The world needs energy. Demand for energy drinks has been sustained by the universal consumer need to be productive, even when faced with the impact of rising inflation on consumer spending. Although the energy drink industry has not been immune to ongoing economic challenges, such as consumers’ financial concerns, which incidentally have led to over half of UK drinkers reducing their energy drink purchases, the global energy drinks industry continues to grow. Leading brands like Red Bull and Monster enjoy consistently strong revenues in global markets. Additionally, the market’s value growth is mirrored in volume, Mintel’s GNPD data shows that the number of energy drinks in the market has increased by 20.8% since 2021.

The market is forecast to continue growing, but that doesn’t mean that consumers are happy with the same old energy drinks. Consumer demands and priorities have changed in the years since the COVID-19 pandemic, and as a result, the industry has had to diversify to cater for different consumer needs. These days, consumers want energy drinks to provide more than just a pick-me-up. In this article, Mintel examines how evolving consumer demands have affected the global energy drinks industry over the past three years.

2021: An Emerging Focus on Health

The COVID-19 pandemic had a notable impact on the energy drinks market. Consumers’ energy levels were severely impacted, leading to a high demand for drinks with energy-boosting properties. Mintel’s market research revealed that in 2021, over half of European consumers were looking for more ways to energise themselves since the beginning of the pandemic, and energy drinks were a quick and convenient stimulant. This was a global trend, and something similar was seen in Brazil, where nearly a quarter of consumers were using more drinks to give them energy because they were feeling more tired since the COVID-19 outbreak.

The pandemic also presented an innovation opportunity for the global energy drinks market, as many consumers’ personal priorities shifted towards health and wellness. Alongside raising energy levels, consumers wanted energy drinks to deliver other functional benefits, such as enhanced hydration or mental stimulation. A successful example of this was the UK energy drink brand, Purdey’s, which expanded its range with a bigger focus on mental stimulation.

2022: Younger Generations and Gaming Culture

The emergence of hybrid beverages looked like a challenge for the energy drinks market at first, but their increasing popularity was surprisingly beneficial for the industry. The growth of the hybrid category served as an accessible entry point for certain demographics that the industry had previously failed to attract, in particular younger women. Brands in the US found success with hybrids that included coffee or tea, and seltzer energy drinks. This underlined a broader industry trend that emerged in 2022, with energy drinks brands targeting specific demographics, or tailoring products to suit the demands and concerns of younger generations, such as the rise of gaming culture.

Gaming culture has had a wide-ranging influence on energy drinks, shaping product development, marketing strategies and consumer engagement. In Japan and the United States, gaming performance drinks like Rogue Energy and G FUEL have been developed to enhance gaming performance with ingredients like nootropics and essential vitamins, targeting the core gaming community and engaging with them through social media. Gaming influencers are shaping Gen Z’s beverage choices through co-branding partnerships, creating new flavours and products that resonate with their followers.

