Only 7% of German dieters consumed “light” or “diet” products in 2015

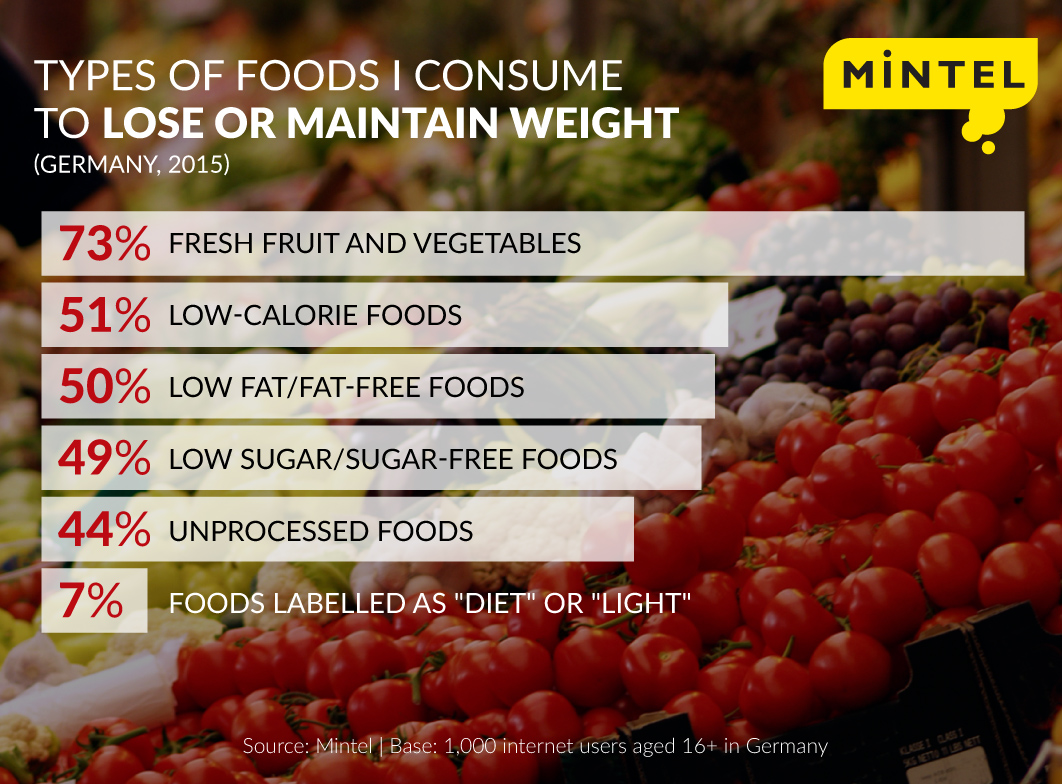

Despite rising obesity levels, it seems products labelled as “diet” or “light” are losing their appeal in Germany as consumers opt for natural and unprocessed foods and drinks in order to lose or maintain weight. Mintel research reveals that only 7% of Germans consumed food and drink products labelled as “light” or “diet” to lose or maintain weight in 2015. What’s more, when asked about dieting behaviour, only one in five (18%) claimed they bought more products labelled as low in sugar, fat or calories in the 12 months prior to the survey*.

Among the reasons for the decreasing popularity of diet food and drink products is the growing scepticism towards such products. More than three quarters (76%) of Germans agree that not all products marketed as “diet” are necessarily lower in calories in comparison to standard varieties, while almost three in five (58%) say they are wary of the ingredients that go into diet food products to make them low-calorie. Moreover, more than two-thirds of Germans (67%) say regular foods are as good as diet food products when trying to lose weight.

This comes despite the fact that a sizeable portion of the German population is concerned about their weight and want to lead a healthier lifestyle. According to Mintel research, almost three in 10 (29%) German consumers say they would like to and need to lose weight, and more than a third (36%) are prepared to change their lifestyle to be healthier.

