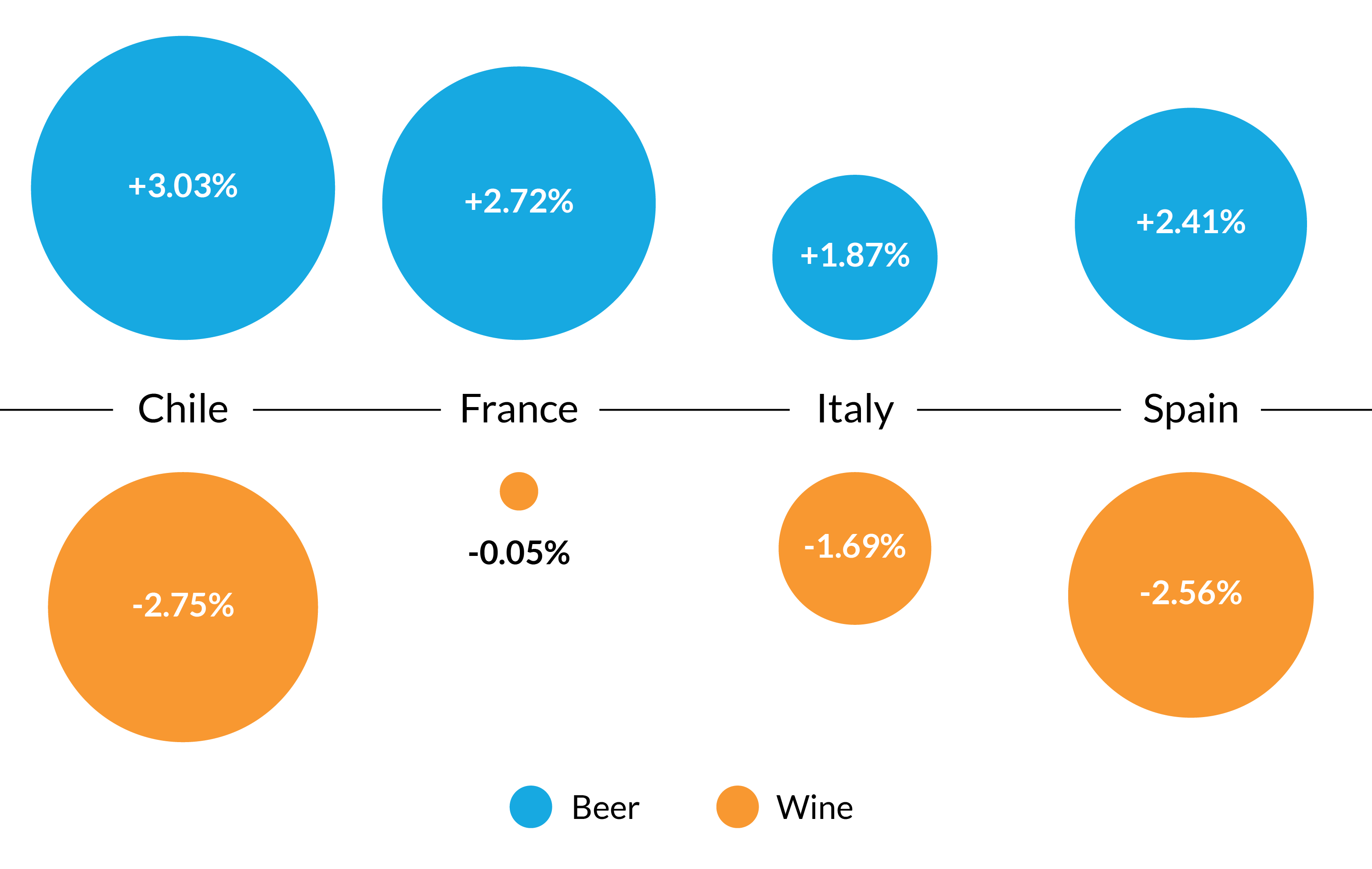

Over the last 5 years countries known for wine have seen the most growth in the beer market. Chile, France, Italy and Spain have seen per capita off trade consumption of beer increase while off trade consumption of wine has decreased. Alongside Mintel’s Senior Research Analyst – Market Sizes, Samantha Kleine, Global Drinks Analyst, Jonny Forsyth, looks at the changing nature of the global beer market.

