In the Inflation Exploration blog series, Mintel explores all the ways that inflation effects consumers around the globe.

It’s no surprise that the economy is at the forefront of consumers’ minds. The Bureau of Labor Statistics reported that consumer prices increased 9.1 percent from June 2021-22, the largest 12-month increase seen in over forty years. As a result, brands are aiming to sympathize with consumers’ financial anxieties by addressing economic concerns in marketing.

In their 2022 back-to-school and grocery campaigns, retailers like Amazon and Walmart positioned themselves as the go-to destinations for guaranteed low prices in our current economic climate. Both brands strategically walked around the word inflation in ads, instead referencing higher prices and unexpected expenses. Their approach will likely prove effective because it is somewhat gentle, directing consumers toward services during a time of need – rather than using inflation as a tool to get consumers’ attention.

On the other hand, other retailers and financial services brands are speaking more candidly and putting inflation at the forefront of marketing messaging. Ads from brands like Kohl’s, Ally, Oportun, and Cleo tell consumers to take an active role against inflation. The messaging starts to look similar, urging consumers to “fight,” “beat,” or “defend” against inflation, by using their services or taking advantage of their deals. Kohl’s new back-to-school national TV commercial tells consumers outright to “beat rising inflation” with the Kohl’s friends and family sale.

Although this strategy recognizes a shared struggle, there are drawbacks to directly referencing inflation. If we’ve learned anything from advertising during the COVID-19 pandemic, it’s that consumers can easily become burnt out on messaging that reminds them of their current hardships. In the early days of COVID-19, video compilations like the one below circulated online – poking fun at brands for having the same, derivative advertising response to a very real and threatening consumer experience.

Brands run the same risk of becoming white noise now – just one of many that are pointing out what consumers are already experiencing firsthand. And interest in hearing about finances online is already lukewarm. Mintel’s Marketing Financial Services Products – US, 2022 finds that 60% of US adults who use social media prefer not to see information regarding financial services topics when using social media.

However, the severity and importance of inflation can warrant messaging from brands – but only if those brands can provide value and support. And Mintel research shows that one in four consumers do report learning more about financial services on social media, so there is an audience to be reached, if brands can reach them correctly.

Present the solution, not the problem

Inflation is so pervasive that it doesn’t require mentioning. Instead, help consumers make connections between their financial health and your services by addressing how your brand can provide value. Whether it’s by cutting consumers’ costs or helping them prepare for their financial future, use marketing channels to promote next steps – not to remind them of the context. Discover, Chase, and Bank of America all advertised cash back on gas purchases in response to soaring gas prices, without mentioning the word inflation once.

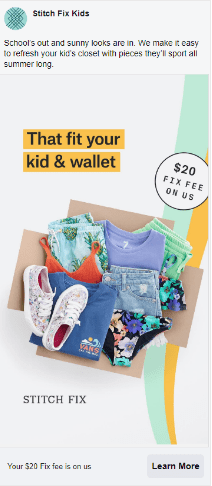

Similarly, the DTC curated styling brand Stitch Fix waived its $20 Fix fee on kids’ boxes, in order to help parents stock up on back-to-school clothing more affordably. The brand mentioned savings in messaging but did not overtly mention the economic factors that may make savings important during this back-to-school season.

Place messaging where it’s relevant

Brands and retailers that want to act as a resource will want to ensure they’re reaching the right audience, to avoid exhausting consumers who aren’t receptive to messaging. One way that brands can promote services to consumers seeking out financial advice is by leaning on partnerships with notable influencers. Influencers known for budgeting tips or financial education will be the best fit. This way, the information is likely more memorable while also feeling more authentic.

Additionally, placing ads on relevant news programs and financial websites can ensure that consumers are receiving information at a time when they are seeking it out – rather than being bombarded with it.

Looking forward

Consumers’ concerns about personal finances aren’t fading any time soon. From the back-to-school season to holiday travel, brands will need to carefully consider how they position products and services to stay relevant. Here are our predictions on how brands will shape their marketing to connect with cost-conscious consumers this upcoming holiday season:

- Big box retailers will diversify the types of products they advertise for holiday gifting. Expect shifts from mostly large, big-ticket items to a wider array of small- and medium-sized items. Retailers will place more emphasis on stocking stuffers and offer more bundled products that make smaller gifts look more substantial.

- Expect Black Friday and Cyber Monday sales to feature more everyday essentials. Amazon reported that some of its Prime Day best-sellers were household essentials such as pet food or diapers. Sweeping percent discounts across categories or brand portfolios will be motivating.

- Premium or luxury brands and retailers will double down on a “less is more” narrative, encouraging consumers to invest in fewer, high-quality products. Travel companies may test the same approach, encouraging people to invest in travel experiences this holiday season rather than physical gifts. Doing so would also give travel companies an opportunity to regain consumer trust after notorious price increases, delays, and cancellations.