-

Articles + –

Overcoming hair wash phobia in China

Haircare has now become a mature and highly saturated sector in China’s beauty and personal care market. While Chinese consumers’ hair washing frequency has increased a lot, the majority of consumers still only wash their hair every two to three days. According to Mintel’s recent research on China’s haircare market, nearly half of Chinese consumers believe washing their hair every day will damage its health. Among all the concerns, hair loss is one of the most prominent factors.

Cultivate better haircare awareness among Chinese consumers

Increased wash frequency is still a key driver for growth for the overall haircare sector, considering China’s huge population. Brands need to offer more education to establish a reasonable haircare routine. Brands can leverage different types of KOL (Key Opinion Leaders), not only fashion-based ones, but also ‘academic’ KOLs to educate Chinese consumers on haircare-related knowledge. Some educational topics include hair wash frequency in different situations (considering seasons, humidity levels, hair types etc), normal amount of hair loss during washing process, and how to massage the scalp during washing.

P&G’s response to ‘hair wash phobia’ has been an interesting one to watch; even though they have tried to persuade Chinese consumers to wash their hair every day more than a decade ago, they are now demonstrating a total turnaround and compromising with Chinese hair wash-phobic consumers.

Rejoice launched a micellar water haircare range with the marketing slogan ‘Challenge: no hair wash for 3 days’, highlighting the superb cleansing capability of the shampoo.

Differentiate daily and weekly hair wash productions

Consumers’ concerns about potential hair damage can be attributed to the great importance that they place on hair health. Therefore, brands can turn this ‘hair wash phobia’ into a positive factor, by introducing a sophisticated hair cleansing system with more segmented offerings. A differentiated product line can be developed with both mild cleansing products for daily cleansing, and deep-cleansing products for a weekly cleansing treatment.

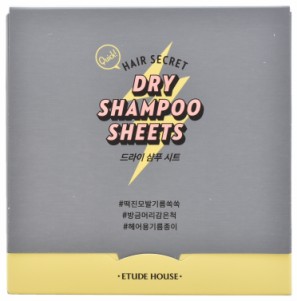

Create products for between-wash usages

Although ‘hair wash phobia’ leads to less frequent washing, it also creates an opportunity for new product development. For example, dry shampoo is a potential subcategory to promote as it precisely targets haircare between washes, and is quick and convenient for on-the-go use. But the usage of dry shampoo is still quite limited to specific consumer groups, such as women in confinement (the 42 days after giving birth) who are usually not allowed to wash hair by Chinese tradition. Therefore, brands can identify more scenarios for dry shampoo usage and extend its use to more consumer groups.

On top of the dry shampoo subcategory, brands should also consider product formats such as sprays, wipes and essences that offer between-wash benefits to solve haircare problems anytime and anywhere.

Formulated with a purifying blend of Binchotan charcoal and natural starches to absorb excess oil at the roots, while drawing out impurities from the scalp and hair.

The double-coated sheet is perfect for on-the-go use and is known for its excellent oil-absorbing properties.

Laurie is Mintel’s Senior Beauty Analyst based in Shanghai. She provides insights on the Chinese beauty market, consumer behavioural trends and new product development.

-

Haircare in China: 2021Explore consumers’ usage of haircare products in China and what brands should include when building good shampoo usage experience...Discover this research

-

Mintel LeapMintel Leap is a revolutionary new AI-powered platform that will transform your research process....Book a demo