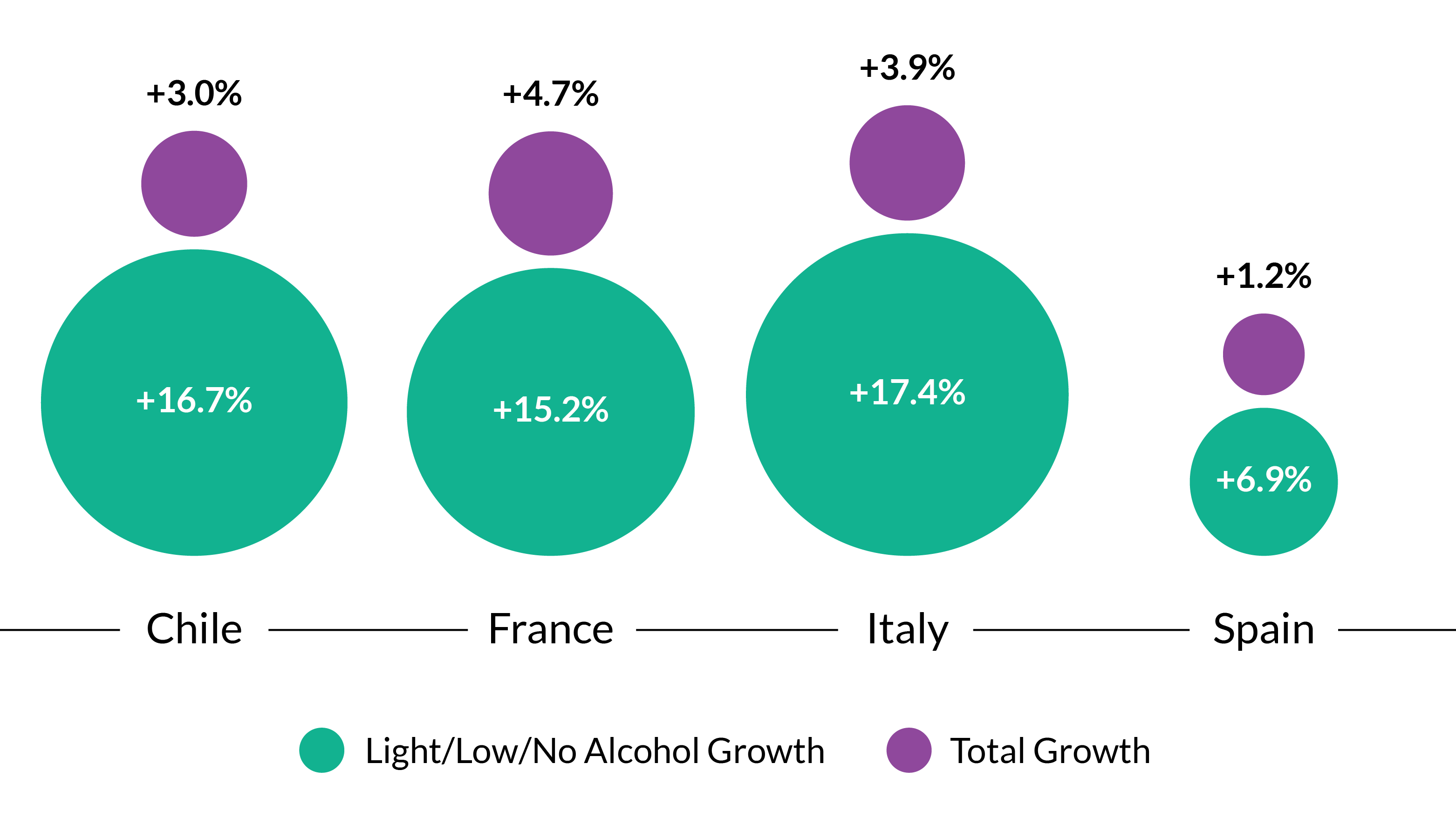

Looking at the segments, we see that standard beer is growing slightly, but the Light/no/low Alcohol segment is experiencing most growth. At the same time, wine sales in particular are in decline.

Chileans cooling down

The increasing popularity of Light/no/low Alcohol beer is a sign of changing attitudes toward beer and consumers becoming more health-conscious and more responsible with alcohol intake, according to Mintel Trends. Government involvement has also contributed toward this trend; for instance, the Chilean government has stimulated healthier habits by implementing stricter regulations against driving under the influence of alcohol. But even though all four countries seem to be moving toward lower-strength beer, there’s a certain section of the beer market where high volume (abv) has not led to low volumes (sales)…

Drink craft beer like the Romans do

The craft beer boom is to thank for the growth in Strong/Extra Strong beers. For instance, as explained in Mintel’s “Global Annual Review of Beer 2016”, craft beer has become the new wine for Italian drinkers. Not only do they purchase more craft beer per capita than other European countries, such as France, Germany and Spain, they also see the highest growth in microbreweries in Europe. They have the third largest number in microbreweries, behind UK and Germany. Italians appreciate craftsmanship in the end.

Overserved with traditional drinks

Even though in Europe we see that the over-55s drink more Light/no/low Alcohol beers and that in Italy all generations are hooked on craft beer, it seems that the decline in wine in these four countries is mainly due to the 18-34s drinking less of it. This is due to the fact that the appeal of wine is wearing thin, instead – according to Mintel’s research – younger consumers are increasingly looking for new, distinctive flavours. The younger generation is the future, so if the aforementioned trends continue these countries should prepare for a bad hangover!

Jonny Forsyth is Mintel’s Global Drinks Analys, responsible for researching and writing all of Mintel’s UK drinks reports. He brings ten years of experience working in the marketing industry, with roles at Starcom Mediavest, AB-Inbev, and Trinity Mirror. He is a regular contributor in global and national media outlets such as BBC, CNBC and Bloomberg.

Mintel Market Sizes’ International team of specialist Research Analysts use a wealth of the most credible sources to provide fast, easy to compare, extractable market data along with supporting trend forecasts for 90 product categories worldwide.