Instant noodle is one of Indonesia’s major staple foods and new Mintel research shows that the instant noodle category has consistently gone from strength to strength in the last decade. It is also projected to experience steady growth for the next five years. Over and above that, Mintel research reveals Indonesia is among the world’s top five instant noodle markets in volume retail sales.

As incomes and urbanisation in Asia rise, premiumisation of instant noodles will continue in response to consumer demand for better quality, more convenient and better-tasting products. Within Indonesia specifically, the instant noodle category is undergoing continued premiumisation.

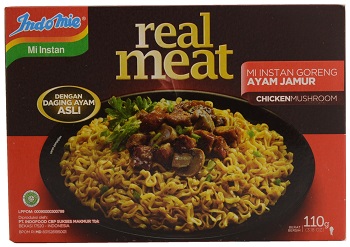

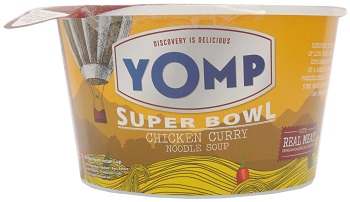

In an effort to drive value growth, instant noodle manufacturers in Indonesia are offering higher quality and more ‘real food’ ingredients like real meat, for instance. With the inclusion of meat, these products offer consumers a more filling, substantial snack albeit the heftier price tag that comes with it. According to Mintel research, 39% of metro Indonesian snack consumers claim that they sometimes eat snacks instead of having a meal – indicating an opportunity to develop snacks that are not just more nutritious, but also offer satiety benefits.

Meat takes instant noodles into meal territory

The instant noodle category in Indonesia was abuzz last year as Mayora Group pioneered a new premium segment with the launch of Bakmi Mewah, luxury instant noodles with ‘real meat’. Targeted towards Indonesia’s young, upper middle-class consumers, Bakmi Mewah’s launch was supported by a strong campaign of celebrity endorsements and it received widespread media attention. In response, the market saw more instant noodle players entering the ‘real meat’ segment.

Bakmi Mewah Rasa Instant Chicken Noodle

Indomie Real Meat Chicken Mushroom Flavoured Instant Fried Noodles

YOMP Super Bowl Chicken Curry Noodle Soup

While instant noodles are a much-loved comfort food in many parts of Asia, they are not known for being nutritious. The processed nature of the product contributes to this perception, so the introduction of real food ingredients will be an effective way of combatting this image and attracting new and infrequent users to the category.

Protein is in high demand in countries like the United States; however, Southeast Asia hasn’t caught on just yet. That said, it could be appealing to younger, health-conscious consumers as protein is also seen to be associated with satiety in Indonesia.

Mintel research indicates that close to half of snack food consumers in metro Indonesia claim to associate protein content with snacks that are filling. What’s more, two in five snack food consumers say they look for snacks that are high in protein. This indicates that increased protein content could be better explored by instant noodle brands looking to keep up with changing consumer tastes. Capitalising on the inclusion of protein in instant noodles could also be a good point of differentiation in this otherwise saturated category.

Avanthi Ravindran is a Senior Trend and Innovation Consultant for the South East Asia and India regions, joining Mintel in 2013. She specialises in customised consulting projects covering the spaces of new product development, trend analysis, competitor understanding and consumer insight. She is also involved in facilitating ideation sessions and presenting at trade shows and conferences. Avanthi has over 10 years of experience across consumer research and brand consulting and has worked with clients across FMCG brands, hospitality brands, financial services and many others.