Whilst food and drink products labelled as “diet” or “light” are falling out of favour, many consumers are addressing health concerns by cutting down on certain foods instead. When asked about key dietary changes, more than three in 10 (31%) German consumers say they are cutting down on sugar, while almost two in five (39%) claim they are reducing their fat intake. What’s more, just over one quarter (26%) say they are cutting down on carbs, while almost three in 10 (29%) claim they are eating smaller portions.

Katya Witham, Senior Food and Drink Analyst at Mintel, says:

“While consumers in Germany are becoming increasingly concerned about being overweight, ‘diet’ and ‘light’ food and drink products are coming under increasing scrutiny in regards to their nutritional values and benefits. Given that most consumers want clearer nutritional information and greater ingredient transparency, they no longer see ‘diet’ varieties as a good or healthy option to lose or maintain weight.”

Instead of relying on “diet” or “light” claims, Germans are increasingly looking towards natural and unprocessed foods to help them keep off the pounds. According to Mintel research, 62% of German consumers agree that they prefer foods that are naturally low in fat compared to reduced-fat products, while 44% say they eat unprocessed foods in order to lose or maintain weight. Moreover, almost three quarters (73%) of Germans claim that fresh fruit and vegetables help them to lose or maintain weight, while 27% say the same of food high in protein, such as lean meat and fish.

The move away from “man-made” diet products and toward natural food and drink is also reflected in recent new product launch activity. According to Mintel’s Global New Products Database (GNPD) only 8% of “minus”-claiming food and drink launches in Germany in 2015 featured the words “light” or “diet” in the product description, compared to 11% in 2012. On the other hand, the share of “minus”-claiming food and drink introductions with “natural” claims rose from 44% in 2012 to 57% in 2015.

“Demand for natural food and drink options continues to increase as consumer interest in naturally functional ingredients is strengthening. As a result, brands are increasingly looking to develop products using natural ingredients and are moving away from the negatives of dieting towards positive health messages. This has led to more brands looking to reformulate their products with more natural and transparent recipes.” Katya continues.

Moreover, as Germans are favouring unprocessed foods in an attempt to lose or manage weight, attention is shifting towards “good sugars” as a healthier alternative to their artificially sweetened counterparts. Indeed, previous Mintel research revealed that the top sugar or sweetener ingredient consumers view as healthy is honey, with 68% of German consumers agreeing it is good for their health, followed by maple syrup (33%) and agave (27%). In comparison, only 2% of German consumers view aspartame as healthy, with similarly low numbers for sweeteners xylitol (3%) and erythritol (3%), as well as high fructose corn syrup (11%).

A similar development can be witnessed in consumer attitudes towards the concept of “good fats” vs. “bad fats”. While over half (53%) of Germans say full-fat butter is healthy in moderation, less than one in five (19%) believe the same about low-fat spreads. Similarly, while almost three in 10 (29%) agree low-fat spreads are “artificial”, only 2% believe butter is “artificial”. Moreover, almost half (45%) of Germans say they are not worried about the fat content in regular yogurt, with 76% agreeing yogurts are naturally healthy.

“‘Light’ or ‘diet’ products are facing tough times ahead as the appeal of natural foods and drinks develops. Such claims on their own are no longer motivating enough and can be seen as counter-intuitive. Brands would benefit from moving their focus away from generic terms like ‘diet’ and ‘light’ and onto tangible benefits, with a strong focus on overall health, naturalness and wellbeing.” Katya concludes.

*the survey took place in Q1 2015 with a sample size of 1,000 internet users aged 16+ in Germany

Press review copies of the research and interviews with Katya Witham, Senior Food & Drink Analyst, are available on request from the press office.

Katya Witham is Senior Food & Drink Analyst, identifying and exploring the major trends across various FMCG categories, giving invaluable insights into global markets.

-

Discover your next big breakthroughGet smart fast with our exclusive market research reports, delivering the latest data, innovation, trends and strategic recommendations....View Reports

-

2025 Global TrendsUnderstand what’s new and next in consumer behaviour and the impact on marketing and innovation strategies....Discover trends

-

Are you after more tailored solutions to help drive Consumer Demand, Market Expansion or Innovation Strategy?Ask for a customised strategic solution from Mintel Consulting today....Find out more