In the Inflation Exploration blog series, Mintel explores all the ways that inflation effects consumers around the globe.

Blue Monday, normally on the third Monday of January, is considered the most depressing day of the year. From a consumer perspective, however, perhaps Thursday 3rd February could potentially take this crown this year and be rebranded ‘Black Thursday’. That’s because on this day it was announced that energy bills will increase by more than 50 per cent from April, the Bank of England also raised UK interest rates and warned households to expect the worst hit to real incomes since comparable records began 30 years ago. The cost of living squeeze isn’t only a problem for the UK. A day before, inflation across the eurozone also hit a record high.

When incomes are squeezed, there’s a natural tendency for people to pay much closer attention to their spending. Nearly four of ten French consumers and around a third of UK and German consumers, for example, tell us they’re sticking to a set budget for their grocery spending “most of the time”. As during the previous recession, this greater scrutiny of spending doesn’t necessarily mean people will trade down: just that they become laser-focused on value across all price points.

With consumers facing a prolonged squeeze on their incomes, many of the lessons learnt following a similar situation after the financial crisis will apply now. Here, I identify three strategies for brands to help consumers deal with a sustained period of inflation and less disposable income.

1. Food and drink: help people find new ways to make their favourite meals on a budget

With six in ten UK consumers saying that ideas on how to make favourite meals on a budget would be appealing, there is vast potential for brands to position themselves as part of a savvy grocery basket by offering suggestions on how their products can be part of affordable meals – from tips for using leftovers to pairing with affordable ingredients.

Even when prices are stable, brands often can’t make their products cheaper without compromising on quality, but they can often frame them as part of an overall affordable choice. In the UK, for example, the recent campaign from Sainsbury’s about using beans and pulses to replace meat in various dishes doesn’t talk about the money, but those swaps obviously save money as well as carbon and calories.

Sainbury’s ‘Help Everyone Eat Better’ campaign encourages people to eat healthier and more sustainably

At the other end of the spectrum, the ‘trading up while trading down’ opportunity is unquestionably still there. When people forego evenings out, the demand for products that elevate at-home occasions will be heightened, creating ongoing opportunities for premium variants offering a ‘wow-factor’. For example, over half of drinks buyers say that premium alcoholic drinks bought from a shop are better value for money than standard drinks bought from a pub/bar.

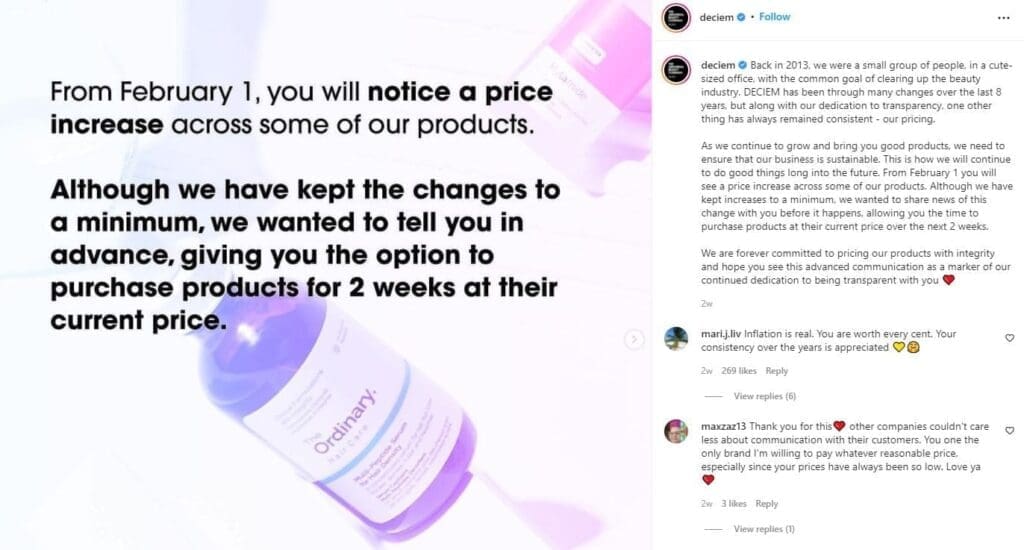

2. Beauty and personal care: be transparent with your consumers

Price hikes in the beauty and personal care sector are inevitable – the cost of raw materials, energy and transport costs are all going up – which will ultimately be borne by consumers to some extent.

However, if brands are able to keep consumers in the loop by being transparent about price hikes they could earn long-term loyalty.

In January, skincare brand Deciem announced increasing prices but explained the move to consumers on its social media page, highlighting the costs it is facing as well as the need to compensate its employees as the cost of living increases. The brand also gave its followers two weeks’ notice, allowing them to stock up before prices went up.

Using social media Deciem gave its customers a heads up that its prices were increasing

3. Travel, leisure & foodservice: balance squeezed incomes v. pent-up demand for experiential spending

Travel, leisure and foodservice brands will inevitably have to push up prices to recoup losses and respond to rising costs.

Whilst consumers will understand this, many will find it hard to justify paying extra for activities while their own finances are squeezed. Brands in these sectors will need to enhance the quality of the experiences they offer to convince consumers that they are getting good value for money.

Wellness and sustainability have become bigger priorities for consumers since the start of the pandemic, meaning brands that develop and promote experiences that are good for consumers’ wellbeing or for the environment are better positioned to manage price increases.

Brands promoting wellness and sustainability are in a stronger position to justify price increases

It’s particularly important for brands in these sectors to understand how the polarisation of household finances is affecting their core customers. For some households, rising inflation could mean that taking a holiday in 2022 becomes an impossible dream.

Others, though, are still sitting on the considerable amounts of savings that were built up over lockdown. With two years’ worth of missed meals out, cinema trips and family holidays to make up for, there’s still huge pent-up demand for experiential spending. Brands who focus too intently on the value end of the market risk missing out on the opportunities among those people who still have cash to spend – something that holds true across almost every area of consumer spending..

Mintel clients can read Toby’s full insights about how inflation will shape consumer behaviour across EMEA in 2022 by clicking here.

Although every recession is different, there are always common themes. Mintel’s 50 year track record of understanding what consumers want and why means that we’re perfectly placed to learn from the past, and to apply those lessons to the future. Clients can also read Jonny Forsyth’s analysis Food and Drink brands can learn from the 2008-09 recession written in the early days of the pandemic – where he covered several key learnings which are even more important now that so many households’ finances are coming under pressure.