.

The fact that so many behaviours have become ingrained means that brands won’t have to contend with the steep change in shopping patterns that we saw at the start of the first lockdown: it is a small comfort, but it should at least help with planning and logistics.

What are the second lockdown consumer opportunities?

Christmas will create potential spending for food and drink remote gifting

The ‘Waitrose Christmas Gift Box’ is sold out on the John Lewis website

Source: John Lewis

In the run-up to Christmas, curbs on social gatherings will severely hit at-home party occasions, with the related gifting in categories like alcoholic drinks and chocolates set to be lost.

While many households plan to spend less on food and drink at home for Christmas, food and drink as affordable gifts are potentially in a position to capitalise on households’ efforts to economise.

Brands able to cater to remote gifting will also thrive, although much of their potential to capitalise on this will pivot on the ability of food and drink brands to ensure timely and appropriate delivery, including directly to gift recipients. Products tailored for delivery will shine, from post-box tailored wine bottles to coffee and chocolate subscriptions.

New lockdown will further boost digital services and products – such as next-gen consoles

Source: Digital Trends

The ‘Zoom boom’ was one of the biggest stories to come out of the first lockdown, as people confined to their homes turned to the videoconferencing platform to not only stay in touch with friends and family but to fill the gap left by the closure of leisure venues. While users will have eased off as restrictions were lifted and ‘Zoom fatigue’ set in, the second lockdown will see people return to video calling as their main or only form of interaction with people outside of their household.

Pub quizzes will head back online and those who had ventured back to the gym will once again be reliant on digital platforms like Zoom, YouTube, or dedicated apps to fulfill their fitness needs.

The first lockdown sparked a boost in sales of the current generation of games consoles, and Lockdown Mk 2 should near-guarantee a sellout for the PS5 and Xbox Series X, both due for release in mid-November.

The closure of non-essential retail stores could put a hold on some other big-ticket tech purchases such as smartphones and TVs, which many people prefer to see or try out in person before buying. Yet, much of this demand will simply shift online, particularly given the inevitable Black Friday bargains and the potential to divert money from usual leisure spending budgets.

While Amazon will benefit from the second lockdown, smaller independents are fighting back

There has been a growing appetite for books and reading as the pandemic has gone on, but the closure of non-essential stores will be particularly concerning for physical media markets heading into the Christmas period – when sales of DVDs/CDs/books are very strong. As with many other categories, Amazon will be the biggest winner in the lockdown period, with people simply heading online for their Christmas shopping.

In recent years, independent bookstores and record shops have shown how physical retail can reinvent itself, carving out a niche as a hybrid retail/social experience. Missing out on the key gifting season would be catastrophic for these independent retailers.

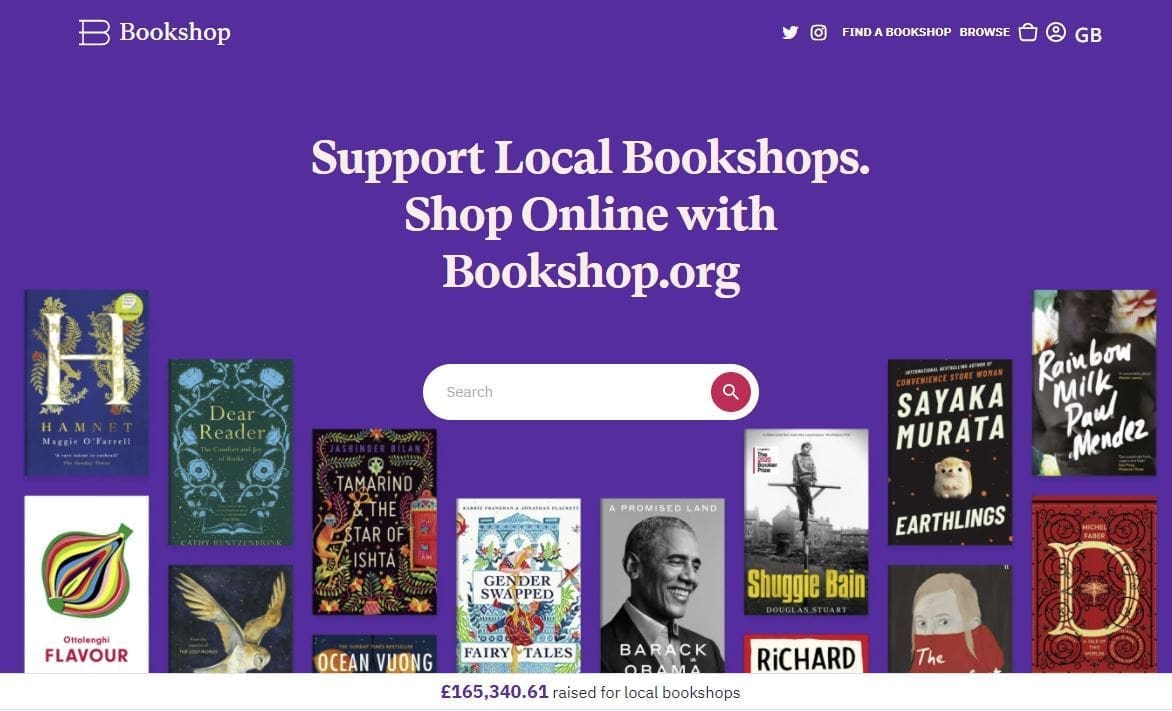

Source: Bookshop

The launch of bookshop.org, a joint platform for independent bookstores to make online sales, could be very important for boosting print sales and helping independent stores survive the second lockdown.

For record stores, the Black Friday-themed Record Store Day could remind shoppers that there are alternatives to Amazon and streaming services.

Overall, people will be looking for escapism more than ever, especially as the weather is less pleasant than during the first lockdown. Along with providing a connection to friends and family, any media that can help take people’s minds off the situation will be valued by consumers.