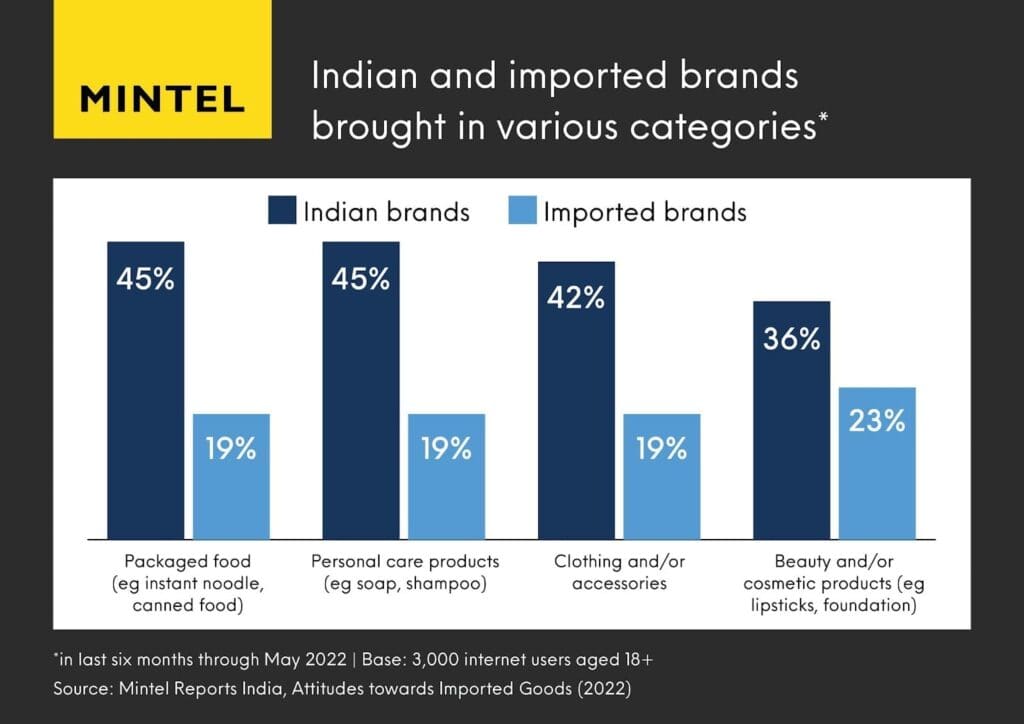

Localism: Indian brands outperformed imported brands among consumers across categories

The localism mindset is growing among Indian consumers. According to new research from Mintel, consumers* prefer to choose Indian brands over imported brands in various product categories such as clothing and/or accessories (42% vs 19%), personal care products and packaged foods (45% vs 19% each). Even for beauty and/or cosmetic products, only 23% of Indians purchased imported brands in comparison to domestic brands (36%). Attributes such as ‘value for money’, ‘good quality’ and ‘healthy’ drive consumer interest towards local brands.

Saptarshi Banerjee, Senior Lifestyle Analyst, Mintel Reports India said:

“The current economic uncertainty, supply chain disruption and climate crisis have further strengthened consumer support of local communities and businesses. We’ve also seen numerous government initiatives in the last few years with an aim to boost local entrepreneurship, such as Make in India, Vocal for Local, Digital India, and Startup India.

“However, it is also critical to evaluate categories where we see a sizeable portion of Indians buying both local and imported goods. To encourage adoption among Indian consumers, imported brands can customise products to align with consumers’ demands or needs. Our research shows that 26% of Indians think that imported products are not made to suit the local lifestyle which is an indication for brands to take steps in this direction.”

Banerjee adds that there is room for imported brands to improve their perception of value, health and ethics, particularly among younger Millennials (aged 25-31) and Gen Zs (aged 18-24). “They particularly seek ethical and moral qualities in a brand, which are quickly evolving into natural expectations from companies on both a local and international scale. Imported brands that support local communities are more appealing to both generations (44% and 40%, respectively) according to our research,” he said.

Lack of visibility and differentiation are key challenges for imported brands

Nearly one-third (32%) of consumers say that it is difficult to differentiate between Indian products and imported products. This comes as many global brands have also begun to manufacture their products in India while domestic brands are also competing in the premium segment, offering superior quality as added benefits such as ethical and sustainable claims (eg organic, natural, artisanal).

Furthermore, the same proportion said there should be a dedicated section for imported products on online shopping sites. This rises to 35% among consumers aged 25-34 who also agree that retailers should make imported products stand out more in-store (33%).

“There are fewer physical retail stores in India that stock primarily imported products other than urban cities, and also few online platforms where imported products are classified separately. Though it can be found on some platforms, there is no clear demarcation of imported brands as a category. As a result, the issue of availability is more related to the lack of visibility of imported brands, particularly outside of urban areas.

“There is an opportunity for imported brands to attract young consumers in lower-tier cities where internet penetration is increasing. Mintel research shows that 48% of Gen Zs in Tier 2 cities associate imported brands with being premium. Brands can benefit from leveraging social media and tapping into their interests (eg gaming) to test product concepts and find new ways to engage this cohort,” Banerjee concluded.

Notes to editors

*3,000 Indian internet users aged 18+

In this study, the definitions of local and imported brands were given prior to the survey:

- Local brands, interchangeably called ‘domestic brands’, refer to brands that originate in India and are manufactured/designed in India

- Imported brands, are brands that do not originate in India and are not manufactured/designed in India

Additional research on Indian consumer attitudes towards imported goods and interviews with the analyst are available upon request from the Mintel Press Office. For those interested in purchasing the full report, please visit the Mintel Store.

-

Mintel StoreGet smart fast with our exclusive market research reports, delivering the latest data, innovation, trends and strategic recommendations....View reports

-

Mintel LeapMintel Leap is a revolutionary new AI-powered platform that will transform your research process....Book a demo