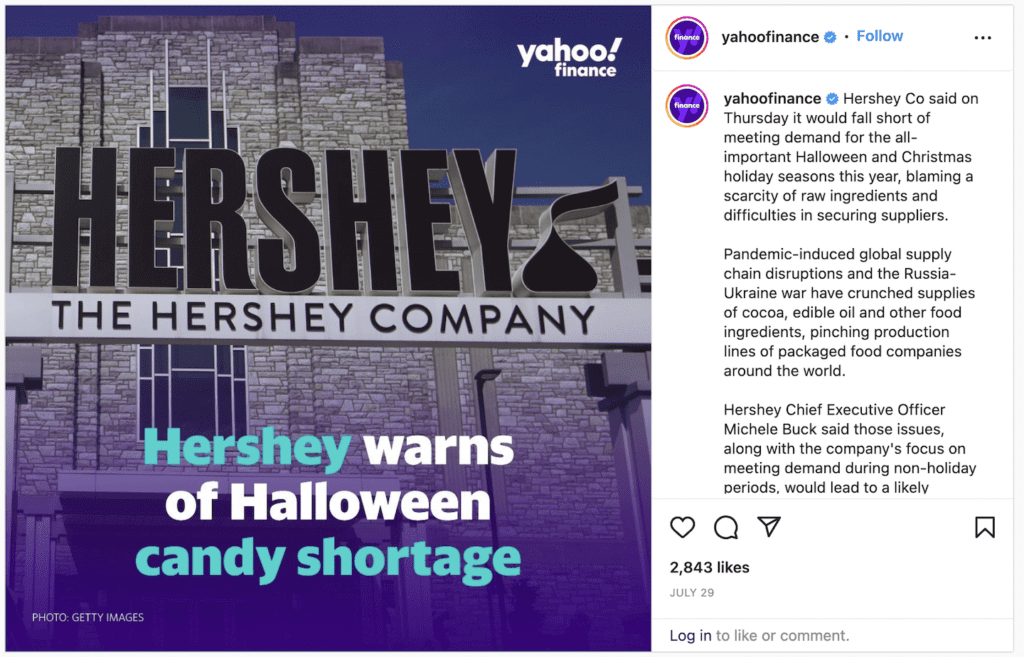

The Hershey Company inadvertently gave consumers a scare earlier this year. In the company’s Q2 2022 earnings statement, they mentioned that a Halloween candy shortage due to supply chain disruptions was anticipated.

Despite…strong growth, we will not be able to fully meet consumer demand [for Halloween candy] due to capacity constraints.

A flurry of social media posts lamenting the situation followed. Days later, the company assured consumers that it would have more than enough candy for the holidays. So did Hershey’s do enough to save Halloween? And what did the confectionery industry learn?

Candy comes first for Halloween shoppers

Hershey’s announcements regarding its Halloween preparedness reveal a number of important facts about the holiday and the company. After the constraints of the main pandemic years, consumers are anxious to celebrate Halloween in 2022.

As of March 2022, more than three quarters of US consumers who celebrate non-winter holidays were looking forward to celebrating these holidays, and more than half said that such celebrations were important to them. Halloween is the top non-winter holiday for candy purchases in the US, and Hershey’s fumble may drive consumers to stock up.

Within days of the original announcement, a number of media outlets and social media platforms were filled with suggestions of where to buy Halloween treats in bulk, pointing out the broad availability of SKUs other than those made by Hershey.

Brand Loyalty is not the top driver for confectionery purchases

The rush to stockpile Halloween treats and the availability of Halloween candy from a number of manufacturers bring the importance of brand loyalty into focus. Hershey seems to have forgotten, at least for a couple of days, that brand loyalty is not the most important driver behind confectionery purchases.

Mars Inc., one of Hershey’s competitors, capitalized on the gaff, and announced its 2022 Halloween SKUs the day after Hershey announced the potential gap in supply.

The purchase of confectionery is driven more by flavor than by brand. For sugar confectionery, familiar flavor is the top purchase factor, surpassing being a well-known brand by 11 percentage points. For chocolate confectionery, familiar flavor tops being a well-known brand by two points.

Consumers are anxious to celebrate even more

After getting through the main pandemic years, consumers are looking forward to celebrating holidays once more. Even though variants of the virus linger, the general sense is that it is now time to get back to the “before,” and revive traditions that were missed.

In 2022, the total anticipated spending for non-winter holidays (excluding Halloween) reached $110 billion, up 5.5% from 2021. Halloween sales had been expected to push that number up significantly

And Hershey may be less prepared for Halloween than consumers: as of August 2022, the brand is notably absent from Halloween-themed social media posts and news surrounding its 2022 Halloween-themed products.

What we think

The reaction to Hershey’s announcement shows the importance of celebrations. Even during depths of the pandemic, with self-imposed restrictions on handing out candy, US consumers maintained Halloween’s candy-centric traditions. They are certainly not ready to give up the trappings of the holiday as the pandemic starts to ease. A return to in-person celebrations is anticipated, and brands would be wise to anticipate and capitalize on that consumer demand.

Mintel clients have access to in-depth, current insight pieces from our analysts like this one. If you are a Mintel client, and would like to read the entire insight piece, click here. Non-clients should visit the Mintel Store to find out more about our research available for sale.