India’s dapper men: Average Indian man spends 42 minutes grooming per day

Men’s grooming is becoming big business across the globe and it seems that India is no exception as latest research from the world’s leading market intelligence agency Mintel reveals that the average Indian man spends 16 minutes grooming his body, 14 minutes on his hair and 12 minutes on his face, totalling a beautiful 42 minutes every day. In addition, men in the metro areas of India are spending a significantly higher amount of time getting ready each day, including time spent on their body (22 minutes), hair (21 minutes) and face (18 minutes) as compared to men overall.

Minu Srivastava, Consumer Research Analyst, India, at Mintel, said:

“Men’s grooming, while still in a rather early stage, has been under the spotlight in India, particularly as Indian men grow increasingly image-conscious and are starting to take care of how they look. In general, men may find it overwhelming at times when finding the right products and regime that they should follow with so many choices in the market. Companies and brands in the Indian men’s grooming market should review the motivations and lifestyle patterns of various groups and customise offerings to fit in. Men in metro areas are spending more time, and as a result, they are likely to seek convenient, time-saving and/or multi-functional products.”

When it comes to looking good, Mintel research shows that almost two thirds (65%) of Indian men* are concerned about an aspect of their appearance. Specifically, a quarter of Indian men admit that body odour and hair greying are their biggest concerns (24% and 23% respectively), while just over a fifth (21%) worry about yellow teeth, excessive sweating, and bad breath, respectively. Meanwhile, 20% say that they are concerned about baldness/hair thinning, 14% worry about acne (on the face or body) and 13% are anxious about signs of ageing—rounding up Indian men’s top 10 appearance-related concerns.

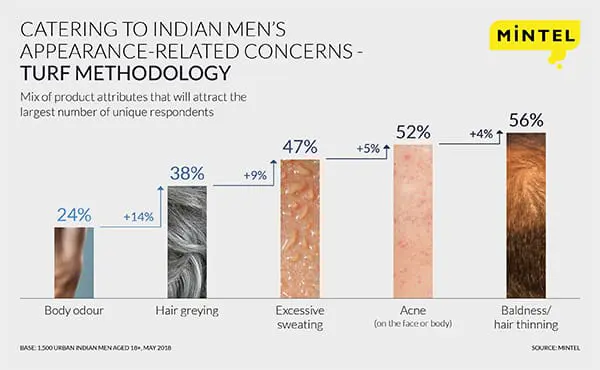

In terms of targeting Indian men with the right grooming products, Mintel research, using the Total Unduplicated Research & Frequency (TURF) methodology**, reveals that men’s grooming products that collectively cater to concerns of body odour, hair greying, excessive sweating, acne, and baldness/hair thinning appeal to 56% of Indian men.

“With various appearance-related concerns among Indian males, the time is ripe for men’s grooming to evolve and expand beyond the basics like deodorants, shaving and depilatories. Players in the men’s grooming market can start looking at catering to various appearance-related concerns and create a bundled product portfolio offering covering body, hair and skin, with products or solutions that address these top concerns in order to appeal to today’s male consumer.” Minu continued.

Men’s grooming has come a long way in India; showcasing the rising importance of this market, Mintel research reveals that 37% of Indian men say that their appearance is very important, rising to 43% of men aged 18-34. What is more, it seems that men in India are primed for grooming as almost three-quarters (73%) of Indian men shop for personal care products, rising to 79% of men aged 18-34. Meanwhile, as many as 57% of Indian men say they enjoy trying new men’s grooming products, while 45% say they enjoy spending time on their own personal grooming routines.

Mintel research also shows how the digital space can play a role in keeping Indian men informed about the latest grooming trends and styles; over a fifth (22%) of male consumers aged 18-34, for example, follow a blogger/Instagram/social media personality.

“The fact that men’s grooming is on the rise in India aligns with Mintel Trend ‘Man in the Mirror’. This discusses how taking pride in, and taking greater confidence from, maintaining a well-groomed appearance now defines what it is to be ‘a man’ in today’s society. To keep male consumers updated on grooming products and trends, companies and brands can look at various forms of strategies. For instance, digital channels, including social media influencers, are something that companies can tap into to engage today’s Indian men. In addition, salons are another channel that companies and brands can pay attention to; visibility, usage, and availability of grooming products at salons can help in educating Indian men about the products and drive at-home use.” Minu concluded.

*1,500 Indian men aged 18+, May 2018

**TURF analysis identifies the mix of features, attributes, or messages that will attract the largest number of unique respondents. By identifying the Total Unduplicated Reach, it is possible to maximise the number of people who find one or more of their preferred features or attributes in the product line. The resulting output from TURF is additive, with each additional feature increasing total reach by incremental amounts.

Press review copies of Mintel’s Men’s Grooming Behaviour Indian Consumer 2022 report and interviews with Minu Srivastava, Consumer Research Analyst, India, at Mintel, are available on request from the press office.

For the latest in consumer and industry news, top trends and market perspectives, stay tuned to Mintel News featuring commentary from Mintel’s team of global category analysts.

-

Discover your next big breakthroughGet smart fast with our exclusive market research reports, delivering the latest data, innovation, trends and strategic recommendations....View Reports

-

2026 Global PredictionsOur Predictions go beyond traditional trend analysis. Download to get the predictive intelligence and strategic framework to shape the future of your industry in 2026 and beyond. ...Download now

-

Are you after more tailored solutions to help drive Consumer Demand, Market Expansion or Innovation Strategy?Ask for a customised strategic solution from Mintel Consulting today....Find out more