In 2019, more consumers will consider whether they’d like to purchase cellular service from their cable provider. This year, we’ve seen new developments from cable providers, as more of them offer mobility services by leasing wireless capacity from carriers such as Verizon or Sprint. In the near future, 5G mobility services will become the pillar of telecom bundles, making cellular services critical for cable and satellite providers looking to compete in the shifting marketplace.

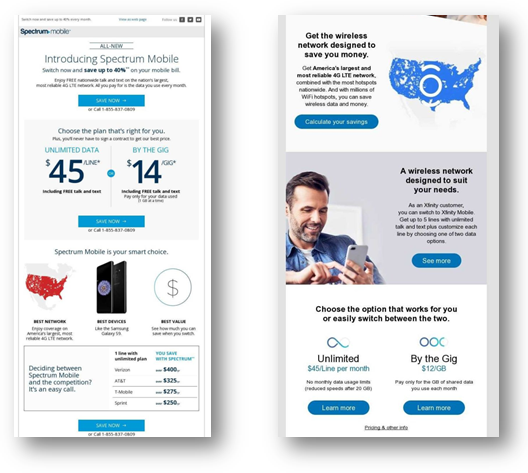

Comcast launched its mobility offering, Xfinity Mobile, in 2017, inviting its internet customers to add cellular with a straightforward pricing structure and competitive price point. Customers can choose unlimited data at $45/month, or pay by the gigabyte at $12/GB per month. Following Comcast’s example, Charter introduced its wireless service, Spectrum Mobile, in June 2018. Comcast and Charter both lease Verizon’s network and have been working together on many of the systems that support their mobility services, so it’s little surprise that Spectrum Mobile is structured remarkably similarly to Xfinity Mobile.

Another cable provider, Altice, will launch its cellular offering in Q1 2019, running on Sprint’s network. A Sprint/T-Mobile merger could be particularly beneficial to Altice, by strengthening the network on which its mobile service will run. Altice has a smaller footprint than the other cable mobile virtual network operators (MVNOs), but is operating in prominent markets such as New York City, Philadelphia and major Texas markets.

Morgan Stanley Research predicts that cable MVNOs will add around 2.2 million mobile phone customers in 2020 – almost half of the industry’s total net customer additions. It’s important to consider that by 2020 the competitive makeup of the marketplace is going to look different. Just as cable providers are moving into wireless, cellular providers are increasingly moving into video and home internet. Investments in 5G fixed wireless, along with AT&T’s multiple streaming video services, T-Mobile’s acquisition of Layer3 TV, and Verizon’s partnership with YouTube TV, all demonstrate that cellular providers want to be your cable bundle replacement.

The ambitions of cable providers extends beyond leasing mobile capabilities from big cellular providers. Charter is testing LTE small cells in various locations and will expand the test into NYC and Los Angeles this year. Charter is also exploring the deployment of its own 5G fixed wireless. If it could acquire additional spectrum licenses, it may be able to eventually offer its own 5G mobility service, which would enable it to expand beyond its existing cable footprint to offer service nationwide. This would result in Spectrum competing directly with the major carriers.

Satellite TV provider DISH is also working to build out a wireless network utilizing its spectrum licenses, with the eventual goal of deploying a 5G network. Pairing its Sling TV service with its own wireless network could make DISH a viable competitor in this space, as well. As analysts have been suggesting for years, DISH’s spectrum assets could make it a prime takeover target for others looking to compete in this space.

What we think

In order to succeed in the changing marketplace, cable providers will have to lay a strong mobility foundation in the immediate term. A positive experience goes a long way when word of mouth is such an important factor in selecting a wireless provider. Mintel’s US research on mobile network providers found 39% of consumers said friends or family influenced their choice of cellular carrier, a factor that is one of the driving influences in choosing a mobility provider. A poor experience with a cable provider’s mobility service could not only jeopardize the entire customer relationship in the near term, but also could undermine the brand’s future efforts in wireless.