-

Articles + –

Low alcohol beer is a heady opportunity in India

There has been a shift in consumers’ outlook on drinking alcohol in India, with many preferring moderate experiential drinking over binge drinking.

Indians, especially younger consumers, want to drink responsibly and are more likely to move away from beer due to its higher alcohol content and negative side effects such as getting drunk or and having a hangover.

According to Mintel research, close to a third of Indians between the ages of 25-34 say that they have reduced their beer intake in the past 12 months. This shift away from alcohol is indicative of the emerging low/no-alcohol trend seen globally and presents an opportunity for local brands in India to tap into this trend.

Potential to innovate with low-alcohol beer

In India, non-alcoholic beer has been the focus for most breweries with a majority of launches focussing on zero alcohol. However, consumer demand indicates an opportunity for low-alcohol beer as well.

Mintel research highlights that two in five beer drinkers have also had low/no alcohol (LNA) beer in the past six months. This goes to show that there is a significant amount of beer consumers who are interested in the category.

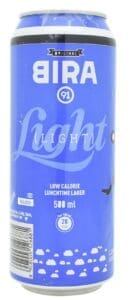

Most regular beer drinkers in India are experimental since a third of these young adults have had more than five types of beers in the past six months. Therefore, innovation is key for beer brands. In fact, as these consumers like to switch between beer variants, trials for LNA beer can be encouraged if brands provide consumers with the freedom to choose options with varying alcohol content levels. Currently, in India, the only brand offering a beer with low alcohol content is Bira with its variant Bira Light.

Bira Light contains 3.5% alcohol by volume (ABV) and has positioned itself as a light lunchtime lager.

Adapting the look and feel of standard strength beer

It is important for low/no alcohol beer offerings to mimic the taste, foam, colour, and packaging of standard strength beer to appeal to the Indian beer drinkers. This is because even though consumers are willing to experiment with LNA beer options, beer drinking is still a social activity.

Picking up an LNA beer that looks distinctly different from regular beer may make consumers conscious of their choice and fearful of judgment by beer connoisseurs. Hence, LNA beer offerings need to be as close to regular beer as possible, a tactic used by Budweiser and Heineken.

Furthermore, with a majority of beer drinkers have beer out-of-home, low/no-alcohol beer needs to tap into the experiences that microbreweries offer on-premise. For example, microbreweries can offer LNA beer on tap similar to draught beers or offer tasters that LNA beer brands can offer to showcase a wide array of their offerings on-premise.

Hence, it is imperative for brands to engage with consumers there and focus on such marketing activities, promotional offers, and experiences to induce more trials.

What we think

Low/no-alcohol beer will appeal to health-conscious young Indian adults who are also focused on responsible drinking. While non-alcoholic beer launches have increased over the last three years, there is an opportunity to provide consumers with low-alcohol beer variants to give them freedom of choice. Not only should brands imitate the overall look and feel of standard strength beer, but they should also provide experiences similar to that of microbreweries and other on-premise locations.

Natasha is Mintel’s Food & Drink Analyst based in Mumbai. She is responsible for analysing and providing insights on India’s food and drink market.

-

Healthier brews and unique flavours is the way forward for beerUnderstand how the beer industry has been adversely impacted by the pandemic in India...Discover this research

-

Mintel LeapMintel Leap is a revolutionary new AI-powered platform that will transform your research process....Book a demo