-

Articles + –

Market Barometer Issue 50 – Tyres – Rolling on

This month’s Market Review looks at at the tyre market; which quickly recovered from the recession at the end of the last decade.

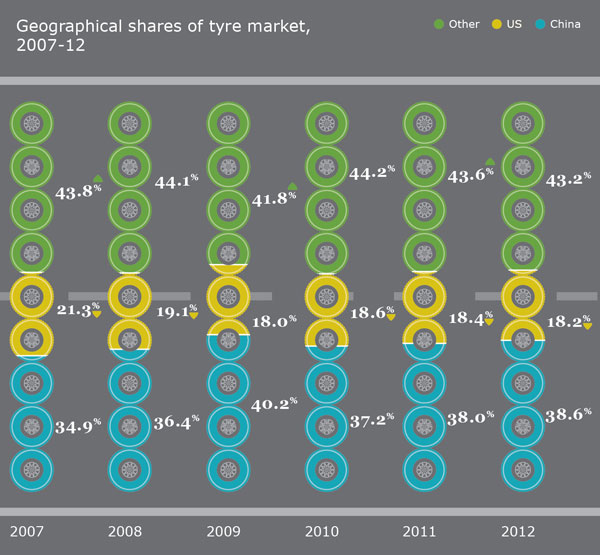

Source: Mintel Global Market Sizes

An economic indicator?

There is some logic in believing tyre sales reflect world economic health. The OEM (Original Equipment Manufacturer) segment is an indication of the might of automotive manufacturing in any nation; while the replacement sector is a measure of the amount of movement, and thereby trade, on the transport system.

A bounce back

In 2008 when the financial rumblings started to reverberate around the globe, tyre sales had already started to slide and, in the 20 largest economies, they fell by 1%. The following year, when the recession was really beginning to bite, there was a further 4% reduction. However, in 2010 the market had more than recovered lost ground by expanding by twice the rate of the previous year’s contraction. Since then, the market has been steadier but in a gradually upward direction.

China power

It is a few years yet before China becomes the world largest economy but, in tyres, it has already long been there. This is in part due to the growing number of vehicles on the road, both for the growing number of affluent, car-driving consumers, but also for the commercial vehicles delivering goods to the stores and transporting manufactures to the ports for exporting. However, the other side to demand has been the burgeoning Chinese automotive industry, where the number of cars and light vehicles leaving the production line in 2013 was due to surpass that of Europe.

Continually turning

China’s share of world sales shown in the graphic has largely been at the expense of the US. It has been rising in recent years but has not reached the peak of 2009 which was largely a reflection of the slump in the West. There are other countries which are beginning to become sizeable target markets. The most noticeable of these are Russia and India which account for 7.4% of world sales compared with 5.6% five years earlier.

-

Mintel StoreGet smart fast with our exclusive market research reports, delivering the latest data, innovation, trends and strategic recommendations....View reports

-

Mintel LeapMintel Leap is a revolutionary new AI-powered platform that will transform your research process....Book a demo