-

Articles + –

How beer and cider brands can stay relevant post-pandemic

What’s happening now

The pandemic brought success to the premium brands that home-bound consumers chose as treats. Long-term performance is not guaranteed, however, as beer and cider face competition from the ever-expanding segment of flavored alcoholic beverages. Sales volume is also at risk as health-conscious adults re-think their alcohol consumption.

What we think

Consumer interest in better-for-you (BFY) options is inspiring increased launch activity in low-calorie and light beer. Meanwhile, canned beer brands are looking to expand their popularity among younger demographics by promoting ethical virtues.

What’s next

As costs rise in many markets, beer and cider brands will need to emphasize their value and the advantages they offer to the more casual and health-conscious lifestyles that resulted from the pandemic. Brands can also stay relevant with consumers by sharing the details and trustworthy verification about their environmental and ethical commitments.

- 52% of US adult beer buyers say price is an important factor when shopping for beer, while 65% say brand is important.

- 28% of US adult alcohol buyers agree the fastest way to improve their health is to drink less alcohol.

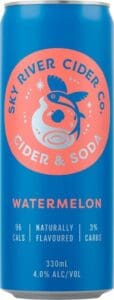

Early adopting brands put BFY claims front and center in their 2021 launches, featuring multiple low/no/reduced (LNR) claims with a goal to increase their potential to appeal to health-conscious adults. Sky River Cider Co. Passionfruit Cider & Soda is a blend of cider with carbonated water and natural flavors. It is said to be a “cleaner, fresher drinking experience.” It contains 96 calories, 4% ABV, and 3%.

Increased nutrition transparency will heighten demand for BFY drinks. The coming years will see more transparency about alcohol’s nutritional impact – both mandated and voluntary. Heineken has committed to adding clear and transparent information about ingredients, nutrition, calories, ABV, and allergens on 100% of its products by 2023. More nutritional information will lead to trends seen in carbonated soft drinks where health-conscious adults expect great-tasting drinks with LNR calories, carbs, and/or sugar.

What we think

As costs rise, consumers who need (or want) to save money will be looking for brands that justify their value. Companies will have to emphasize the BFY aspects of beer and cider in order to stay relevant to adults who are cutting back on alcohol. Consumers will also come to expect more detailed and trustworthy ethical and environmentally friendly claims on alcohol in the coming years.

Future

Brands will have new marketing opportunities to reach consumers who are balancing their free time between traditional in-person social venues and immersive online forums. At the same time, brands will be challenged to keep pace with consumers’ increasing demands for BFY beer and cider as well as high expectations for sustainable production methods.

Brands can meet consumers in the digital worlds where they spend their free time, such as video games or the metaverse. Virtual bars – like Miller Lite’s ‘The Meta Lite Bar,’ the first-of-its-kind tavern, located in Decentraland, one of a crop of platforms that host the metaverse – could become new places to socialize with friends near and far.

The health of the planet will become a more urgent issue in the next five years. Consumers will be more motivated to buy from companies that invest in innovative and effective sustainable practices. Brands that are collaborating with scientists and other innovators could be seen as more premium for inventing more sustainable practices. For example, Finnish brewery brand Hartwall and energy provider Lahti Energia are building a biogas facility that creates renewable energy from the spent grain leftover from brewing.

What we think

Consumers’ increasingly hybrid offline-online lifestyles will create more opportunities for companies to promote their brands in the in-person and online realms where consumers spend their free time, according to Mintel’s 2022 Global Consumer Trend ‘Flexible Spaces. Health consciousness will only grow in the next five years as more companies and regulators mandate nutrition disclosures on alcohol. Access to clear and understandable information will make consumers seek more BFY beer and cider and be open to the health benefits of functional non-alcoholic beer and cider.

The health of the planet will become a more urgent issue in the next five years. Consumers will be more motivated to buy from companies that share their investments in innovative and effective sustainable practices, such as using spent grain as a source of energy or using algae to capture carbon dioxide.

Jenny Zegler is an Associate Director of Food and Drink at Mintel. Jenny blends her trends expertise with food and drink topics such as health, formulation, sustainability and premiumization.

-

The Future of Beer and CiderDiscover the latest trends and changing consumer behaviours across the global beer and cider industry!...View our reports store

-

Mintel LeapMintel Leap is a revolutionary new AI-powered platform that will transform your research process....Book a demo