The buy now, pay later (BNPL) market has experienced a fast ascent over the past few years. As the pandemic led to lockdowns and consumers turning to online channels to do their shopping, the prospect of immediately owning a product and paying for it in a series of fixed, and often interest-free, installments was greatly appealing in uncertain economic conditions.

As the demand for BNPL solutions continues to soar, over half of Americans report using this type of installment loan, which is typically interest-free and provides the predictability of a fixed repayment schedule. Among the most popular use cases for BNPL are electronics, home improvements, apparel and household appliances – staples when it comes to discretionary spending categories. BNPL is also expanding into the medical and travel industries.

Opy partnered with Amex to provide cardholders BNPL financing at participating healthcare and auto repair merchants for purchases up to $20,000 with installment plans lasting as long as 24 months. Uplift is the leading BNPL provider focused on the travel industry, forging partnerships with the likes of United and Southwest airlines.

Millennials are the biggest adopters of BNPL

Almost three-fourths of Millennials and more than half of Gen Z have used BNPL financing the most. BNPL is popular amongst Gen Z and Millennials because they carry less purchasing power, and are more likely to be on unsteady financial footing. Almost three-quarters of Millennials say that they live paycheck to paycheck. BNPL’s structure directly aids these younger consumers with limited purchasing power, allowing them to obtain products and services they desire now.

BNPL is a form of debt and credit, despite these terms being absent from BNPL brands’ marketing materials, and this is why regulators are seeking to classify it as such. Millennials’ credit card usage levels are strong, with more than half of consumers using them for the majority of their purchases. This demographic’s strong credit card and BNPL usage indicate that Millennials are not as credit-averse as they are often assumed to be. The transparency and lack of fees could be what is pushing Millennials to use BNPL for their shopping needs, but the utility, rewards and credit building potential are likely what is keeping them around as credit card holders.

BNPL platforms

While BNPL has seen significant adoption, there is no universal model with which these providers operate. Some charge late fees (Afterpay, Klarna ) and others do not (Affirm, PayPal ). Some carry interest (Affirm, Klarna) on longer-term plans and others just stay true to the standard ‘interest-free pay in 4’ model.

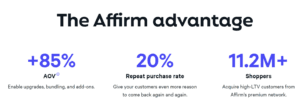

For merchants, having a BNPL solution naturally expands their customer base, attracting people who may desire a product right now but be hesitant to pay for it in full. Affirm makes these advantages clear on its website, showing that its merchants reported an 85% increase in average order value.

Source: Affirm business

Credit card issuers’ take on BNPL

The biggest difference is that credit card BNPL is not offered at the POS, but customers will get the option of splitting a payment into installments after they make a purchase. Unlike pure-play providers, credit card BNPL also carries a monthly payment fee should users opt into a plan. The three most notable credit card BNPL offerings are Amex’s Plan It, My Chase Plan, and Citi Flex Pay.

Source: Amex Plan It paid Facebook ad

What we think

FIs can enhance their customers’ financial literacy by communicating about the perils of BNPL with them. As BNPL continues to proliferate in the mainstream, traditional FIs have the opportunity to stand out by leveraging their roles as subject matter experts in financial wellness, becoming their customers’ first point of contact for all things related to financial education and literacy.

FIs are seeking growth and differentiation in a saturated market. Both FIs and pure-plays have the chance to differentiate themselves by tapping into industries with big-ticket items and higher AOVs, such as travel and medical procedures. Consumer interest in both is significant, and it represents a lucrative opportunity to provide longer-term installment financing (with interest) in both markets.