-

Articles + –

The wine category is still peripheral in China’s alcohol market today—Mintel research reveals that it makes up the lowest share of the Chinese alcohol business which also includes spirits and beer.

Chinese consumers’ annual wine consumption is stuck at just over a litre per capita, but Mintel research indicates that the category is particularly popular among consumers aged 20-49, which could prove to be a bright spot for brands.

Given the low consumption of wine in China, companies and brands in the industry must make efforts in positioning wine as an alternative to spirits and beer.

Re-establishing presence in the on-trade

In China, wine generally has a lack of presence at on-trade occasions, and instead, is used more for at-home consumption. This is due to the general perception that wine is a drink that’s best consumed during the festivities or family occasions.

In order to raise the category’s on-trade profile, it is vital for companies and brands to explore the different demographics in China’s consumer marketplace. Market players could do more to engage younger Chinese consumers by holding tasting events and promotional tours or pop-up events in bars, clubs and restaurants.

Wine companies and brands can also appeal to China’s younger consumers by introducing changes to packaging as a means to incentivise more single-serving purchases. This concept would be ideal and particularly well-received in a low-volume market like China, and the novelty found in some single-serving formats (eg miniature bottles, canned wine) is likely to appeal to younger consumers who are more experimentative and after new experiences.

Schlumberger Traditional Sparkling Brut Wine, Germany

New traditional glass bottles in 200ml size are great for portion control and freshness, making this product convenient for on-trade use.

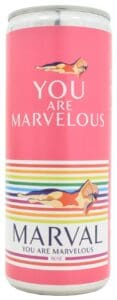

Marval You are Marvelous Rosé Wine, USA

This canned wine product comes with eye-catching graphic prints, and is in the format of single-serve convenience.

Beautifying wine

Mintel research reveals that over four in five Chinese women in their 20s say that drinking wine is good for their skin condition. In light of this, it is important that companies and brands remember the strong beauty associations that wine actually possesses, especially when targeting the younger Chinese consumer.

Wine companies could echo this trend in their branding and promotional strategies to catch the eyes of younger consumers. In essence, playing up on wine’s beauty benefits could be the driving force behind younger female consumers choosing wine over the other ‘fashionable’ alcohol drinks.

Jonny Forsyth is Associate Director, Mintel Food & Drink, monitoring and engaging with latest innovations and market developments in all alcohol and coffee categories.

-

Mintel StoreGet smart fast with our exclusive market research reports, delivering the latest data, innovation, trends and strategic recommendations....View reports

-

Mintel LeapMintel Leap is a revolutionary new AI-powered platform that will transform your research process....Book a demo