-

Articles + –

Financial Services Marketing Trends 2017: Howd we do?

Earlier this year, Mintel Comperemedia released a series of marketing trends across key industries, including financial services. The five Financial Services Marketing Trends we identified for 2017 were:

- Is Anybody Out There?: In today’s world of mobile banking and FinTech, financial brands are challenged to reimagine the meaning of customer service.

- Banking in Sync: Advancements in technology and connectivity are making the banking experience a more seamless part of everyday activities.

- Payments Confusion: As the digital payment landscape becomes increasingly fragmented, consumers will look for clarity and a centralized payment solution.

- Selfie Security: Advancements in secure biometric recognition will give marketers an opportunity to alleviate the widespread security concerns inhibiting digital or mobile payment adoption in 2017.

- Financially Fragile: Financial institutions will seize the opportunity to engage the sizeable portion of the population on the brink of financial crisis.

As we prepare to release our trend predictions for 2018, we take a look back at the two trends that evolved the most over the last year.

Is Anybody Out There?

Customer service continues to grow as a key focus for brands and marketers in almost all industries. In financial services specifically, Mintel confirmed it is a weak point, especially among young consumers. According to Mintel’s US report on financial services marketing, 47% of Millennials are satisfied with the customer service they receive from their financial services providers, compared to 52% of Gen X and 60% of Baby Boomers. Consumers want to feel that they are valued by their financial services institution, and one way to do that is to provide exceptional customer service.

The way in which customer service is delivered is also evolving as brands come up with innovative ways to avoid problems before they even happen. This is where we see the worlds of customer service and personal financial management (PFM) colliding and bringing a more proactive approach to financial management. Capital One does this by keeping an eye out for potentially fraudulent transactions on customer credit cards. In an email sent to one cardholder, Capital One pointed out a considerably generous tip that was left on a restaurant bill, and proactively asked the customer if this was left intentionally.

By addressing or preventing a problem before it turns into a crisis, financial brands can foster a more trusting and loyal relationship with its customers and we expect to see new innovations in this arena in the future.

Banking in Sync

Banking in Sync

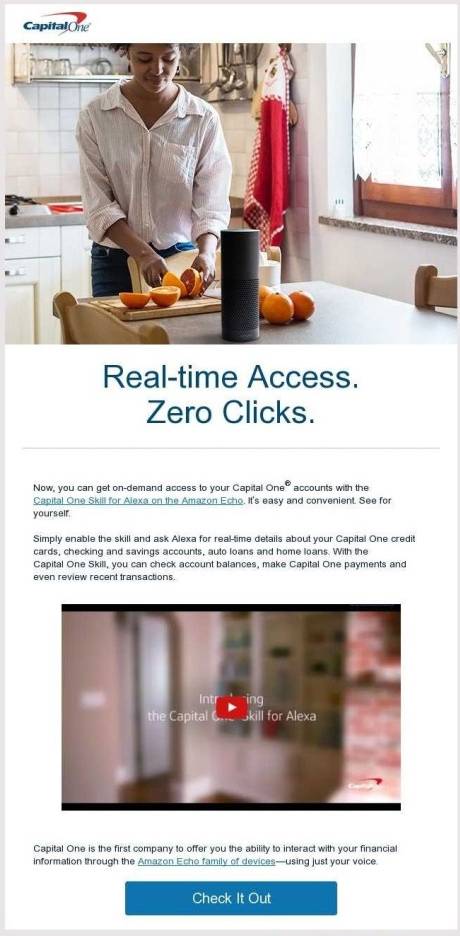

Capital One’s partnership with Amazon in 2016 to introduce banking skills to Alexa was the first step toward a more connected digital banking experience. US Bank joined the Amazon family this year with new skills for Alexa such as checking balances and paying bills, with more features expected to be released in the future.

This trend continued to evolve throughout 2017 with the introduction of new and more powerful AI-driven banking apps and chatbots. Although Bank of America introduced its new chatbot, Erica, in 2016, the bank has been taking its time to roll it out to customers. Positioned as more than just a basic mobile banking app, Erica is intended to be a digital assistant to help navigate the bank’s app. And in addition to performing basic transactions, Erica is designed to make recommendations and provide advice that takes into account a customer’s entire financial portfolio, bringing a more strategic approach to managing one’s accounts.

The growing availability of AI-driven and voice-first banking apps allows consumers to engage with their financial services providers on a more frequent basis. Banking is no longer something you have to take time out of your day to do, but rather it’s something you can do while you go on with your day. For financial services marketers, this is where the development of a unique and innovative value proposition is going to become increasingly important. Having a chatbot won’t be enough. Banks will have to communicate the value that the bot can bring to someone’s life and how it can sync up with other activities to create a seamless and frictionless experience.

Lily Harder is the Vice President of Research for Mintel Comperemedia. Lily specializes in the financial services industry, researching and presenting on the latest industry trends, competitive intelligence insights and newsworthy developments.

Lily Harder is Vice President of Research, Mintel Comperemedia. She specializes in financial services, researching industry trends and competitive intelligence insights.

-

Mintel StoreGet smart fast with our exclusive market research reports, delivering the latest data, innovation, trends and strategic recommendations....View reports

-

Mintel LeapMintel Leap is a revolutionary new AI-powered platform that will transform your research process....Book a demo

Banking in Sync

Banking in Sync