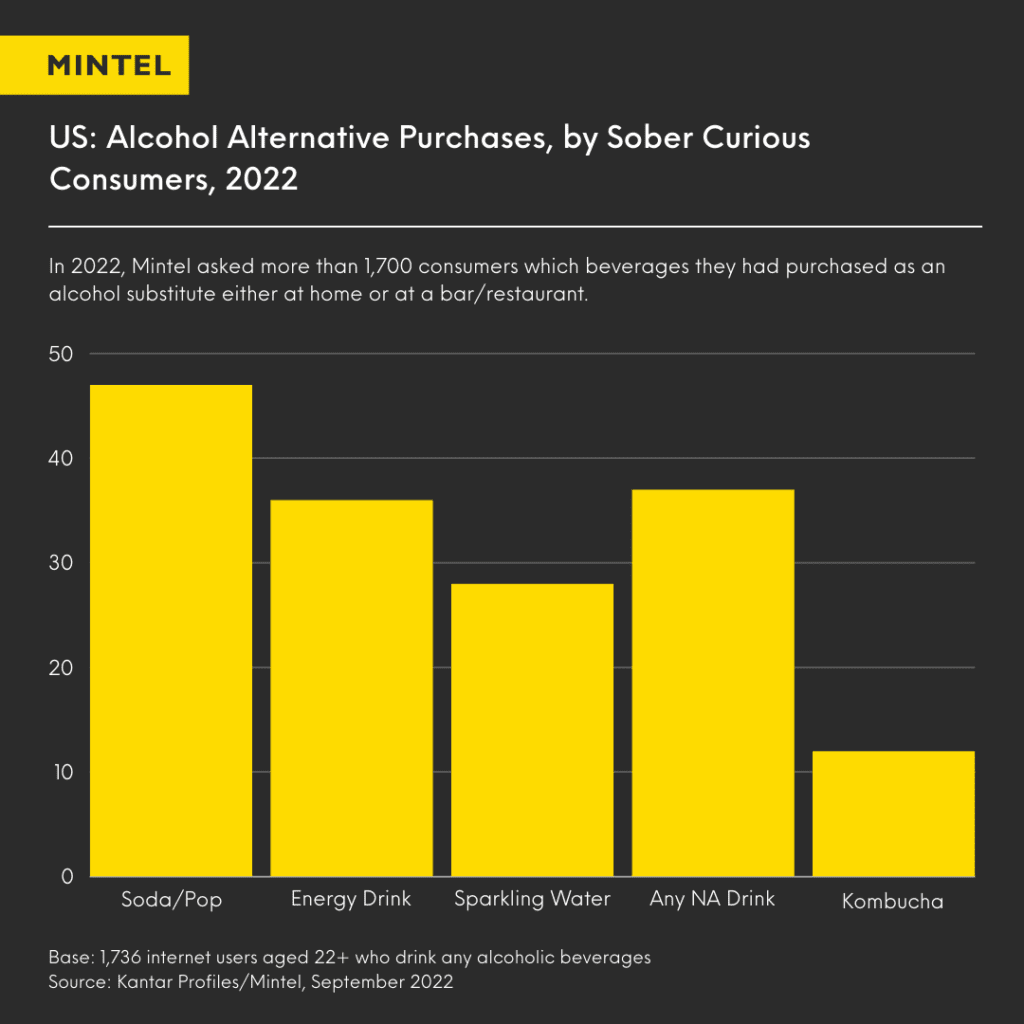

Targeting Gen Z consumers has also provided another lucrative opportunity for the energy drinks market. Gen Zs exhibit a more mindful approach to drinking alcohol when compared to previous generations, and energy drinks are well-placed to capitalise on the growing alcohol moderation trend. Energy drinks are seen as an appealing option for consumers who want to socialise without alcohol, particularly during social occasions.

2023: Natural Ingredients and Sleep Health

Health and wellness trends moved even further into the spotlight in 2023. For many consumers, one of the key pillars of health and wellbeing is a good night’s sleep. This presented a challenge for the energy drinks industry, as a focus on sleep health can drive caffeine moderation. Mintel’s market research found that in Germany, over a third of energy drink users were limiting their caffeine intake to avoid disrupting sleep. The market began to see a demand for energy drinks with moderated caffeine content, and this is an area which still holds potential for energy drinks brands. Moving forward, brands could follow an example from the coffee category. No Coffee‘s variable caffeine level coffee pack, for example, provides gradually smaller caffeine boosts to be dosed throughout the working day, rather than a large dose of caffeine that could disrupt sleep.

The energy drinks industry has seen a growing interest in natural ingredients as consumers become more health conscious and concerned about artificial additives. Brands are responding to this demand by innovating and offering products that feature plant-derived ingredients, which are perceived as healthier alternatives to artificial ones. Globally, botanical ingredients such as ginseng, ginger, sage, moringa, maca, and kola nuts are being considered for their energy-boosting properties and potential to offer a natural alternative to caffeine. In the UK, Tenzing has introduced carbon-neutral energy powder products made purely from plants and free from artificial ingredients, catering directly to the third of consumers who see plant-derived ingredients as more appealing than artificial ones. Similarly, in India, consumers show a preference for Ayurvedic/herbal ingredients over synthetically processed ones, and brands are adopting clean, natural, and Ayurvedic/herbal positioning.

2024: Looking Ahead with Mintel

Mintel’s forecast for the energy drinks market indicates that the industry is expected to keep growing. However, brands cannot rely on past successes and still need to innovate and evolve as the competitive landscape constantly shifts consumer demand. Interestingly, as the user base of energy drinks grows and diversifies, brands have begun to distance themselves from an overtly masculine image, which could open the door to even more growth amongst demographics who had previously slept on the energy drinks industry.

Over the past few years, consumer demands in the energy drinks industry have shifted. An increased focus on health has resulted in consumers looking for more than a sugary, caffeinated pick-me-up. More and more consumers want functional drinks that can help them achieve their health goals, rather than potentially hinder them.

Subscribe to our newsletter, Spotlight, to get free content and insights delivered directly to your inbox.