-

Articles + –

The 3 biggest German food packaging trends of 2021

With the ongoing pandemic, German consumers have become increasingly aware of the environment. As sustainability becomes a necessary business objective, companies and brands are under pressure to become more environmentally friendly. Packaging in particular has often become the centre of attention in public debates, which, in turn, has borne interesting innovations in this field. In this article, we look at the three biggest packaging trends we have observed in the German market this year.

1. Refill and unpackaged options on the rise

Almost half of German consumers claim they have switched from buying packaged to unpackaged foods in 2020, leading to an increasing number of packaging-free stores across Germany. Big retailers such as Alnatura have jumped on this bandwagon and have been trialling packaging-free aisles as a result of this development.

Another example for a brand offering refillable options is ‘Unverpackt für Alle’, which sells its products in plastic-free and reusable jars that can be returned at reverse vending machines in supermarkets.

Unverpackt für Alle Paprikapulver (Paprika Powder) is described as Hungarian paprika with a spicy fresh taste from the Kalocsa region and retails in a plastic-free reusable jar.

Reducing the plastic on fruit and vegetables is also a key part of the overall reduction of packaging and an important factor for German consumers. However, since packaging is important for keeping food fresh for longer, the elimination of packaging – in this case of fruit and vegetables – could lead to an increase in food waste. Steps to explore alternative packaging materials remain relevant and meet consumer demand: According to Mintel’s report on food packaging trends in Germany, almost half of all Germans say they are interested in fruit/vegetables with a plant-based protective coating to extend shelf life. EDEKA, one of the leading supermarkets in Germany, is trialling such approaches. EDEKA is testing ‘Apeel’, a protective coating of plant origin developed to keep fruit and vegetables fresh for longer and ultimately to reduce food waste.

2. Brands highlight the carbon footprint of their products

CO2 emission is a great concern among younger consumers especially. Therefore, food and drink companies have set up initiatives to reduce CO2 emissions and become carbon neutral, or even carbon positive. Brands are highlighting their environmental efforts with on-pack claims about plastic and carbon footprint emissions to entice eco-minded consumers.

PPura Classic Tomato Sauce is said to be CO2 positive and according to the manufacturer, it is produced with 100% renewable energy, and uses short transport routes.

3. Waste-reducing materials point towards the future

More sustainable packaging will become the norm as consumers have started to see most plastic packaging as harmful waste, giving little thought to its actual purpose, e.g. extending shelf-life, and without knowing if other materials are truly better for the environment.

The perception that plastic packaging is worse for the environment than other materials is strong enough to force packaging brands to look for alternatives. Whether they are edible, biodegradable/compostable or simply reusable — waste-reducing materials are the future of food and drink packaging. However, brands still need to support the popularity of compostable products by educating consumers about the advantages of compostable food packaging and giving clear instructions on how to dispose of it.

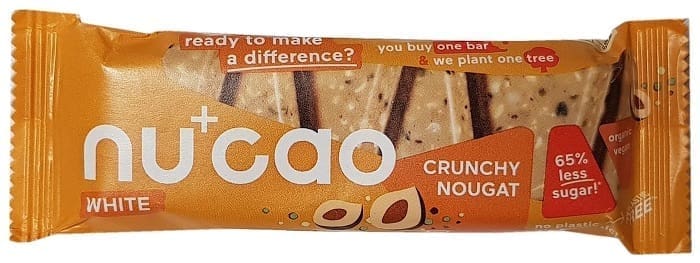

Nu+Cao White Crunchy Nougat Organic Bar retails in a home-compostable pack.

What we think

Despite COVID-19 and the resulting hygiene concerns that have temporarily made plastic packaging an essential item for perceived safe consumption, there is still culpability regarding unsustainable and excess packaging. Sustainability is, and remains, a key factor in food and drink packaging. Steps to explore alternative packaging materials are still relevant and brands that put sustainability at their core and develop exciting packaging innovations that meet consumer demand will see further growth.

If you’re client and would like to find out more about our German food packaging research, please speak to your Account Manager. If you’re not client, please get in touch with helpdesk@mintel.com.

Hanna is Food and Drink Analyst at Mintel Germany, analysing the latest trends in the German food and drink sector.

-

Germany Food Packaging Trends Market ReportExplore the latest trends and innovations across the German food packaging market...English language version

-

Deutschland Lebensmittel-Verpackungstrends ReportEntdecken Sie die aktuellsten Lebensmittel-Verpackungstrends auf dem deutschen Markt...Deutsche Version

-

Mintel LeapMintel Leap is a revolutionary new AI-powered platform that will transform your research process....Book a demo