-

Articles + –

Chinas Mengniu is quietly taking on the global dairy industry

A little over 10 years on from the tainted milk scandal that rocked the Chinese dairy industry, market leading Mengniu has rebuilt. It is now busily buying up dairy companies in Asia as it embarks on a strategy to dominate the global dairy market. In just this past week, it has snapped up two Australian companies – Bellamy Organic in a AUD1.5 billion deal, and Lion Drinks and Dairy (LD&D) for AUD600 million.

Dairy Farmers is one of the brands owned by Lion Dairy & Drinks

Dairy Farmers is one of the brands owned by Lion Dairy & Drinks

This turnaround is remarkable. The instant milk formula (IMF) category was among the hardest hit by the scandal, but over the past year, the efforts of local companies such as Mengniu to regain consumer trust has paid off: sales growth of domestic IMF brands is now outpacing that of imported brands. Mengniu is also benefiting from a broader trend of nationalistic pride called Guochao – the term used to describe the current fashion for local brands and culture that is seeing domestic brands trending across numerous industries. As a result, consumer attitudes in China are shifting. Data shows that the percentage of Chinese consumers who link overseas origin with high product quality is declining.

With the domestic market shored up, the goal of Chinese dairy majors is to take on the international dairy market. The first step in this plan is Southeast Asia. Mengniu exports its dairy products to Myanmar, Singapore and Malaysia. While in Indonesia, Mengniu has built a dedicated dairy production facility and started selling dairy products under the YoyiC brand at the end of 2018.

Access to sources of high quality milk are necessary to fuel this expansion, and this is a key motivator for the recent Australian acquisitions. Another benefit of the LD&D deal for Mengniu is that its newly acquired brands, such as Farmers Union and Berri, already have a long history in Southeast Asia. Mengniu can build upon consumer familiarity with these brands to further enrich the product lineup in the region.

What’s next?

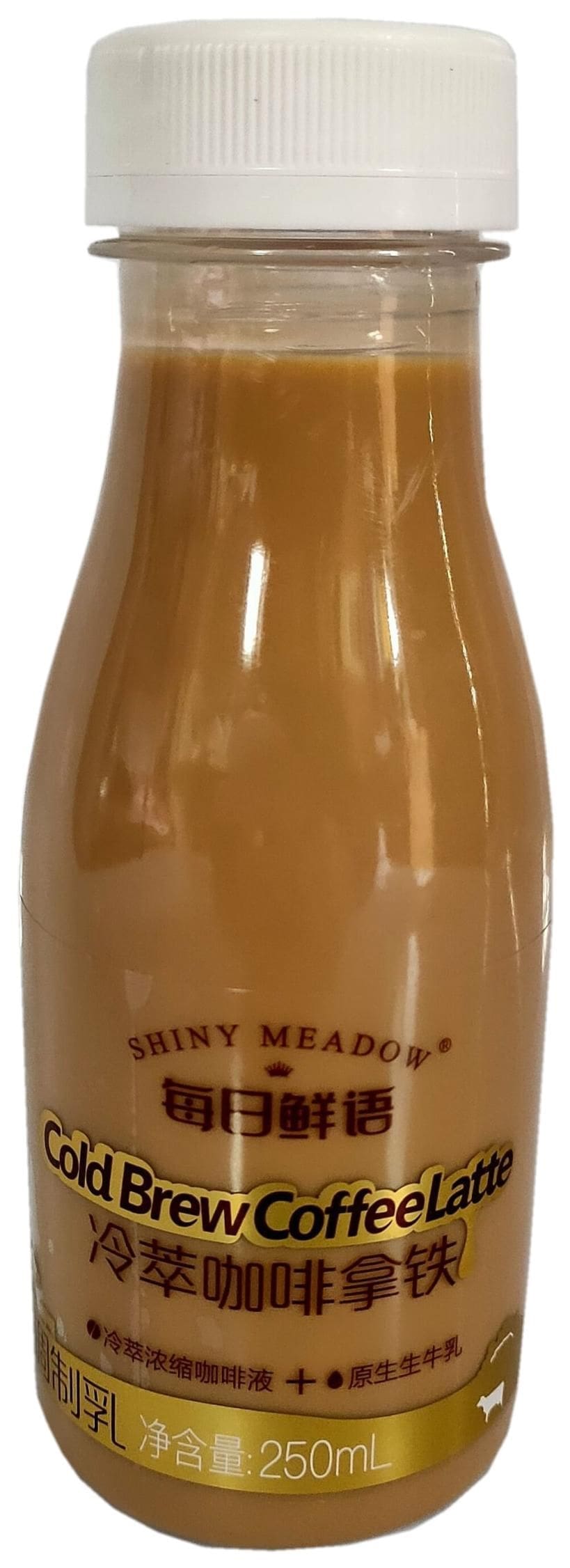

Apart from the prized dairy asset, LD&D’s non-dairy operations like ready-to-drink (RTD) coffee and juice will allow Mengniu to transform itself into a more dynamic and diverse company that can cater to changing consumer tastes and preferences – not just in dairy, but also in other trending categories. In China, Mengniu is diversifying its products beyond dairy and has made an entry into RTD coffee with the launch of Shiny Meadow Cold Brew Coffee Latte in September 2019.

Finally, while Mengniu is gradually expanding its reach globally via South East Asia, its ultimate goal is to become a truly international company. Reflecting this strategy, and how long term their vision is, in June 2019, Mengniu Dairy partnered with Coca-Cola and signed a US$3billion deal to sponsor the Olympic Games until to 2032. Like a Phoenix rising from the ashes, Mengniu is ascending and quietly laying the foundations to become a growing force in the global dairy and beverages industry.

Credit: VCG

Credit: VCG

Heng Hong Tan is Mintel’s APAC Food and Drink analyst based in the Kuala Lumpur office. He comes with over a decade’s worth of experience identifying emerging food and drink trends.

Daisy Li is an Associate Director with the Mintel Food & Drink team, speciliasing in the China market. She monitors and reports on the latest innovation and trends impacting the Chinese food and drink market.

Heng Hong is Mintel’s Senior APAC Food and Drink analyst based in Kuala Lumpur. He comes with over a decade’s worth of experience identifying emerging food and drink trends.

-

The Milk and Dairy Beverages Market in China in 2021Find out about global and China launch activity and product innovation and where the growth opportunities are...Discover our reports store

-

Mintel LeapMintel Leap is a revolutionary new AI-powered platform that will transform your research process....Book a demo

Dairy Farmers is one of the brands owned by Lion Dairy & Drinks

Dairy Farmers is one of the brands owned by Lion Dairy & Drinks

Credit: VCG

Credit: VCG