Carbonated soft drinks (CSDs) are second only to milk in dollar share of non-alcoholic beverages consumed in Canadian homes. Despite their current leads, milk and CSDs are forecast to have lower growth rates than competitive non-alcoholic beverage categories, including coffee, bottled water and tea.

Volume sales of CSDs, specifically, have been impacted in recent years by broader consumer trends toward healthier diets and lifestyles. In fact, nearly two thirds of adults characterize CSDs as a “treat,” according to Mintel research. The perception of CSDs as “treats” may be influencing Canadians to drink them less frequently and to consume lower volume servings when they do drink them.

Health priorities influence change

Shopping habits are also changing as Canadians become increasingly mindful of their health and wellness. Three in four agree that living a healthy lifestyle requires sacrifices, according to Mintel’s Healthy Lifestyles Canada 2016 report. For some, these sacrifices likely incorporate changes in dietary choices, such as CSD consumption. Per capita CSD consumption was just 93 liters in 2015, as compared to 101.4 liters in 2007, according to Mintel Market Sizes.

Calorie-conscious consumers now have more options with the growth of introductions of low, no or reduced calorie offerings since 2011. Between November 2015 and October 2016, one quarter of Canadian CSD launches had low, no or reduced calorie claims, as compared to just 9% from November 2011-October 2012, according to Mintel’s Global New Products Database (GNPD). Consumers who are looking for fewer calories now also have the option of smaller volume packaging.

Craft and natural present potential for new niches

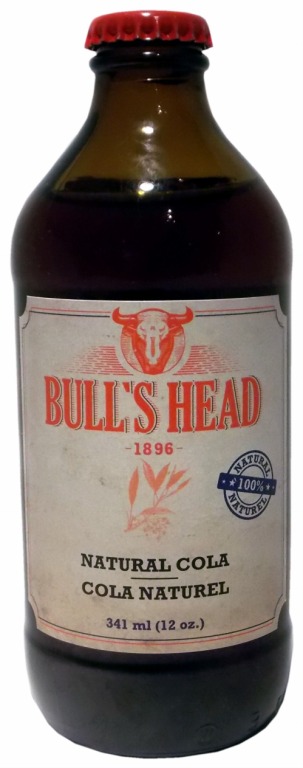

Taking advantage of craft beer’s growth in Canada, the CSD category also could benefit from craft formulations that offer the authenticity of local, small batch production. Quebec is home to several companies that produce craft soda brands with an emphasis on local heritage and production quality. While these brands lack the mass recognition that The Coca-Cola Company and PepsiCo benefit from, the more premium “craft” positioning may better align with occasional “treat” occasions that some Canadians associate with CSDs.

Jenny Zegler is a Global Food & Drink Analyst at Mintel. She has a hybrid role on Mintel Food & Drink as the dedicated food and drink trends analyst and coverage of the carbonated soft drink category. Jenny joined the Mintel Food & Drink Platform after her tenure as a Beverage Analyst on the US Mintel Reports team. During her career, she has also written for several food and packaging magazines covering the US snack food, bakery, confectionery, meat, and packaging industries.