Indian consumers seek personalised haircare amid stagnating market

Despite stagnant growth in the haircare category, 35% of Indian consumers have increased the time spent on haircare routines in the six months leading to September 2023, with 44% expressing interest in personalised products tailored to their individual hair types according to Mintel Global Consumer research.

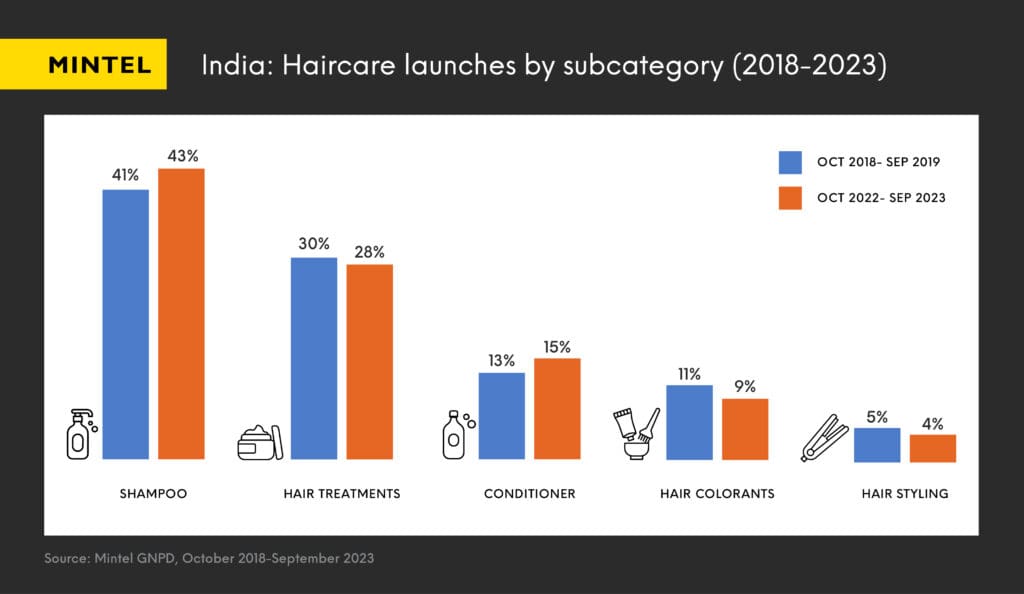

Haircare subcategories such as shampoo, hair treatment and conditioner have seen stagnant growth in the last five years. Mintel research indicates potential for reviving innovation as Indian consumers are embracing haircare routines, new haircare formats and diverse hair types.

Growing awareness of unique hair types

The majority of Indians identify their hair type as straight (71%), however, there’s an increased awareness of one’s unique hair characteristics among a small segment of consumers who claim to have curly and wavy hair (16% and 8%, respectively). Moreover, wavy and curly hair are gaining traction in Google Trends searches, indicating growing consumer awareness of diverse hair types and textures.

Twinkle Behl, Beauty and Personal Care Analyst, Mintel Reports India, said:

“There is an opportunity for brands to challenge the conventional notion that beauty is confined to one particular hair texture and celebrate the unique and varied hair characteristics among consumers. There is also potential to revitalize haircare product innovation as Indian consumers are spending more time on haircare regimes and show a willingness to experiment, especially with personalized options. For instance, Mintel Global Consumer research shows that 42% of Indian consumers mostly use the same haircare brands but occasionally experiment with new ones.”

Indians with curly hair perceive their hair as being more prone to damage such as dull hair (16%), split ends (14%) and dry hair (12%), leading them to seek conditioners with moisturising claims.

Behl suggests, “Brands can increase the usage of haircare and styling products by highlighting their damage protection and hydration benefits.”

Opportunity to expand beyond traditional formats

While hair oil remains a dominant format in hair treatments, there’s a growing segment exploring new formats, such as leave-in treatments, for their convenience, particularly among consumers with wavy hair (20% vs 11% of the total sample).

“Haircare brands have a significant opportunity to increase usage of leave-in treatments by positioning them as effective solutions for addressing hair concerns, particularly damage. Brands can enhance their functionality and emphasise key features such as convenience and fragrance,” Behl added.

Brands can capitalise on the demand for innovative hair products and concepts, especially as over half of Indians (54%) are bullish about their financial prospects this year according to Mintel research*. This consumer optimism is likely driven by the strength of India’s projected GDP growth rate of 6.5% in 2024, according to the International Monetary Fund.

While some Indian consumers are drawn to innovative new offerings, advanced formats (e.g. hair mask and hair mousse) in their haircare routines have yet to gain momentum, despite offering convenience and addressing specific hair concerns.

Behl recommends brands pay special attention to consumers with wavy hair, who seek specialised products for added nourishment.

“About 2 in 5 (41%) of Evolved Haircare Users – those consumers who are using new product formats such as leave-in treatments, dry shampoos, hair styling sprays, or waxes – express challenges with washing off hair oils. This suggests a potential shift towards more convenient hair treatment formats in the future,” said Behl.

“New formats such as leave-in treatments have a good opportunity to enhance usage. Positioning them as effective solutions for hair concerns faced by consumers (e.g. hair loss, thin hair), along with convenience and fragrance enhancements, will make them more appealing,” Behl concluded.

*Financial situation over the next year or so as of September 2023; Mintel Global Consumer, The Holistic Consumer

Additional research on haircare trends and interviews with the analyst are available upon request from the Mintel Press Office. For those interested in purchasing the full report, please visit the Mintel Store.

-

Mintel StoreGet smart fast with our exclusive market research reports, delivering the latest data, innovation, trends and strategic recommendations....View reports

-

Mintel LeapMintel Leap is a revolutionary new AI-powered platform that will transform your research process....Book a demo