“Vegan” food and drink product launches outpace “vegetarian” in Germany

While veganism has been booming for some years in Europe, it seems that growth is particularly strong in the German market. In 2015 new product launches carrying a “vegan” claim outpaced those labelled as “vegetarian”, with Germany launching more vegan products than any other European country in 2015.

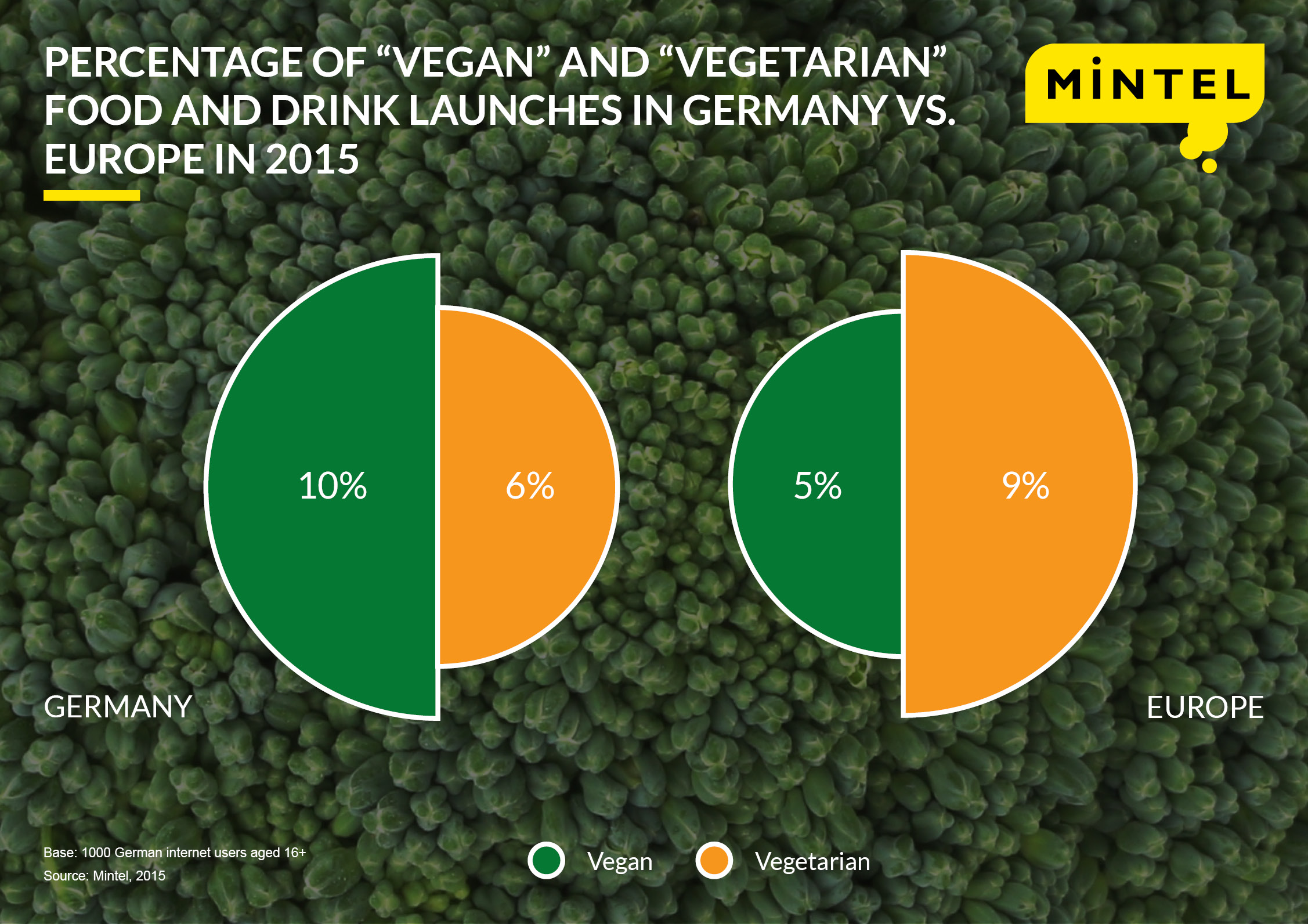

New Mintel research finds “vegan” claims were featured on one in 10 (10%) newly introduced food and drink products in Germany in 2015, while only 6% were labelled as “vegetarian”. This is a substantial increase from only two years ago, when “vegan” and “vegetarian” labelled products each only accounted for 3% of all launches in Germany.

While the growing popularity of veganism is reflected in wider Europe, launch activity is on a much smaller scale, with products marketed as “vegan” accounting for only 5% of all food and drink products launched in overall Europe in 2015, up from 2% in 2013, according to Mintel Global New Products Database (GNPD). “Vegetarian” claims are still a step ahead of “vegan” claims across Europe, accounting for 9% of all European food and drink launches in 2015 – a number that has been relatively stable since 2013 (9%).

Germany has thus taken the European lead when it comes to vegan launch activity, accounting for 36% of all vegan food and drink introductions in Europe in 2015, followed by the UK (21%), France (7%) and Italy (4%). In 2013, the UK was leading in vegan food and drink introductions, launching 40% of products, followed by Germany (22%) and Finland (5%).

Katya Witham, Senior Food & Drink Analyst at Mintel, says:

“The vegan diet is rapidly moving from the fringe to the mainstream as one of the fastest-growing segments in the German food and drink industry, with consumers’ interest in meat-free diets continuing unabated. Germany has seen vegan references explode in the market as veganism infiltrates foodservice and retail packaged food sectors. Vegan products seem to succeed in attracting attention from a much wider, health and ethically driven, flexi-vegan consumer base. Demand is also spurred by the growing interest in both free-from and organic qualities, which are commonly represented by vegan products.”

In Germany, the meat substitute category was among those with particularly high levels of vegan innovation, with products marketed as vegan accounting for over half (52%) of total meat substitute launches in 2015, up from only 8% in 2011.

What’s more, clean label messages such as “no additives” or “no preservatives” appear on a growing number of vegan meat substitute products. According to Mintel GNPD, such labels were featured on 18% of all vegan meat substitute launches in Germany in 2015, up from just 3% in 2013.

This comes as German consumers are growing increasingly sceptical of the content of food and drink products they buy. Mintel research reveals that 35% of Germans avoid food and drink products that contain artificial additives or preservatives, while 33% regularly check the ingredients list on the pack.

“The range of vegan meat alternatives is growing significantly, providing meat replacements in all shapes, sizes and flavours – from deli slices, meatballs and mince meat through to game, poultry, bacon, and sausages. However, with many faux meat products containing additives and preservatives to stabilise them and add flavour, meat substitute brands are increasingly forced to reformulate in order to make their products more natural as consumers become more and more uncertain about food and drink ingredients.” Katya concludes.

Press review copies of the research and interviews with Katya Witham, Senior Food & Drink Analyst are available on request from the press office.

Katya Witham is Senior Food & Drink Analyst, identifying and exploring the major trends across various FMCG categories, giving invaluable insights into global markets.

-

Mintel StoreGet smart fast with our exclusive market research reports, delivering the latest data, innovation, trends and strategic recommendations....View reports

-

Mintel LeapMintel Leap is a revolutionary new AI-powered platform that will transform your research process....Book a demo