Instant noodles have been viewed as a sunset industry in China and have experienced a decline in retail sales in recent years, due in part, to the fact that they are perceived as unhealthy and loaded with artificial additives. This can be attributed to the trend of consumers moving towards healthier snacks, and the explosive growth of China’s food delivery space which has given consumers easy access to fresh, healthy meal options almost anywhere.

In response, instant noodle brands have focused their efforts on quality improvement and upgrading the image of the category as a whole. This taps into Mintel’s Global Food and Drink 2019 Trend ‘Elevated Convenience’, which points out how consumers are no longer willing to compromise on health and quality for convenience. In fact, these efforts have paid off; Mintel estimates that the instant noodle category in China saw improved growth rates in 2018, indicating an opportunity for instant noodles to make a revival in the country.

Brands need a healthy, high quality makeover

In order to compete with the current trend of prioritising health and quality in food products, instant noodles need to establish a trusted and respected new image. For example, Master Kong has taken the initiative by partnering with China’s Aerospace Industry Partners in 2017 to help build strong credentials for the company. Master Kong has leveraged this cooperation to reinforce their new image with healthier ingredients and innovative processing methods. This move helped the company establish a reputation of producing safe, nutritious and high quality products.

Instant noodle brands are cleaning up their reputation as junk food. According to Mintel Global New Products Database (GNPD), these days, new product launches are more focused on healthy and clean label formulations—all in a bid to introduce premiumisation to the category.

Master Kong stewed beef instant noodle (Source: JD.com)

This product features separate packaging for the noodle and stewed beef and is said to be made with imported real beef, providing consumers with a non-fried and nutritious option.

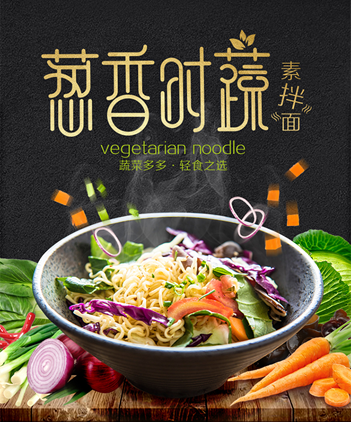

The Cereal Ways vegetarian instant noodle (Source: Tmall.com)

This instant noodles includes four different types of vegetables. It appeals to consumers who lean towards the ‘light meal concept’.

Highlighting indulgence to drive premiumisation

Beyond just promoting healthy features, instant noodles can also look into enhancing consumers’ consumption experience by introducing new, upgraded types of soup, noodles or toppings.

Ramen Talk is a new brand that has recently gained internet fame in China. The brand has distinguished itself from the competition with its ready-to-cook range which uses real meat and vegetables, making it one of the most expensive instant noodles on the market.

Another trend that we see is the arrival of restaurant chain-branded instant noodles. For example, BAMAN, a start-up restaurant chain, started selling instant noodles online in 2017 as an extension to its offline stores. Use of the ‘not from concentrate’ (NFC) production technique allows consumers to recreate the rich texture and taste of rice noodles from the restaurant.

Raman Talk instant noodle (Source: JD.com)

This instant noodle product uses real meat and vegetable. It cooks in just five minutes and claims to have restaurant quality taste. The product is only available through online channels.

BAMAN beef instant rice noodle (Source: JD.com)

This product contains real meat and its soup is said to be made using high temperature sterilisation product technology which offers the product a fresh taste.